Push it

Reasons to make open banking account information services real-time

A year ago1, I covered open banking Account Information Services (AIS) in the UK and concluded that AIS looks more niche than mainstream and more business than consumer.

This article gives an update on AIS in the UK and highlights how AIS could have greater utility with real-time services to become more mainstream.

AIS Recap

AIS APIs allow third party providers (TPPs) to access a user’s bank account, with their consent, for retrieval of:

· Account balance

· Transaction history

· Account details (type, currency, account number)

· Multi-account view (retrieve data from accounts across multiple banks)

· Consent management

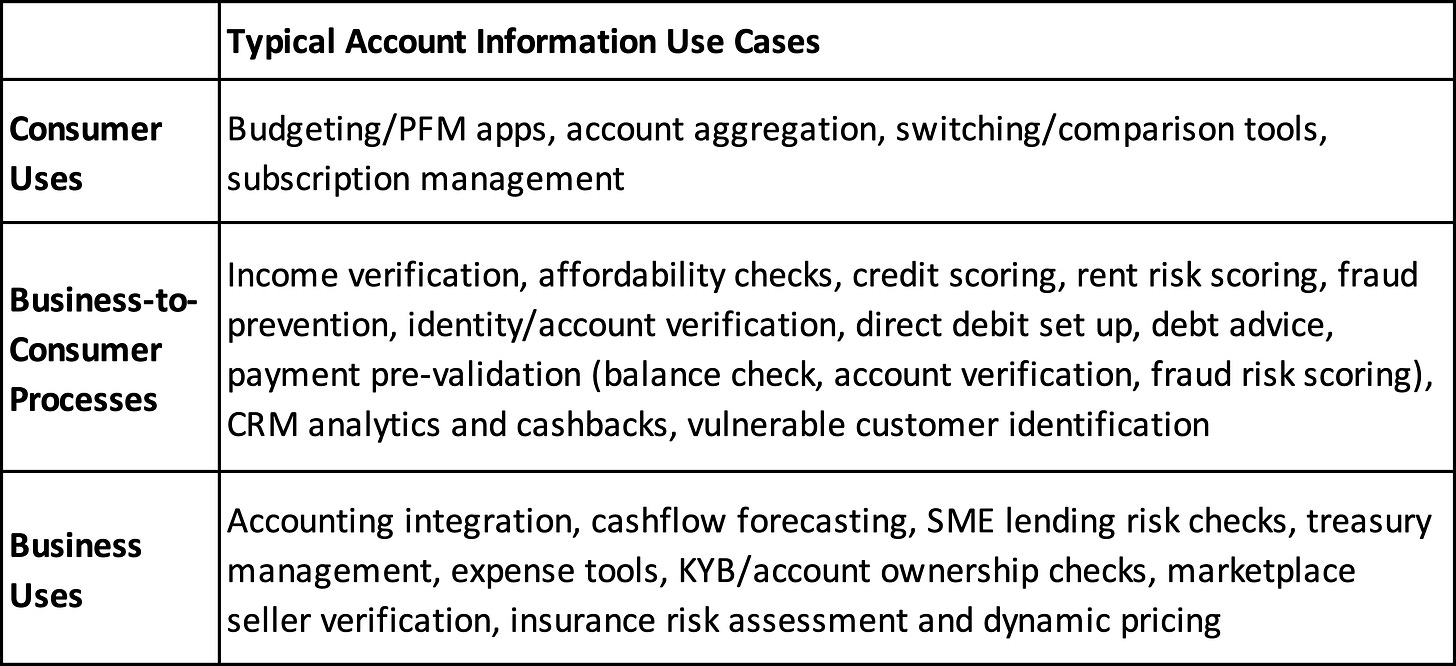

Uses for AIS APIs are numerous as shown in Table 1:

Table 1 – AIS use cases

AIS UK Metrics

The number of AIS users each month climbed from 5.7m in September 2024 to 7.6m in September 2025 a 32% increase. I forecast 8.1m users in December this year and 10.9m at the end of next year.

User numbers since June 2022 with a forecast to December 2026 are shown in Figure 1.

Figure 1 – UK open banking users, actual and forecast

For comparison, Figure 1 shows Payment Initiation Service (PIS) users alongside AIS users. PIS users passed AIS in August 2023 and have kept climbing. The number of PIS users rose from 6.8m in September 2024 to 9.7m in September 2025, a 43% increase.

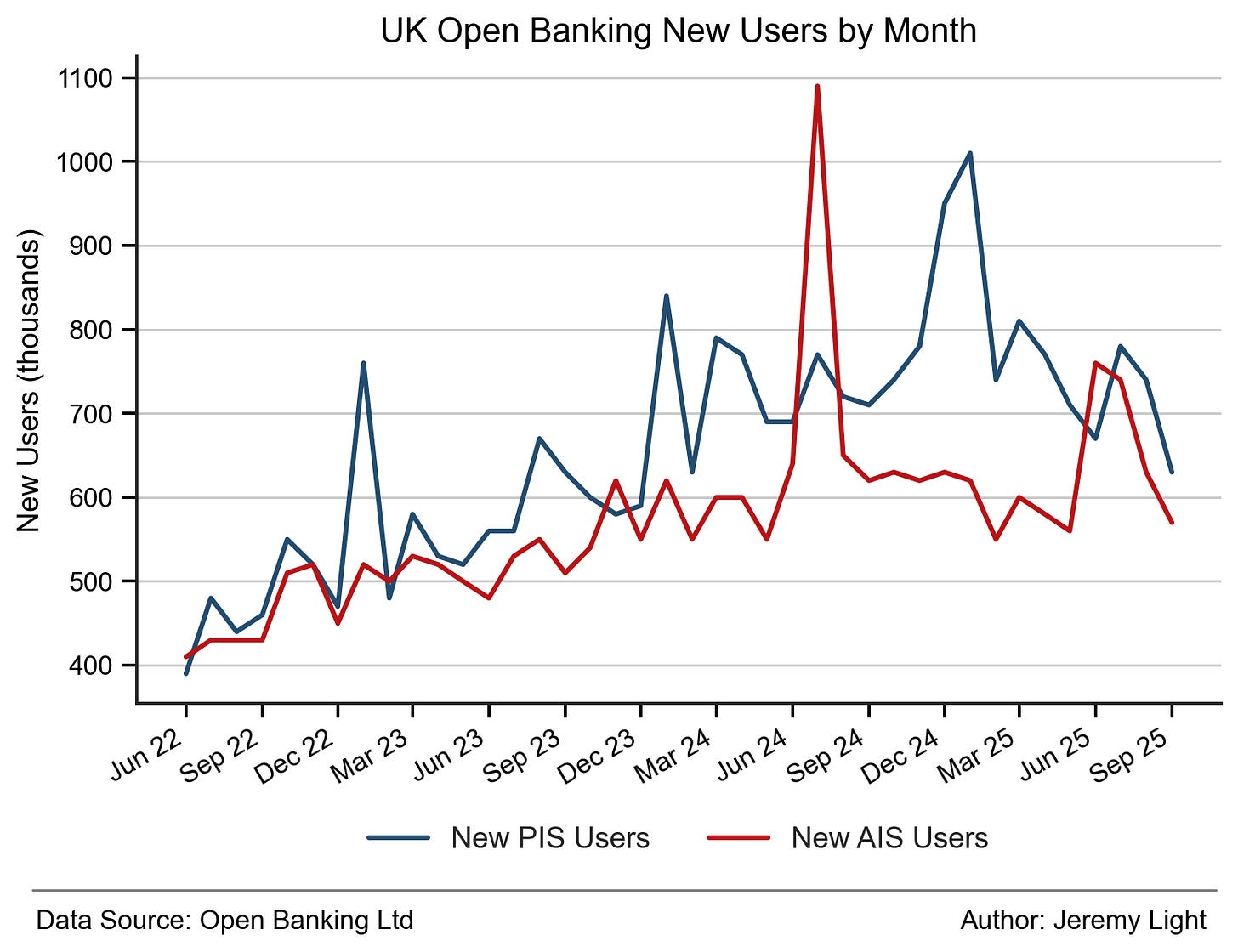

For the past two years, there have been around 620k – 630k new AIS users each month, with a spike to over a 1m in July last year. This is shown in Figure 2.

Figure 2 – UK open banking new users each month

New PIS user numbers are higher than AIS, averaging around 780k per month over the past year, helping to explain why overall PIS user numbers in Figure 1 are pulling away from AIS.

There is no direct connection between Figure 1 and Figure 2 as some users are irregular or one-time users and drop off from the totals month-to-month. I calculate that around 90% - 92% of AIS users return to use AIS each month and 92% - 94% of PIS users return. This is an improvement from a year ago when these percentages ranged from 86% to 90%. Open banking services appear to be sticky and fulfilling a regular need for most users.

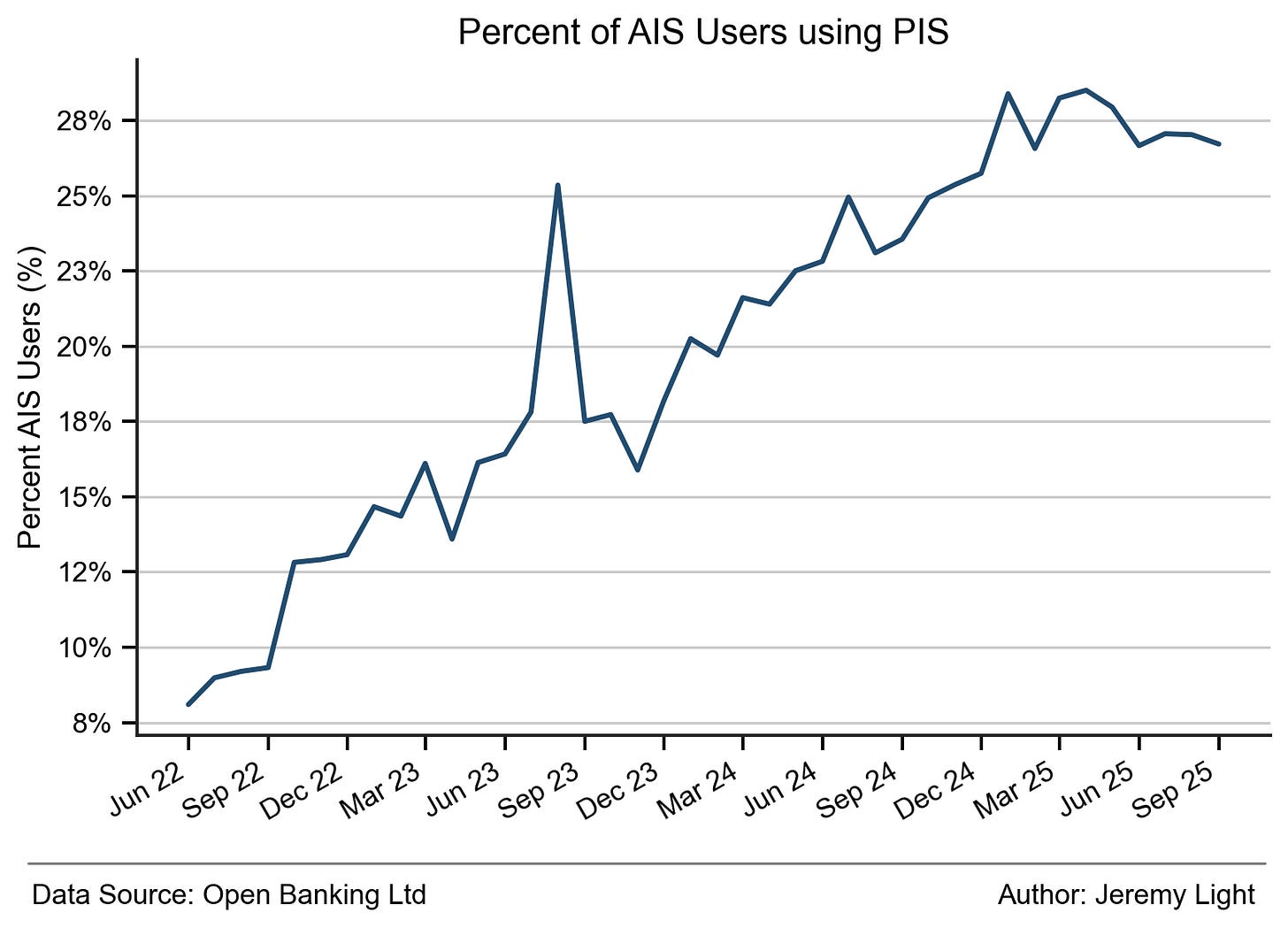

My estimate of the percentage of AIS users who also use PIS are shown in Figure 3. This rose from 8% in June 2022 to a peak of 29% in April this year. Since then, it has stopped rising. It is too early to conclude it has reached a plateau but it suggests that the synergies between AIS and PIS may have a reached a limit, at least for now.

Figure 3 – UK open banking users of both AIS and PIS each month

Unlike PIS where an initiated payment is the measurable result of PIS calls, there is no equivalent for AIS. Instead, we can look only at the number of AIS calls.

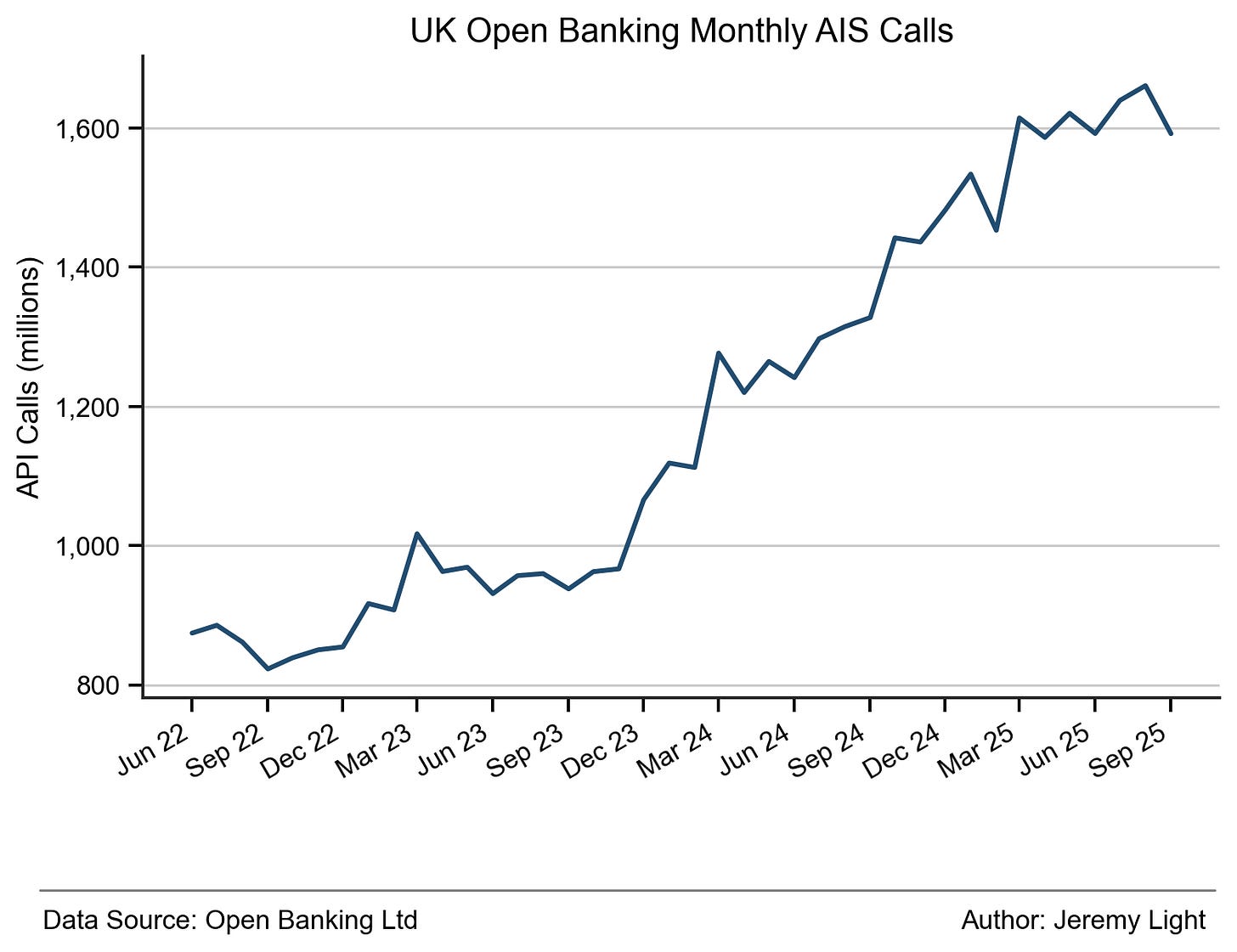

Figure 4 shows how the number of AIS calls has risen over the past few years. Currently, there are around 1.6 billion AIS calls per month.

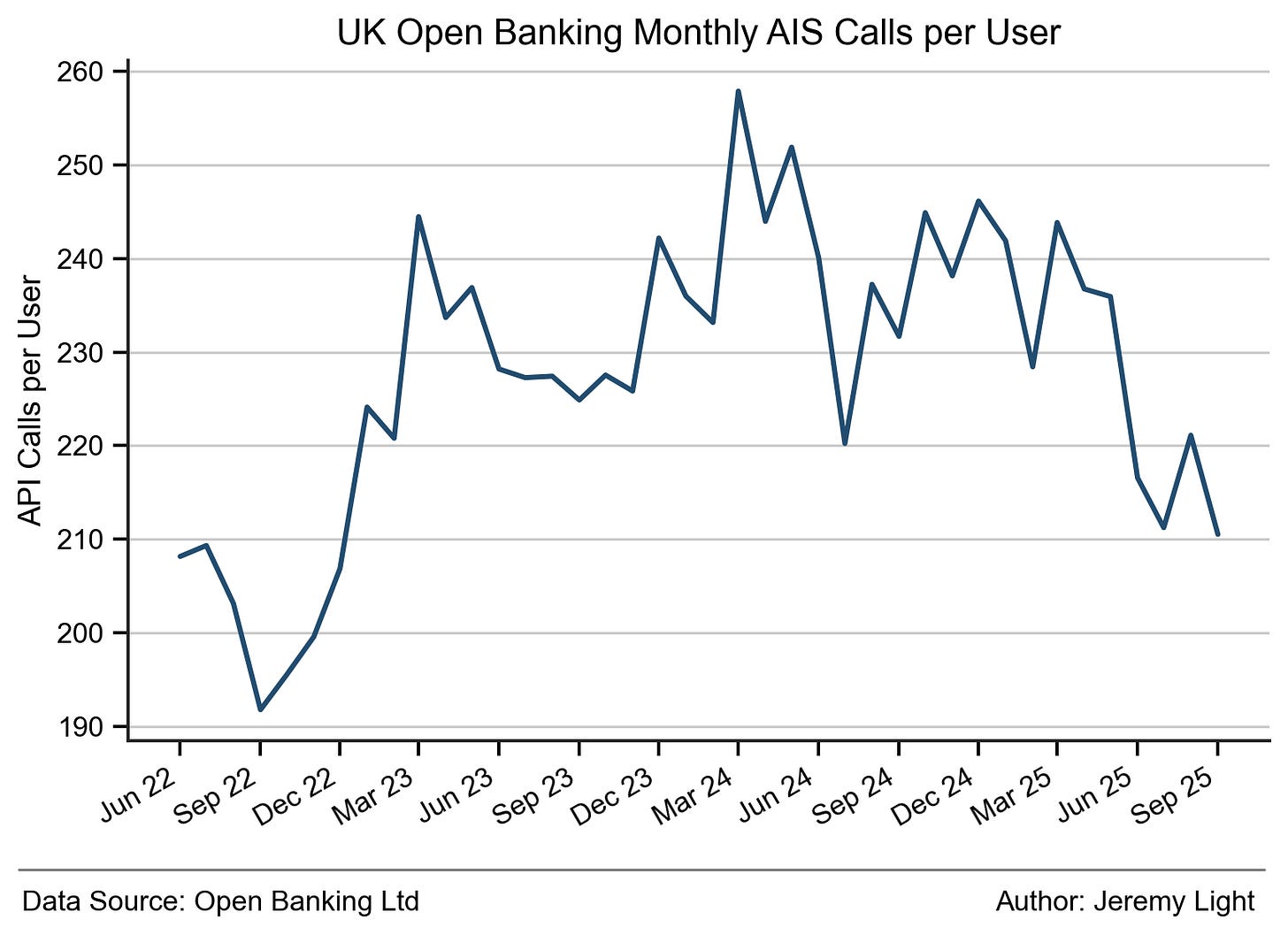

Lastly, Figure 5 shows the monthly AIS calls per user. These have fluctuated between 210 – 260 calls per user per month over the past two years which is about 7 – 9 calls per user per day.

Unlike payment initiations, triggered by a user, AIS calls are triggered mainly by automated processes polling accounts to retrieve account data. Users often have two or more accounts, so 7 – 9 calls per user per day may indicate TPPs on average poll each user account approximately 2 – 3 times per day.

Therefore, with calls per user per month range-bound, Figure 5 suggests that refresh frequencies and polling schedules have stabilised operationally and that AIS usage has matured. It suggests also that growth in AIS is being driven by the growth in users seen in Figure 1 rather than by API calls per user or by increased usage of AIS services per user.

AIS Architecture

The core regulated UK open banking APIs are request-driven2 - TPPs poll bank accounts periodically to get the latest data snapshot. This can be inefficient (expensive) and may result in a sub-optimal user experience. For example, a SAAS accounting system may use a TPP to poll its linked bank accounts and upload new transactions twice a day but UK bank accounts are updated in real-time. When a new bank payment is sent or received, the accounting system is out of synch with the bank account until the next scheduled poll/download which can be very frustrating for the user.

An alternative is an event-driven/push architecture where account information is sent to the TPP when something changes and only if there is a change e.g. when a payment is received. This is more efficient than polling, only new data is sent and only when it happens, resulting in far fewer calls and lower data payloads. Also, critically, it allows for always-on, real-time services such as real-time cash position management, continuous reconciliations, continuous fraud monitoring and dynamic credit line management3.

Until UK banks start providing event-driven APIs widely for open banking, TPPs are unable to provide real-time AIS services enabled by them. This is a major factor limiting the use and utility of AIS.

A further limiting factor is trust and control. UK consumers are wary of AIS, as the consent requested often is worded to give companies (TPPs - often with unfamiliar names) unlimited access to their account data for an unlimited or unspecified time for unclear reasons. The same is true for businesses – for example, to set up on an ecommerce marketplace, typically a seller needs to link their bank account and give AIS access; this allows the TPP/marketplace to access competitive and confidential business information (e.g. off-marketplace revenue and customers) with the business having no control or knowledge of how it is used. Until stronger consumer and business protections are in place, with better user control over their data, trust in AIS remains an issue.

Conclusion

AIS open banking is growing steadily in the UK at the rate of about 2m new active users per year. This growth is unspectacular but with almost 11m active users in total likely by the end of 2026, it is respectable.

AIS services appear to be sticky and fulfilling a regular need for most users. The metrics suggest a steady operational state in AIS usage with mature and standardised AIS use cases. The proportion of AIS users who also make payments through PIS has levelled off, indicating there may also be a natural limit to the synergy between AIS and PIS.

AIS in the UK (and in Europe) is limited by trust concerns. Stronger consumer and business protections are required to control AIS data and to provide granular consent on data use and destiny.

AIS is also limited by its use of request-driven APIs, restricting AIS services to using data snapshots and single requests. More advanced, always-on, real-time AIS use cases with continuous analytics and real-time financial data streams would drive up AIS usage but they require a different, event-driven architecture.

Banks could offer event-driven AIS APIs more widely and charge for them, enabling TPPs to offer much richer services. This is nothing new but there is little evidence of banks taking steps to do this – the technology is proven, all it requires is a little imagination and effort.

I believe AIS is always likely to be more useful to businesses than to consumers but with better protections and real-time services, AIS has potential to become more mainstream than niche.

AIS update Nov 2024: https://jeremylight.substack.com/p/never-mind-the-unlocks

The UK’s regulatory APIs are request-response (REST) but the Open Banking standard does include specifications for event notifications. However, I understand this is used with the core request-response APIs rather than as an alternative to them - TPPs are notified when new events are available to poll. https://standards.openbanking.org.uk/api-specifications/

TPPs can increase the frequency of polling to simulate real-time but this is expensive on computer resources and they risk getting rate-limited by the polled bank if the frequency is too high ““429 Too Many Requests”: https://directory.openbanking.org.uk/obieservicedesk/s/article/Can-the-ASPSPs-implement-rate-limiting

"UK consumers are wary of AIS, as the consent requested often is worded to give companies (TPPs - often with unfamiliar names) unlimited access to their account data for an unlimited or unspecified time for unclear reasons."

This is a very good point Jeremy. I've declined a service more than once because I am uncomfortable with these broad consents.