So Young

M-PESA's 18th birthday in Kenya

M-PESA, the famous mobile money system in Kenya, turned 18 last week. It was launched on 6 Mar 07 by Safaricom in partnership with Vodafone1.

Aimed at facilitating microfinance, internal remittances and selling mobile phone airtime across Kenya, M-PESA was an immediate success.

An earlier pilot had shown very encouraging results, but I doubt at the launch Safaricom or Vodafone anticipated the speed of adoption, or the vibrant and hugely successful financial ecosystem that the 18-year-old M-PESA has grown into today.

M-PESA has expanded into other countries in Africa using the same technology platform it operates in Kenya, however, this article examines its business solely in Kenya and the figures used are those for Kenya only.

In late 2009, M-PESA’s growth was described2 as “astonishing”, with 8.3 million registered customers, corresponding to 57% of Safaricom’s customer base and 21% of the population. I expect there would have been even more astonishment if it had been known that 15 years later, the Central Bank of Kenya (CBK) would record 82m mobile accounts, mainly M-PESA, more than one account for the whole population (56m)3.

The stand-out figure though, is the number of transactions. Safaricom reported 28 billion M-PESA transactions for the financial year ending 31 Mar 244, up 34% on the previous year, valued at 40 trillion KES (Kenyan Shillings - $309bn USD), up 10%.

In contrast, credit and debit card volumes in Kenya were just 61m payments for the same period (and declining)5.

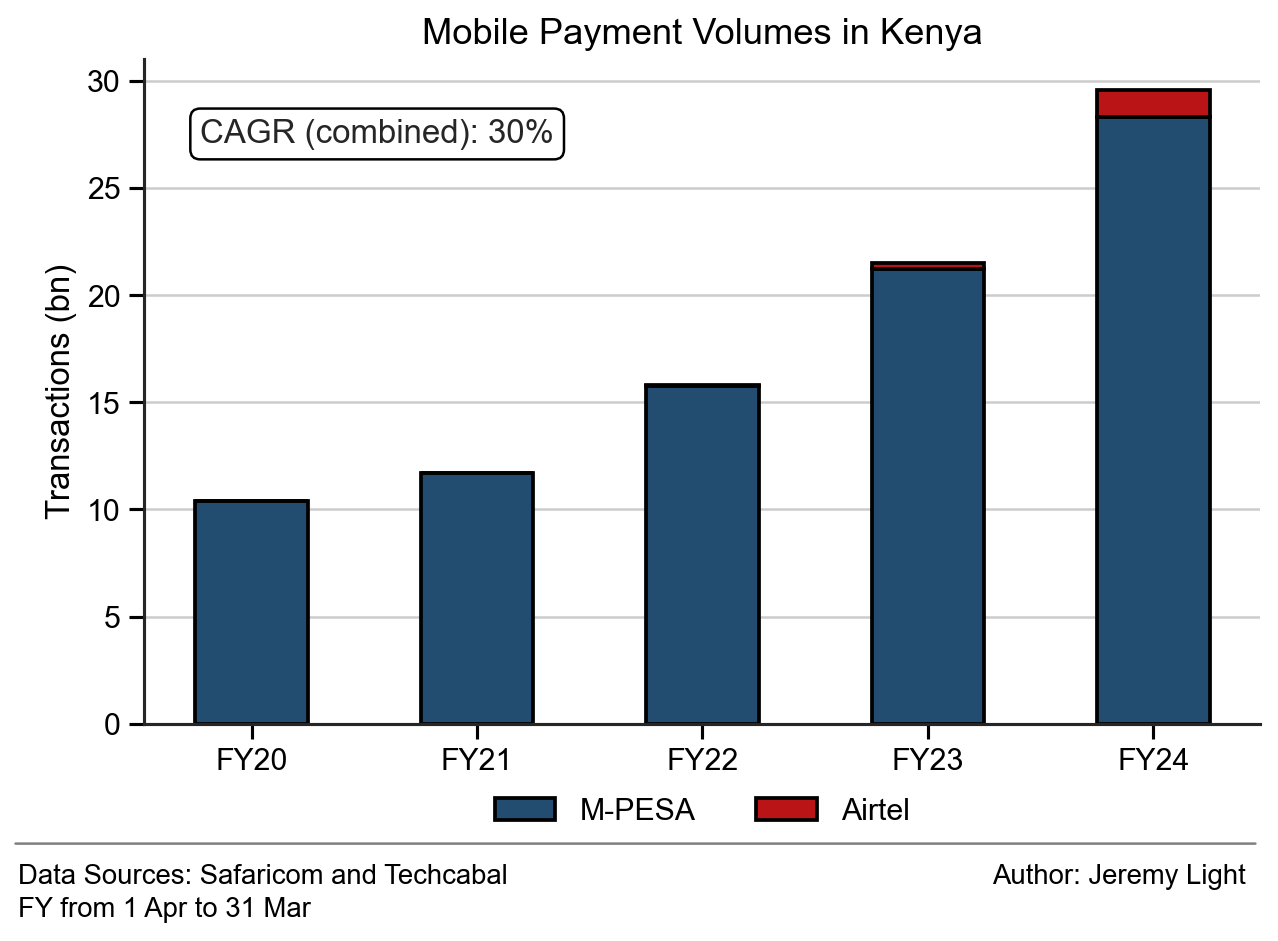

Figure 1 shows the transaction growth of mobile payments in Kenya over the past five years including Airtel, which has re-emerged recently as the nearest competitor to M-PESA in Kenya6.

Figure 1 – Growth of mobile payment volumes in Kenya in recent years

Last week I published an article7 comparing the leading real-time and mobile payment systems in the world, using annual payments per capita as the comparator. Excluding China (due to insufficient data), the leaders among the group are Thailand at 355 payments per capita, Brazil at 266 and India at 119.

However, on this metric Kenya outstrips all of them at 527 payments per capita.

I observed that most of the countries in the sample had a remarkably consistent figure of around 650 total annual payments per capita, covering mobile/real-time, cards and cash payments, even though the mix of the three payment methods varied widely in each country. Applying this to Kenya suggests that cash transactions account for just 19% of all consumer payments in Kenya, which is at odds with a reported figure of 80%8. I suspect that this reported figure is out of date given the rapid growth of M-PESA and that cash usage has reduced significantly in recent years.

Normally, I would make an estimate for FY25 (ending on 31 Mar 25, this month) to include in Figure 1, but the FY24 total is so large in comparison to the population size and M-PESA has sustained 34%-35% growth for the past three years, making a forecast very difficult. It will be interesting to see the outcome for FY25 in Safaricom’s next annual report to be published in June/July9.

How M-PESA Works

Originally, M-PESA was used as a cash-transfer system within Kenya. 18 years ago, only 26% of the adult population had a bank account and there were very few bank branches outside of cities. The economy was mainly cash-based.

Due to migration to cities from the countryside in search of work, many people had dependents and families in the countryside to support. Typically, they would send cash home using bus drivers and taxi drivers as couriers, or take a day off work to deliver it themselves – risky, time consuming and expensive. M-PESA solved this.

With M-PESA, using feature phones (USDD/SMS), the cash is deposited with an M-PESA agent, in a city for example, who sends a code by text to the recipient. The recipient walks into any M-PESA agent near them and gets the cash on presentation of the SMS. Safaricom credits the agent’s M-PESA account, plus a commission.

M-PESA is also available as a mobile app on smartphones. In FY24 it had about 32m active consumers, with 3.6m active on the smartphone app. There is a separate smartphone app for businesses, with 142 thousand active (footnote 4).

Safaricom already had agents throughout Kenya selling airtime and with M-PESA, this network expanded rapidly due to network effects. Agents range from local shops to supermarkets to petrol stations to banks – they are incentivised with fee income, additional footfall and in some cases capital and loans. Many agents are also retail businesses who use the Lipa Na M-PESA capability to accept M-PESA payments, there are 633K of these and a similar number of micro businesses such as motorcycle taxis, food vendors and kiosk owners who use M-PESA’s Pochi La Biashara capability to get paid.

To use M-PESA, consumers and businesses need a registered Safaricom SIM on their mobile phone (there is no need to have a smartphone) and with it they may open an account at an agent on presentation of id. Safaricom sends a confirmation SMS and the user creates a PIN. They are now set up and can deposit cash into their M-PESA account as well as receive it. See footnotes for how a payment is made10.

Today banks are connected into M-PESA and M-PESA accounts (wallets) are usable for a full range of transactions and uses, all in real-time. Wallet-to-wallet, wallet-to-bank, bank-to-wallet, online and in-store, ATM withdrawals and bill payments.

The M-PESA Ecosystem

M-PESA has expanded far beyond a cash-in/cash-out service (although this is still core to it) into an ecosystem where a user can fulfill many of their daily needs using the app, paying in real-time electronically without using cash or going near an agent.

M-PESA describes its consumer and business mobile apps as super-apps, with over 100 mini-apps that can be downloaded individually (without overloading the low-capacity smartphones popular in Kenya) covering a range of needs – for example, savings and loans (M-Shwari, KCB M-PESA), micro overdrafts (Fuliza), international payments, airtime for international numbers, train booking (Madaraka Express), flights, entertainment and events, healthcare (M-TIBA), bill manager, ecommerce and investments (Ziidi).

Initially, banks in Kenya tried to derail M-PESA – they saw it as a threat. However, in large part due to M-PESA, with banks now integral to its ecosystem, almost 85% of the adult population in Kenya has a bank account today (although no bank account is needed to have an M-PESA account).

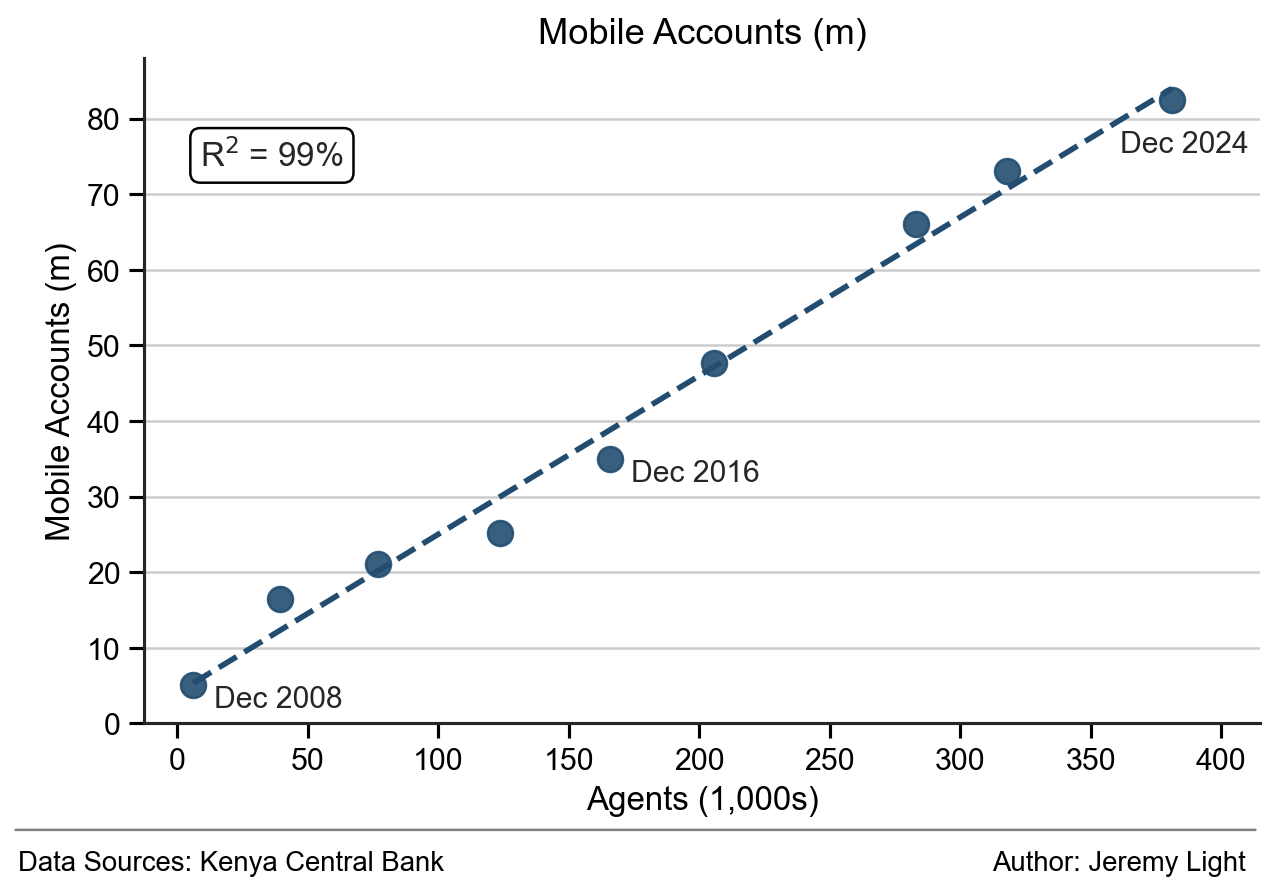

An interesting aspect of the ecosystem is the linear relationship between agents and M-PESA accounts. The CBK has tracked and published the number of agents and mobile accounts (mainly M-PESA) each month since March 2007 (footnote 3) and there is a clear linear relationship between the two.

Figure 2 shows this relationship (with only year-end figures for clarity) – averaging about 225 mobile accounts per agent throughout its 18-years, which have grown to over 381,000 agents and 82m mobile accounts as of December 2024.

Figure 2 – Growth of mobile accounts and agents in Kenya

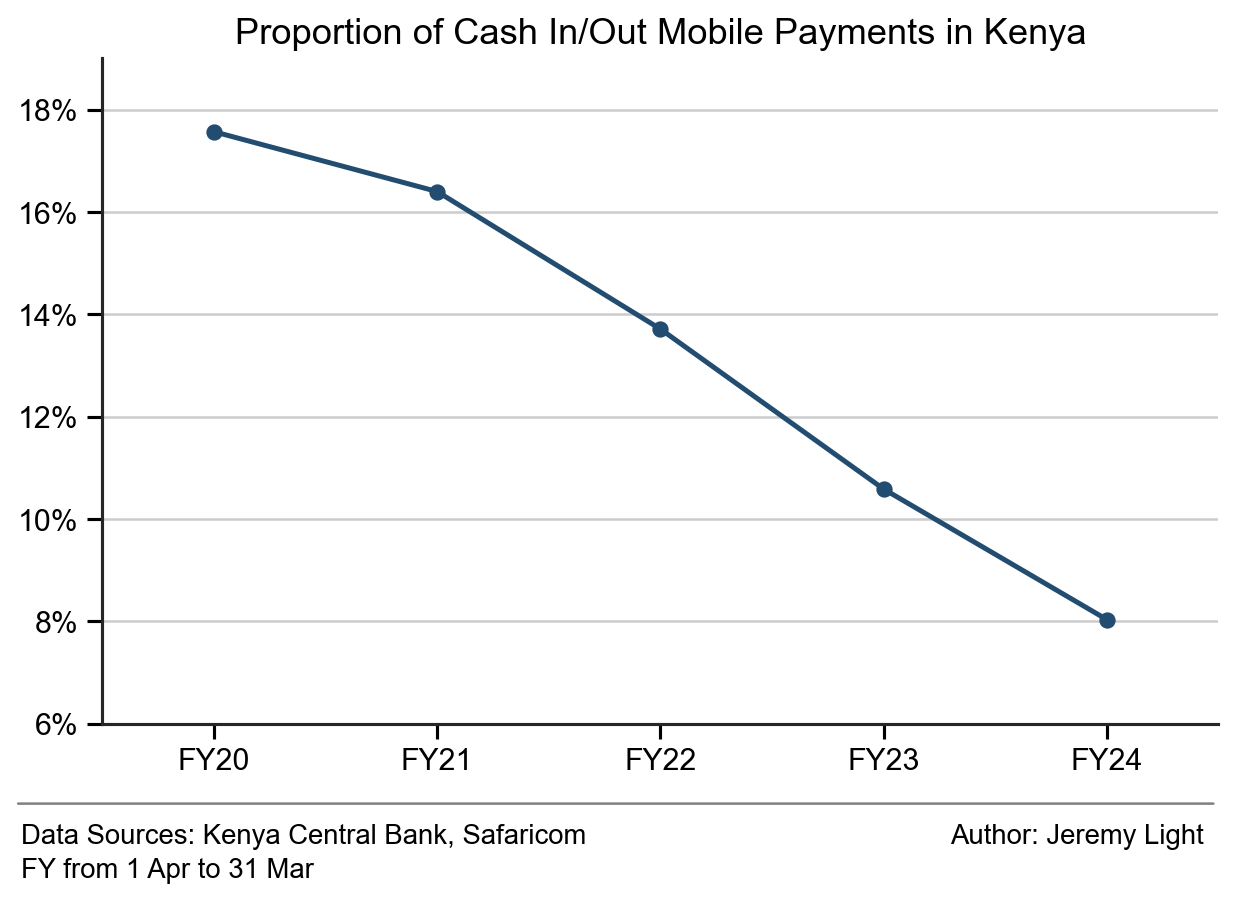

The CBK monitors and publishes (footnote 3) the volume and value of cash-in/cash-out transactions, to keep track of liquidity requirements. In recent years, as shown in Figure 3, the proportion of all transactions that are cash-in/cash-out transactions has fallen, indicating that even though these type of transactions are growing still, use of M-PESA for digital payments is growing even faster.

Figure 3 – Decline in proportion of mobile payments for cash in/out due to fast growth in digital payments

As M-PESA volumes rise, their average value has fallen, from 1,898 KES ($14.68) in 2020 to 1,420 KES ($10.99) last year. This is another example of payment atomisation I have written about previously11.

M-PESA is a significant revenue generator for Safaricom. In FY24, M-PESA revenue was 139.91bn KES ($1.1bn), up 19% YoY (footnote 4). Only 43% of transactions are chargeable, but M-PESA’s value proposition has always been value adding, allowing fees to be charged – for example, a 30 KES ($0.23) cash-in/cash-out fee, say, is well worth paying compared to taking a day off work and/or paying a bus or taxi driver with a material risk of loss. The average fee for chargeable transactions is 0.62% of transaction value12.

I will cover M-PESA fees in a later article on fees in payment systems.

Success Factors

M-PESA is one of the most successful mobile real-time payment systems that you will find anywhere in the world and after PayPal, it must be the most enduring.

Key contributors to this success include:

1. Safaricom’s 80% market share of mobile telecoms in Kenya at the start gave it a ready-made customer base covering most of the Kenyan population.

2. Safaricom’s agent network already established to sell airtime and mobile phones gave it a ready-made infrastructure to handle cash-in/cash-out services, rural and urban across Kenya and a starting point for rapid expansion.

3. A widespread need to improve internal cash remittances ensured a strong product-market fit and high, persistent demand when M-PESA launched.

4. A harmonious ecosystem with banks brought into it and agents compliant with Safaricom’s rules, incentivised by commissions, footfall, capital and the opportunity to become merchants on the network, creating strong network effects.

5. Easy consumer adoption – M-PESA is cheap/free, quick and easy to set up, very easy to use, with a standardised user experience for everyone. It had an immediate impact on people’s lives when it launched, with word-of-mouth recommendations playing a key role in early adoption.

6. A supportive central bank – CBK had a critical role in allowing M-PESA to operate with light regulation as a telecoms payments network rather than under bank rules, based on pilot testing to ascertain actual risks in practice; having the foresight to see the beneficial impact on internal cash remittances; batting away bank lobbying and objections to M-PESA early on; and in bringing the banks into the M-PESA ecosystem, to the ecosystem’s benefit and to their benefit – the number of bank accounts has roughly tripled due to M-PESA.

7. A scalable network – M-PESA scaled easily and it scaled fast and predictably (Figure 2).

8. Safaricom’s commitment – although a telecoms operator, M-PESA accounts for 42% of Safaricom’s revenue (FY24 - footnote 4). The company has always made M-PESA a priority in terms of investment, expansion of the agent network, growing M-PESA as a financial ecosystem rather than a product, technology development, pricing and regulatory engagement, driven by successive CEOs.

9. Brand – the M-PESA brand is widely recognised in Kenya and globally.

10. M-PESA is bank agnostic and works without needing a bank account – although M-PESA has drawn a large proportion of the population into the banking system, it works without needing a bank account and when connected to a bank account, any bank in Kenya may be used.

11. M-PESA is homegrown – sovereignty of payments infrastructure is important in many countries. Like Pix and UPI, M-PESA is another good example - designed and built for Kenya, which has led to a very strong product-market fit.

12. Seamless integration with cash – M-PESA’s roots are in internal cash remittances and its services facilitate the transition from cash to digital payments, working seamlessly with both, giving consumers choice and control.

13. M-PESA supports all payment types – wallet-to-wallet, wallet-to-bank, P2P, B2B, bills etc. Although there are limits on higher value payments (depending on user type), M-PESA is an all-in-one payment service that caters for most payment needs (and is being expanded into a super app for wider financial and other services).

14. M-PESA allows any user to send and receive payments (like cash and unlike cards) using mobile phone numbers as an easy-to-use way to address and route payments, allowing use by small and large businesses and for P2P payments.

15. Instant notification – both sender and receiver get instant notification of payments by SMS, making it practical to use M-PESA in commerce.

Many of these factors are common to those in other payment systems I have covered – iDEAL (Netherlands), Pix (Brazil) and UPI (India)13 and show the way for development of modern payments systems.

Conclusion

At 18, M-PESA is among the most innovative and successful mobile real-time payment systems in the world. In terms of annual payments per capita, it is far ahead of most, possibly all, by a wide margin.

It has arrived where it is today by a different route from others – especially with its cash-in/cash-out heritage, its agent network and its burgeoning super-app capabilities. However, it demonstrates, along with the others, that whatever the starting position and the length of time it has been in operation, the world’s payment systems are marching towards mobile, real-time payments, with wallets, working with and without bank accounts.

Different countries have different concurrent levels of cash and card payments – cash is in decline everywhere, as are cards in many places (or are likely to decline eventually, even where they dominate), giving way to mobile, real-time payment systems like M-PESA.

M-PESA has come of age, an established and vibrant financial ecosystem – its future is bright.

Happy 18th!

At the time, Safaricom, a Kenyan company was 40% owned by Vodafone (5% today), a UK company. Today, in a confusing ownership structure, M-PESA is owned jointly by Safaricom and Vodacom, a South African company (which is 65% owned by Vodafone). Vodacom also owns 35% of Safaricom. Safaricom operates M-PESA in Kenya and Ethiopia, while Vodacom operates M-PESA in six other countries in Africa.

Consult Hyperion: https://chyp.com/2009/12/30/m-pesa-update/

CBK mobile statistics: https://www.centralbank.go.ke/national-payments-system/mobile-payments/

Zain launched Zap as a competitor to M-PESA in 2009, but had little success – Airtel acquired Zain in 2010 and in recent years has been developing its mobile money service in Kenya.

Real-time payment system comparison: https://jeremylight.substack.com/p/the-landscape-is-changing?r=axqgy

Techcabal reference to cash usage in Kenya: https://techcabal.com/2024/12/18/popular-payment-methods-kenya/

Airtel also, for the same reporting period, due to be published in June, but in the past, they have provided no detail on their mobile payments volumes in Kenya.

To send money to another M-PESA user, using their mobile phone number:

Dial the M-PESA USSD code (*334#) or open the M-PESA app.

Select "Send Money".

Enter the recipient's mobile phone number (must be a registered M-PESA user).

Enter the amount to send.

Confirm details (recipient name appears for verification).

Enter M-PESA PIN to authorise the transaction.

Both sender and recipient receive an SMS confirmation.

For non-M-PESA users, the sender can still transfer money to the recipient who gets a code via SMS to withdraw the cash from an M-PESA agent.

Payment atomisation: https://jeremylight.substack.com/p/got-a-lot-o-payin-to-do?r=axqgy

Based on chargeable transaction value of 22.7trn KES and revenue of 139.9bn KES, reported in the Safaricom’s FY24 annual report (footnote 4)

4-Oct-24 and 11-Oct-24 (iDEAL), 6-Feb-25 (UPI), 27-Feb-25 (Pix): https://jeremylight.substack.com/publish/home

Thank you for this comprehensive update Jeremy.

If you are curious, here's a short piece from the 15th anniversary that talks about M-PESA's origins https://dgwbirch.substack.com/p/a-milestone-for-m-pesa

Milford - thank you for your feedback. My angle in the article is the adoption of M-PESA as a payment system, its scale, how it got there and what makes it successful. It is one of several I am writing about payment systems around the world. Any negative externalities are a separate subject, but leaving them out I can see why you might see the article as unbalanced.

I do have a concern about financial inclusion - I am all for digital payments, they make life much easier, as exemplified by M-PESA, with demand for them from its start. However, many equate financial inclusion with having a bank account, meaning the ability to borrow more, which is what banks want, whether for good or bad (usually for bad, banks encourage or allow people to take out loans without needing them). It would be interesting to know why the % of the banked population increased from 26% to 85% with M-PESA when it can be used without a bank account.

I am also all for cash - it is the only form of money which individuals own and can use freely and it provides a counterbalance to digital payment fees. Norway for example has just 4% cash usage but some of the highest mobile payment fees in Europe, higher than cards - retailers have no option but to accept them.

I am covering payment fees in a later article, including examining the relationship of cash usage with payment fees. Any info you have on them for M-PESA or elsewhere would be welcome, I will reciprocate with anything I unearth.

On the face of it, there seems little egregious with Safaricom when looking at its FY24 annual report (footnote 4). 57% of M-PESA payments and 44% by value are non-chargeable in Kenya - chargeable txns average 1,861 KES, non-chargeable average 1,086 KES, indicating that may be it is higher value txns that incur fees. However, it is unclear what non-chargeable means. Non-chargeable just to the consumer or non-chargeable to the consumer and the retailer (when there is one)? Typically in payment systems, P2P payments are free to both sender and receiver and P2B payments are "free" to the consumer, but incur fees for the retailer, unseen by the consumer.

Dividing the M-PESA revenue (140bn KES) by the value of chargeable transactions (23 trn KES) is 0.6% which is low compared to card transaction fees, and it will include income from all their services and super-app in addition to transaction fees. However, this is just an average, if there is a fixed fee component on transactions, fees on low value transactions could be much higher in % terms, which is a key problem worldwide inhibiting micropayments.