Under Pressure

Open banking A2A real-time payments

Over the past two months I have shown how real-time Account-to-Account (A2A) payments initiated through digital wallets are booming worldwide. However, this has been achieved without using open banking protocols, despite enormous efforts to introduce them, mainly regulatory, some commercial, especially in the UK and Europe.

What will it take for open banking to catch up?

To provide some context, the top five countries in the 50 I have researched1 with real-time payments systems had real-time payment volumes per capita in 2024 of:

- China: 1,147

- Kenya: 613

- Thailand: 485

- Singapore: 440

- Malaysia: 332

In this list, open banking programmes have little or no role. China has none. Kenya’s is at the planning stage. Malaysia and Thailand have non-binding frameworks. Singapore has an open banking programme (SGFinDex) whose use for payments is limited, with PayNow (clearing through FAST) dominating digital A2A payments instead.

In comparison, those countries/regions where open banking is most active include Australia (ranked 23) at 75 real-time payments per capita in 2024, UK (ranked 22) at 75, the Eurozone (ranked 26) at 55 and the USA (ranked 27) at 50 (footnote 1).

In Europe, open banking is entrenched through regulation but a number of countries there have real-time payment methods that are winning without using open banking APIs – Denmark, Netherlands, Norway, Poland, Portugal, Romania, Sweden and Spain. The Wero digital wallet launched last year as a Europe-wide solution uses the SCT Inst payment scheme but deliberately avoided open banking APIs, finding them to access insufficient bank functionality to support a Wero wallet2.

Open banking in the USA has been around a long time and has developed commercially, without regulatory impetus. Data aggregation for personal financial management has broadened into payments, with de facto standards like FDX3 emerging. Players include Finicity and Plaid. For payments, they face strong headwinds competing with bank preferences for card networks over A2A payments.

Open Banking in the UK

The UK has perhaps the most advanced regulatory-driven open banking programme. In May 2025, 28m open banking payments were initiated, with almost nine million users4.

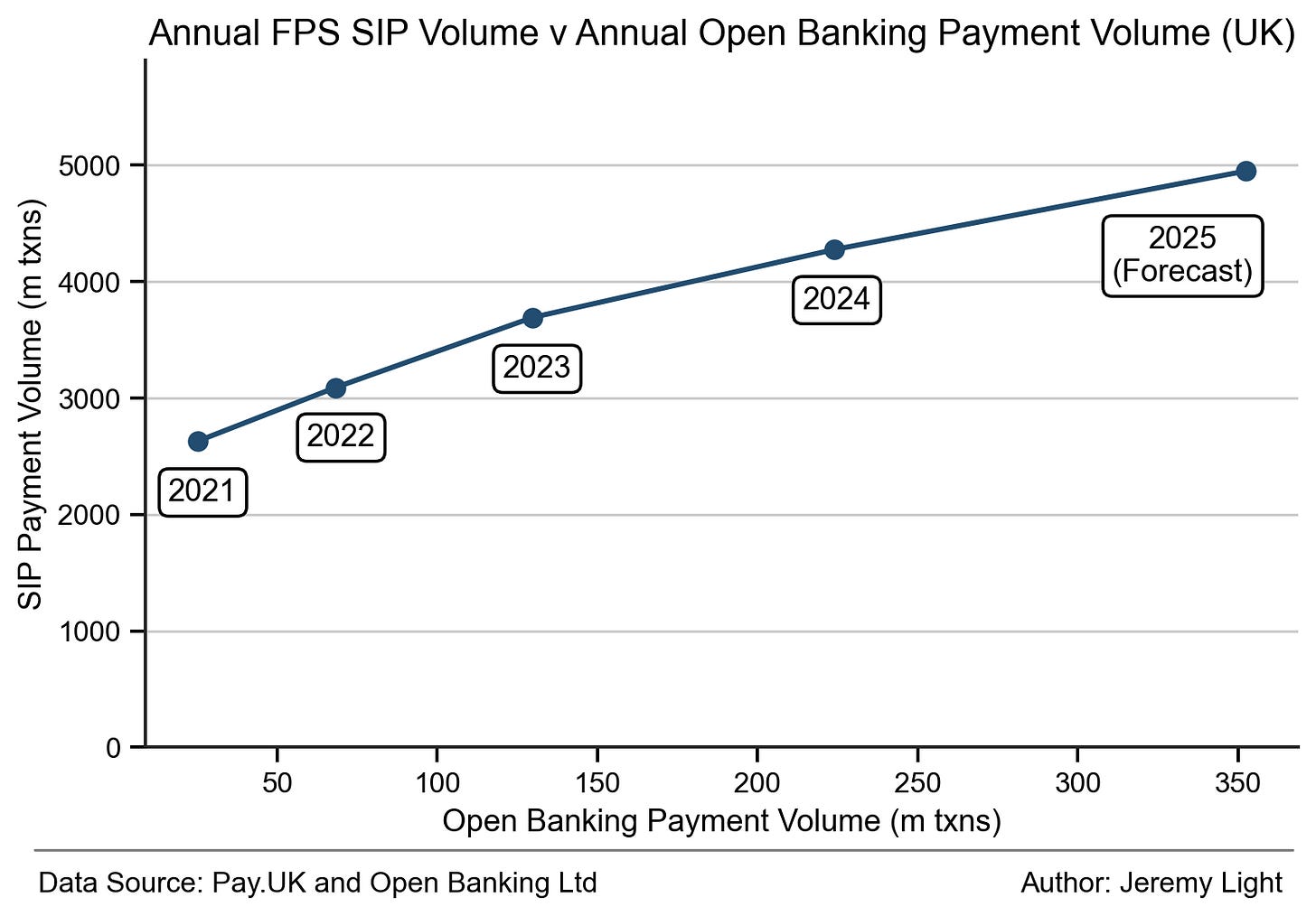

Figure 1 plots UK real-time payment (Single Immediate Payment - SIP) volumes against open banking payment initiations, reflecting growth of open banking payment initiations at around 70% annually, higher than SIPs at 16%. However, SIPs initiated through open banking were only about 5% of all SIPs in 2024, which I forecast will rise to 7% in 2025. There is still some way to go before open banking is a major driver of SIP volumes.

Figure 1 – UK Faster Payment SIP volumes .v. open banking payment initiations

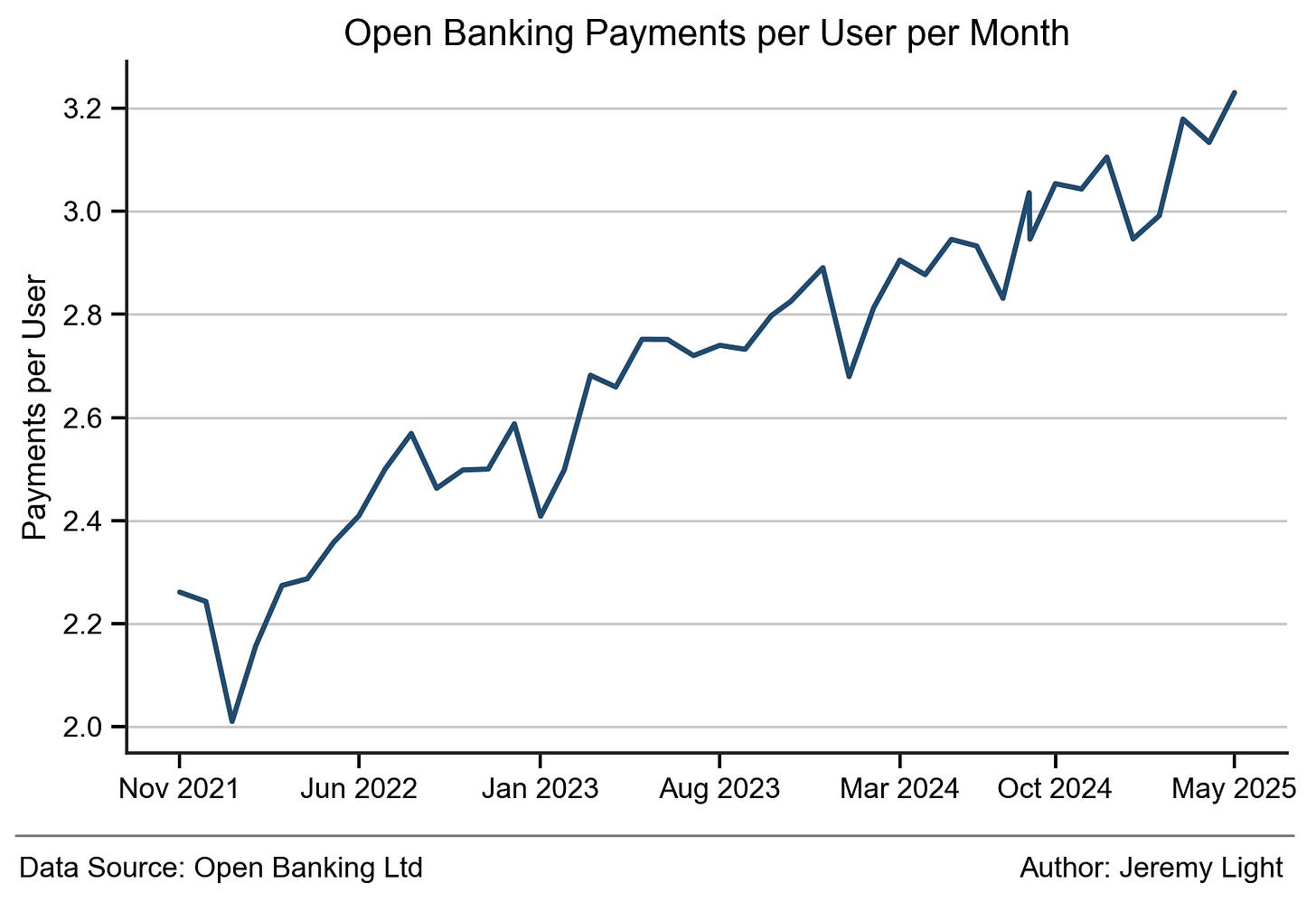

Figure 2 shows the monthly open banking payments per user, which were 3.2 in May 2025. Compare this figure to the 11 contactless card payments per card per month, with UK users having around three cards on average5 and it is apparent that UK users are only just starting with open banking.

Last year I stated that this metric was stuck in a narrow range but more realistically it is edging slowly upwards at the rate of about an additional monthly payment per user every 3 – 4 years. This indicates that network effects are yet to kick-in to drive up volumes, where users have more merchants to pay with open banking and more frequently, in turn drawing in more merchants driving more transactions.

Figure 2 – UK monthly open banking payment initiations per user

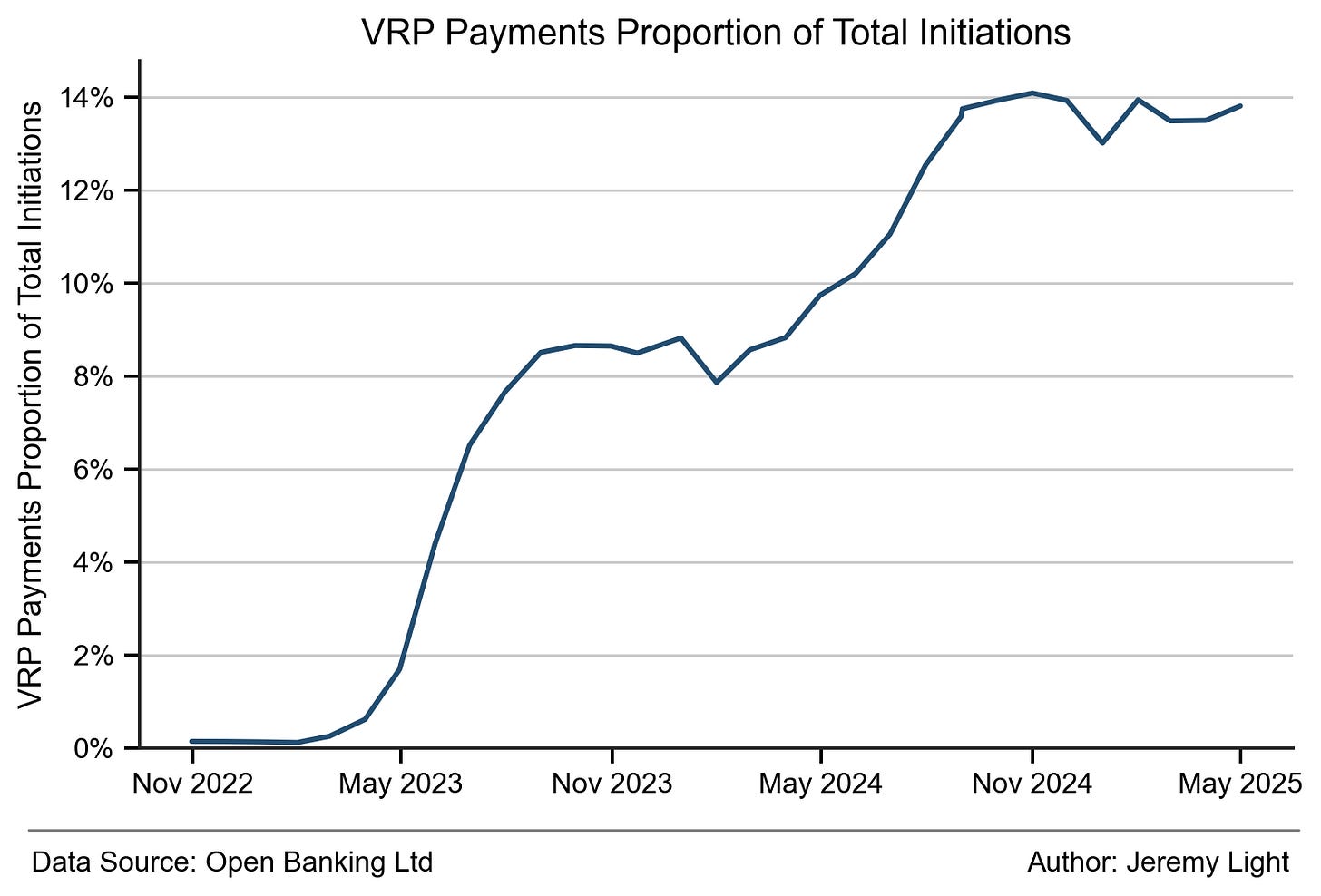

Variable Recurring Payments (VRPs) are the great hope to expand the uses for open banking and the number of merchants accepting it. Figure 3 shows VRPs have plateaued at around 14% of open banking payments, having risen from a previous plateau of 8% two years ago.

At the moment VRPs are restricted in the UK to moving money between customer’s own accounts with the main use, it seems, to pay into accounts set up to repay debts (to utility companies, credit cards etc). With moves underway6 to extend VRPs to pay into any account, specifically from customer accounts to retailer accounts, VRPs could take off soon, reaching a much higher level of usage than in Figure 3.

Figure 3 – UK monthly open banking payment initiations per user

Overall, Figures 1, 2 and 3 show UK open banking payment adoption is ticking steadily upwards but has a long way to go to match other A2A real-time payment methods.

At the start of 2025 I forecast7 390m UK open banking payments for 2025. Based on 2025 volumes so far, I have revised the full year forecast downwards a little to 350m, split 300m single payment initiations and 50m VRPs.

However, if UK SIP volumes are to hit, say the same level as Malaysia on a per capita basis (number five in the world ranking above), they would need to reach at least 23bn annual real-time payments, over five times higher than last year’s volume of 4bn payments.

If open banking is to drive this increase in the UK and in the rest of Europe, what needs to change?

Driving Up Open BankingVolumes

Many in the UK, including Open Banking Ltd8 believe the Data (Use and Access) Act, which passed into UK law last week is essential for open banking to develop further but I doubt it will make much difference for payments. The Act makes it easier for organisations to share data and make personal data available for wider use. However, rather than data sharing, it is digital wallets that account for the runaway success of real-time A2A payments in the countries listed earlier and in others close behind them such as Brazil and India.

In my view, open banking needs to be integrated into digital wallets if it is to drive up real-time A2A payment volumes to the heights seen in the countries listed earlier.

The key characteristics of these wallets are:

- Connectivity to any bank in a country (or for bank-provided wallets such as in Brazil, provision by all banks with adherence to common standards on functionality and UX)

- A stored value account as an option and an alternative to connecting to a bank account

- A single tap/scan/click to initiate a payment

- Useable on-line and in-person to meet all day-to-day payment needs, principally through using QR codes for acceptance

- A common addressability standard (allowing flexible aliases such as email, mobile phone numbers, user-generated or other ids)

- Support for P2P payments so that anyone and any business can accept payments as easily as making them

- Ubiquitous adoption by merchants of all sizes from micro-merchants and sole traders to large retailers.

Interestingly, Wollette in the UK announced9 this week it will launch a digital wallet later in 2025 using open banking, powered by Ordo. It is short on details on how this works but next week I will explore how the value chain for open banking could be opened up using digital wallets without relying on mobile banking apps.

Conclusion

There is a stark contrast between the volumes of A2A real-time payments initiated through digital wallets around the world and those initiated through open banking.

In Europe and the UK, this is due to open banking being driven by regulation and to a regulatory-driven mindset that has taken hold. So far, there has been insufficient commercial impetus for open banking to really take off, with the exception of the USA but where it is still held back by competition from cards.

Digital wallets with A2A real-time payments have no need for open banking – the evidence, particularly from countries in Asia is overwhelming but open banking needs digital wallets to get widespread mass adoption.

In turn, open banking embedded in digital wallets needs to make those wallets do more and be better than straight A2A real-time payment wallets – a tough challenge and a topic for next week.

See previous articles since 25 April 2025 covering real-time A2A payments in Africa, Europe, Latin America, Middle East and North America. Within the next month, I plan to publish the ranking of all 50 countries researched in a single article.

Payments Trilogue EPI Wero at 21:12:

FDX: https://financialdataexchange.org/

UK open banking performance statistics: https://www.openbanking.org.uk/api-performance/. These cover the nine banks mandated (by the CMA) to provide open banking APIs but other, smaller banks also provide them voluntarily.

UK Finance card spending update March 2025: https://www.ukfinance.org.uk/system/files/2025-06/Card%20Spending%20Update%20-%20March%202025.pdf

VRP initiatives. VRP operator: https://www.fintechfutures.com/open-banking/uk-financial-industry-players-to-fund-operator-for-commercial-vrps ; Potential commercial models: https://www.openbanking.org.uk/wp-content/uploads/The-commercial-model-for-cVRP-Wave-1.pdf

Wollette and Ordo: https://wollette.com/en/landing/ordopay

The big issue is that OB in the UK is that there is no scheme, just connectivity and rails. Almost every successful comparator you've mentioned had a top down, often central bank led implementation, and or a central scheme of some kind.

I am bullish on Wero is a it a scheme with big potential scale. In the UK Visa A2A will be something to watch. Otherwise existing OB doesn't have a brand or an acceptance mark, and saying Pay By Bank sounds a bit vague, and to some a bit scary.

Yet I'm sure over time OB volumes will grow to a decent level compared to cards. But if we had done it another way it could have been a lot quicker.