For those who follow my posts, you can see a clear trend that digital wallets with real-time account-to-account payments lead new payment methods across the world.

Open banking trails some way behind and card networks are fighting a rear-guard action to protect their deeply entrenched positions. Stablecoins and CBDCs are also lurking in the background.

However, what are account-to-account payments and what is a digital wallet? There are so many variations of each, it can be hard to make sense of them.

In this article I outline a taxonomy for each to help navigate the fast-developing digital payments landscape.

Account-to-Account Payments (A2A)

A2A electronic payments started first with Western Union in 18711, using telegraph wires to send messages instructing their offices to transfer funds between accounts across the USA.

Today there are a variety of electronic payment instruments such as credit transfers, direct debits and cards, with different features such as batch processing .v. real-time, domestic .v. cross-border, retail .v. corporate, push .v. pull, recurring .v. one-time only, online .v. in-person, bill payments .v. ecommerce purchases, transfers .v. payments, interbank .v. intrabank, bank account .v. stored value account, bilateral .v. multi-lateral, credit .v. debit, contactless .v. swipe, custodial .v. non-custodial. There is much to consider.

To help, Figure 1 shows a taxonomy for A2A payments. Very importantly, it includes payments between stored value accounts such as PayPal and also between bank accounts and stored value accounts. Banks like to show their commitment to financial inclusion, but it is mainly to draw people away from using cash where banks make no money and into the banking system where they can entice them with credit.

Therefore, stored value accounts are an alternative to bank accounts and an important component in A2A payments – they enable digital inclusion by allowing those without a bank account to pay for digital services. By removing the need to apply for a bank account, stored value accounts facilitate the transition to digital services for those who prefer normally to use cash.

Figure 1 – Account-to-Account Payments Taxonomy

Bank Account A2A

Bank account payments are split into direct and intermediated. Direct A2A payments are the core of the banking system, where any bank account can pay any other bank account (m:m) using online and mobile banking.

Intermediated payments are core to commerce where intermediaries, pioneered by Western Union in the 19th century, facilitate payments from any bank account to a subset of bank accounts, those of their customers. For example, GoCardless enables billers to collect direct debit payments from their customers as well as for them to initiate open banking payments.

A2A payments are increasingly used for ecommerce payments. A long-established example is iDEAL in the Netherlands which handles over 70% of ecommerce there. Payments are 1:1, between the consumer and online retailer. Marketplaces require 1:many payments where a purchase payment is split between the seller, marketplace, logistic provider and other suppliers - new Fintechs are emerging to serve this sector such as Ryft Pay.

Open Banking is established in many countries and gaining traction, where payment initiation service providers (PISPs) allow users to initiate payments from their bank accounts when on third party websites. There are two models, one where the retailer is the PISP – there are very few, if any examples of this, the other where the PISP is an aggregator connecting multiple retailers to banks, for example Ordo in the UK, Plaid in the USA, Trustly in Sweden.

Stored Value A2A

Stored value A2A payments work best in an open ecosystem where they connect with the banking system and other stored value brands. Closed loop stored value systems are mainly many:1 such as Oyster in London where payments are made from Oyster accounts to Transport for London. The Starbucks app is another example.

Alipay and WeChat Pay in China are examples of stored value payments in an open ecosystem. Even though a large proportion of payments are between accounts within their respective platforms, payments can be made between them and with other wallets and with banks in China through the NetsUnion Clearing Corporation2.

They also allow pass-through payments, where there may be insufficient funds in a wallet to make a purchase, but the payment is made by pulling the funds automatically from the user’s bank account into the wallet. PayPal in the UK and Europe works in a similar way using direct debits.

Many stored value accounts link to banks to fund and defund the account and to make payments from stored value accounts to bank accounts. PhonePe, using UPI in India, for example - a user may know only the recipient’s phone number or UPI id and has no need to know or care whether the payment is being made to a stored value account on a wallet or to a bank account.

Digital Wallets

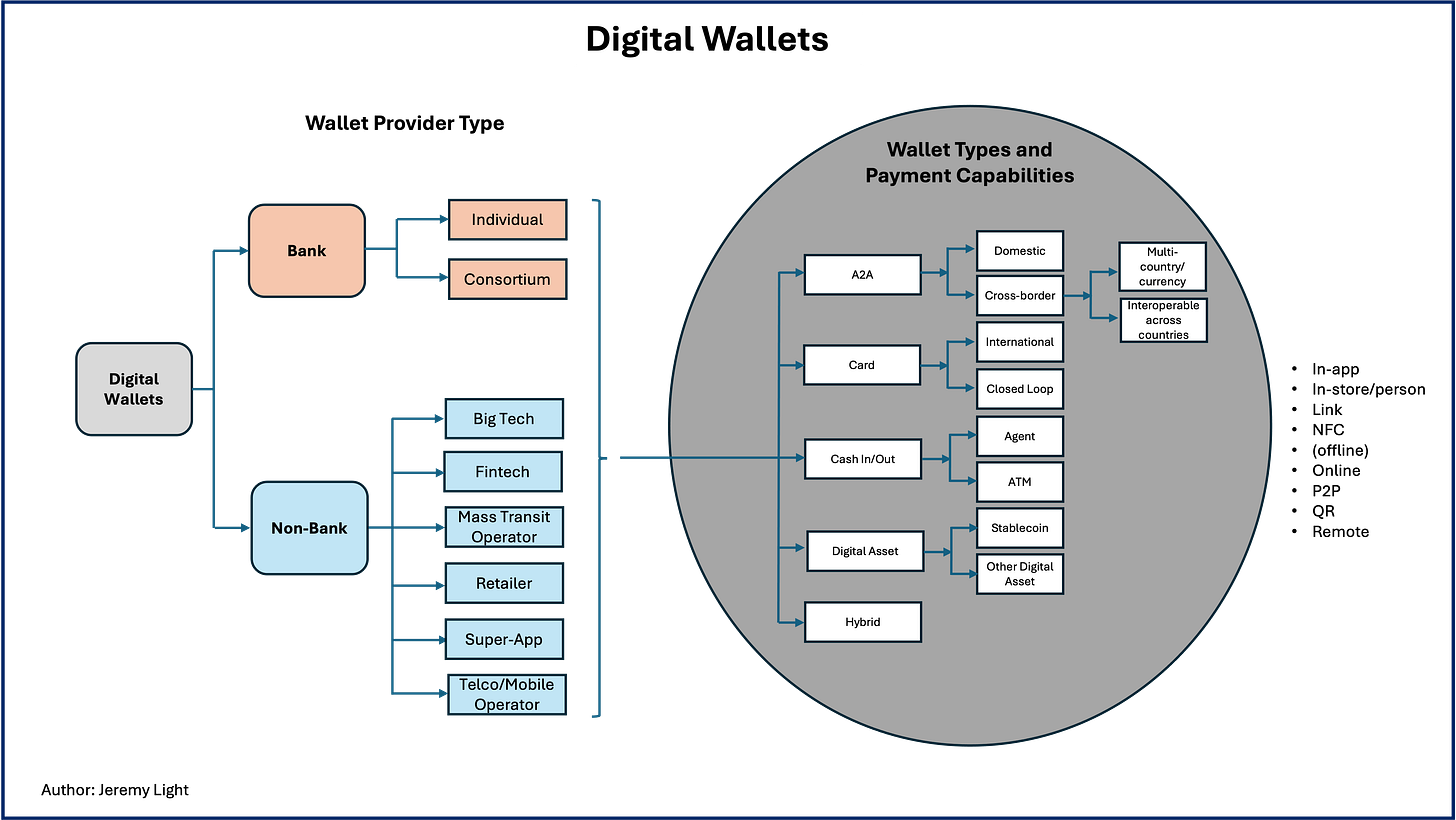

There are a large number of digital wallets with differing capabilities, but they can be reduced down to the types shown on the right in Figure 2. There are wallets for A2A payments such as Alipay, Blik, PayPal, Swish; for card payments such as Apple Pay and Google Pay, cash in/out (domestic remittances) such as M-PESA; and for digital assets such as Revolut.

Figure 2 – Digital Wallet Taxonomy

The most versatile wallets are hybrid and support multiple payment methods – A2A, cards, cash and even digital assets. It is likely that hybrid wallets will become the norm.

Cross-border A2A wallets are a key area for innovation. There are two types – wallets designed to operate in multiple countries such as Wero in Europe, albeit in just one currency (Euro) or Vipps in Finland, Norway and Sweden and those that are interoperable cross-border. Examples include Duitnow wallets in Malaysia, PayNow wallets in Singapore, UPI wallets in India and PromptPay wallets in Thailand which can be used across these countries by visitors from each.

A consortium in Europe, EMPSA3 with 11 established wallet providers across 14 EU countries is seeking to achieve a similar aim, in competition with Wero, with a service analogous to mobile phone roaming. There is also international expansion of domestic wallets such as Alipay International across Asia, Europe and the USA, M-PESA across Africa and Blik expanding from Poland to Slovakia and Romania.

Wallet Providers

Wallet providers are numerous and are split between bank and non-bank. Most banks have their own mobile apps and some have extended them to be suitable for a full range of uses in-store, ecommerce as in Brazil with the Pix system. However, the more successful bank wallets tend to be from bank consortia driven by their combined coverage and scale. For example, Zelle in the USA and Bizum in Spain.

Non-bank wallets are proliferating, injecting competition into payments in many countries, most notably in India where 97% of UPI payments (17bn+ per month) are made through non-bank wallets, despite UPI being set up for banks4. Figure 2 shows six different types of non-bank wallet provider, there are probably more that are driving innovation in payments around the world.

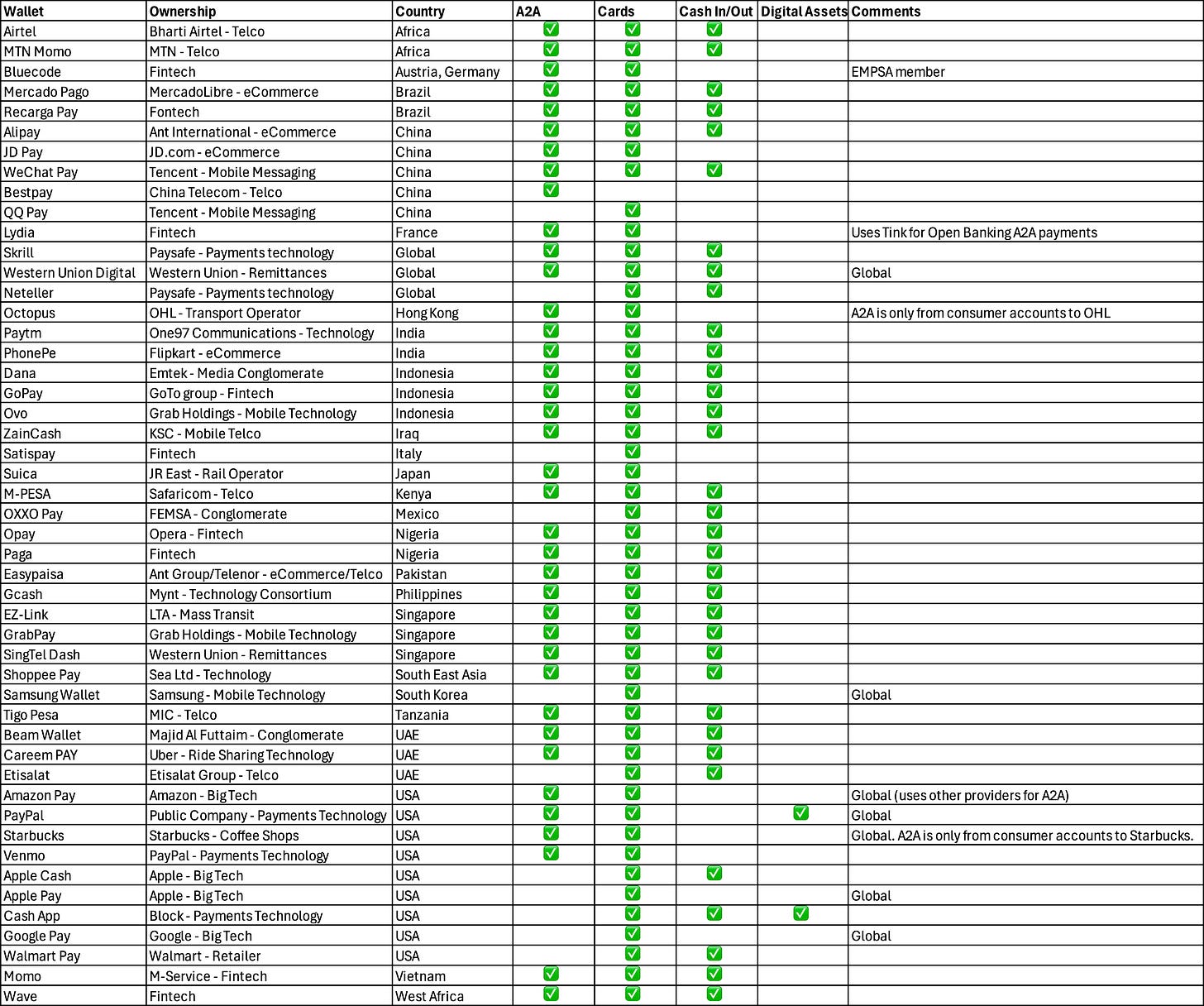

At the end of this post is a table listing digital wallets from 38 regions and countries, mapped to the wallet provider and wallet types shown in Figure 2.

Conclusion

Digital wallets for initiating and receiving real-time A2A payments are the future of the payments industry and how we pay across the world. The taxonomies in Figures 1 and 2 help make sense of new developments and characteristics of successful wallet propositions.

These show, for example that open banking is just one part of A2A payments. Countries such as the UK that prioritise open banking only are missing out on the bigger A2A picture - having a real-time clearing system on its own is insufficient in today’s payments landscape. Countries without a national digital wallet such as Australia, Ireland (which cancelled one in 20235) and the UK have a lot of catching up to do.

Digital wallets can facilitate digital inclusion and the transition to digital from cash by accommodating cash in/out capabilities. Support for both bank accounts and stored value accounts is necessary. Those that support both A2A and card payments with connectivity into the card networks allow seamless payments between A2A and card networks. This allows a transition from cards to A2A without dictating to users which to use. Hybrid wallets covering A2A, cash and cards have the most utility.

These hybrid digital wallets using real-time A2A payments are here today at scale and will be core to the way we pay for many years. They are the foundation for new innovations to come, such as for micropayments, stablecoins and agentic AI payments.

Bank Digital Wallets

Non-Bank Digital Wallets

European Mobile Payment Systems Association: https://empsa.org/

India article: https://jeremylight.substack.com/p/sailing-to-the-moon

Yippay: https://www.finextra.com/newsarticle/43300/irish-banks-ditch-plans-to-build-mobile-payments-app