A Real-time Wallet to China

A country with some of the highest transaction volumes you can imagine

UPDATED 29 OCT 25 - THE PREVIOUS VERSION PUBLISHED ON 27 MAR 25 ASSUMED ERRONEOUSLY THAT INTEROPERABILITY IS ENABLED BETWEEN ALIPAY AND WECHAT PAY WALLETS, WHEREAS NONE EXISTS. NUCC PROVIDES A SINGLE CLEARING SYSTEM FOR PAYMENTS/TRANSFERS BETWEEN WALLETS AND BANK ACCOUNTS BUT PROVIDES NO CONNECTION BETWEEN WALLETS. AS A RESULT, MOST PEOPLE IN CHINA HAVE BOTH WALLETS.

Most people in financial services know that China has two huge mobile payments wallets, Alipay and WeChat Pay that account for most retail payments in the country.

However, outside of China I suspect few have a good understanding of China’s payments infrastructure, its usage and where these wallets fit.

There are hardly any case studies discoverable online about China’s real-time, digital wallet payments and it is difficult to get statistics. Where information is available, interpreting it is tricky.

Neither Ant Group, owner of Alipay, nor Tencent, owner of WeChat Pay publish annual reports with details about their payment businesses. The only reliable source of information I can find in English, on payments in China is the People’s Bank of China (PBOC) quarterly and annual Payment System Reports1. The information provided is at a high level, but comprehensive, covering card and electronic payment instruments, the main bank payment systems and aggregate non-bank payment statistics (which I assume cover Alipay, WeChat Pay and other wallets).

Bank Payments Systems

The PBOC reports payments statistics in narrative form2 and below is my extract of the 2024 payment systems data from these texts in Table 1.

(at the time of writing: 1 USD = 7.25 RMB, 1 EUR = 7.86 RMB, 1 GBP = 9.39 RMB)

Table 1 – China’s payment clearing and settlement systems (2024) + non-bank institutions

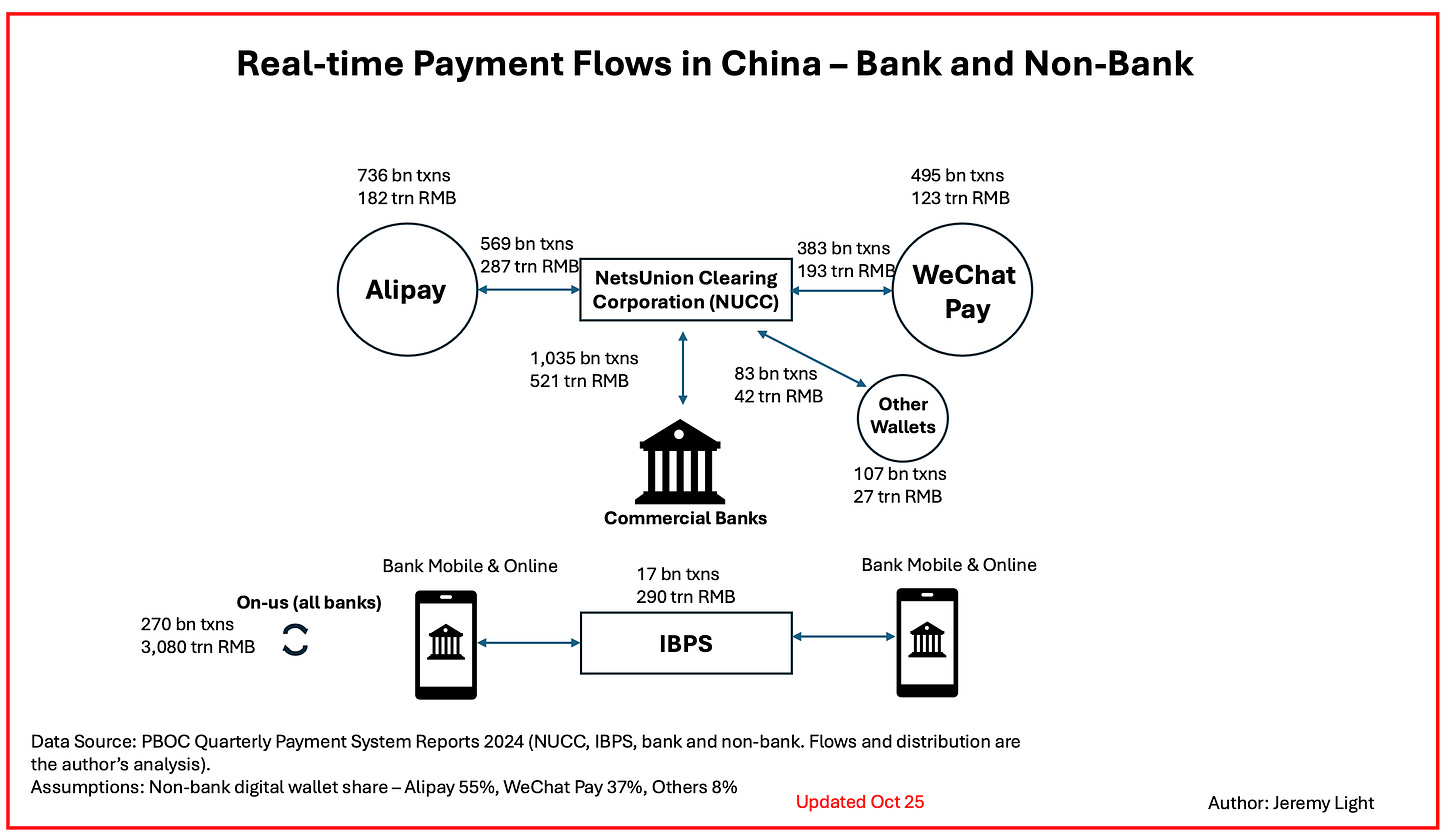

From a real-time payments perspective, the relevant payment systems in Table 1 are IBPS and NetsUnion Clearing (NUCC) and the non-bank payment institution online (digital) payment figures. IBPS clears and settles real-time online and mobile payments between banks. NUCC clears and settles payments between banks and non-banks, mainly Alipay and WeChat Pay (but there is no clearing and settlement between non-banks) – see Figure 1.

IBPS was launched in 2011 and NUCC in 20183.

Figure 1 – Real-time clearing systems and real-time payment flows4 (revised since original publication)

NUCC transactions are deposits into wallets from bank accounts, wallet withdrawals to bank accounts and payments initiated from a wallet to pull funds into it from a bank account.

The average value of a non-bank wallet payment is 248 RMB (34 USD), for NUCC 503 RMB (69 USD) and for IBEPS 17,432 RMB (2,324 USD). Online and mobile payments through banks are much higher value and lower volume than through non-bank wallets. Non-bank wallets are used for everyday payment needs while bank real-time payments are used clearly for other purposes in the main, most likely business payments.

Non-bank wallets in effect hold e-money, funded from a bank account or another wallet. If there are insufficient funds in a wallet to make a payment, the wallet pulls the funds in real-time from the wallet holder’s bank account. Payments can be made wallet-to-wallet (of the same brand) and wallet-to-bank-account. Bank account to wallet payments are permissible only for a wallet and bank account held by the same person to fund the wallet.

Electronic Payment Volumes in China

The transaction volumes for electronic payments covering cards, online and mobile banking and non-bank wallet payments are shown for the past five years in Figure 2.

Card volumes (China Union Pay) account for 18% of electronic payment volume in 2024 and 3% by value. The number of cards in China is surprisingly high at 9.9 billion (9.2 billion debit card, 727 million combined debit and credit card), or seven per capita. This high figure is driven by the enormous number of bank accounts, 15 billion including 14.8 billion for individuals, around 10 per capita (footnote 1).

Bank payments online and mobile, account for 14% of electronic payment volume in 2024 and 88% by value.

Non-bank digital wallet payments account for 68% of electronic payment volume in 2024 and 9% by value. Alipay and WeChat Pay account for most of these payments. WeChat Pay has more users (Deep Seek says 1.47bn vs 1.04bn for AliPay) and Alipay has bigger transaction volume. There is very little data on their market usage other than 2.8 billion wallets between them5 (a little higher than Deep Seek’s 2.5 billion total) and they probably account for 90%+ of all non-bank wallet payments. Other wallets with much smaller adoption include UnionPay Cloud QuickPass, Bestpay, QQ Pay and JD Pay.

Payments per Capita

Earlier this month I compared the retail time payment volumes of eight countries6 and showed Thailand had the highest of the group at 335 payments per capita. Since then, I have analysed Singapore and Kenya, which exceed Thailand with respectively 457 and 527 payments per capita, but China goes beyond both these by far, with 1,151 payments per capita – see Figure 3.

Figure 3 – Comparison of real-time payments per capita in different countries7

This equates to three payments per capita per day, every day of the year. In practice, only a subset of these can be payments for goods and services, the rest being transfers of funds between accounts and wallets. However, there is no information to quantify this.

Cash usage in China is very low. There were around 6bn cash withdrawals by card in 2024 (footnote 1), which is around four withdrawals per capita per year, suggesting about one in 10 - 13 people use cash regularly (if they make a withdrawal once per week).

Alipay and WeChat Pay

Alipay and WeChat Pay are super-apps, covering financial services, entertainment, social media, travel and leisure, shopping, restaurants and more. From a payments perspective they are used for a range of payment purposes - in-store, online, bill payments and person-to-person payments.

Anecdotal evidence suggests WeChat Pay is used for payments that result from messaging (P2P, restaurant ordering etc) whereas Alipay is used more for in-store and online payments.

Each has developed in different ways. Alipay was launched in 2003 as an escrow service for Taobao, Alibaba’s e-commerce platform. Similar to PayPal’s synergy with eBay, Alipay grew as Taobao and ecommerce grew. It was spun off from Alibaba in 2011 and has expanded since, both as a super-app and internationally outside of China.

WeChat Pay was launched by Tencent in 2013 as a payment service, initially using bank cards, integrated into WeChat, the largest messaging app in China. In 2014, it launched WeChat Red Packets (Hongbao) during the new year which caused adoption to go viral. Since then, WeChat Pay has expanded rapidly, including internationally, competing directly with Alipay as a super-app through WeChat Mini Programs (sub-apps within WeChat).

Both wallets have developed as super apps out of necessity. Payments on their own generate very little revenue and the addition of apps enabled by payments allowed the wallets to survive.

There are no published figures I can find on the two wallets’ relative market share, but one report8 suggests a split of 55% to Alipay and 37% to WeChat Pay at the end of 2023.

Conclusion

The payment volumes and values in China are enormous, in absolute terms and relative to other countries.

The number of bank accounts, averaging 10 per capita may give a clue as to why. It suggests a cumbersome banking system requiring consumers and businesses to use multiple accounts to meet their needs. This is likely to require frequent transfers between different accounts and wallets to position funds in the account or wallet where they are needed, driving up volumes - Chinese consumers and businesses must be experts in cash management.

There is an obvious correlation between the high number of bank accounts, cards and card transactions. Also, there may be a connection between these and the non-bank digital wallet transaction volumes. However, I am unable to identify one or explain why these volumes are so much higher than elsewhere in the world on a per capita basis. It is clear that ultimately, consumers prefer the convenience of Alipay, WeChat Pay and other wallets over bank accounts and bank apps for their everyday payment needs.

China is different to most countries and has a unique economy, in size and structure. It is also opaque, as evidenced by the dearth of payment statistics available online (in English or Chinese) and the absence of much detail, so it is difficult to identify the factors behind the adoption of real-time digital wallet payments. However, China is an advanced market for them, both bank and non-bank, with minimal cash usage.

Outside of card payments and bulk payments, all electronic consumer payments are real-time. As such, China is an indicator of how eventually every country may adopt real-time payments through digital wallets at scale.

This is critical to the payments strategies of payment service providers and start-ups the world over - bank and non-bank. They need to position and plan accordingly for a payments landscape where real-time payments through digital wallets dominate the markets where they operate.

The leading countries, as shown in Figure 3 including China, point to the future and to the opportunities and threats to expect along the way.

PBOC Payment System Reports http://www.pbc.gov.cn/en/3688110/3688259/3689026/3706133/4756451/5327700/index.html (note - this website appears to use http instead of https, so you may get a “Not Secure” message)

probably because the payment instrument statistics (footnote 1) are difficult to reconcile with the payment system statistics due to e.g. overlaps, making tabulation difficult

I believe prior to 2018 digital wallets connected directly with commercial banks through bilaterals until PBOC required them to set up and clear and settle through NUCC.

Figure 1 calculations:

- Non-bank online payments (digital wallets): 1,338 bn payments, value 332 trn RMB

- Split between wallets: Alipay 55%, WeChat Pay 37%, Others 8%

- NUCC flow: 1,035 bn payments, value 521 trn RMB split 55% Alipay to/from banks, 37% WeChat Pay to/from banks, 8% Others to/from banks

- IBPS flow = 17bn payments, 290 trn RMB

- Bank on-us flow = sum(online, mobile, phone) flow for banks minus IBPS flow

Statista Alipay and WeChat Pay wallets: https://www.statista.com/statistics/1271130/mobile-wallet-user-forecast-in-china/

https://jeremylight.substack.com/p/the-landscape-is-changing?r=axqgy I excluded China from this analysis due to insufficient data, but I had overlooked the non-bank payment statistics in the PBOC payment system reports (footnote 1).

see previous article (footnote 6) for the Eurozone, USA, Australia, UK, Poland, India, Brazil, Thailand

Singapore: https://www.mas.gov.sg/statistics/payment-statistics/semi-annual-retail-payment-statistics (my estimates for 2024)

Kenya: https://www.centralbank.go.ke/national-payments-system/mobile-payments/

China - footnote 1