In September I wrote about the product-market fit of UK open banking payments and payment initiation services (PIS) adoption.

In this article I focus on the adoption of AIS in the UK, account information services which form open banking together with PIS.

Background – AIS APIs and Uses

AIS APIs allow third party providers (TPPs) to access a user’s bank account, with their consent, for retrieval of:

· Account balance

· Transaction history

· Account details (type, currency, account number)

· Multi-account view (retrieve data from accounts across multiple banks)

· Consent management

Uses for AIS APIs include:

· Business financial management – importing bank account transactions and balances to finance and accounting packages for accounts receivables and accounts payables reconciliation, accounts integrity and cashflow analysis

· Personal finance management (PFM) – expenses tracking, budgeting, analysis for investment advice

· Account aggregation – combined view of multiple bank accounts

· Account information retrieval – for pre-populating direct debit mandates, subscription management

· Credit scoring, income verification and affordability analysis

· Insurance risk assessment and dynamic pricing.

UK Banking Open API Performance

The provision of AIS and PIS APIs is a regulatory requirement for banks in Europe under the PSD2 directive. The UK went one step further1 with a requirement for the nine largest banks to build their APIs to standardised specifications supervised by Open Banking Ltd. OBL publishes performance statistics2 on the UK open banking APIs which this article uses.

For AIS, these cover the number of AIS API calls each month and the monthly users3 of AIS APIs. They reveal a surprising number of insights.

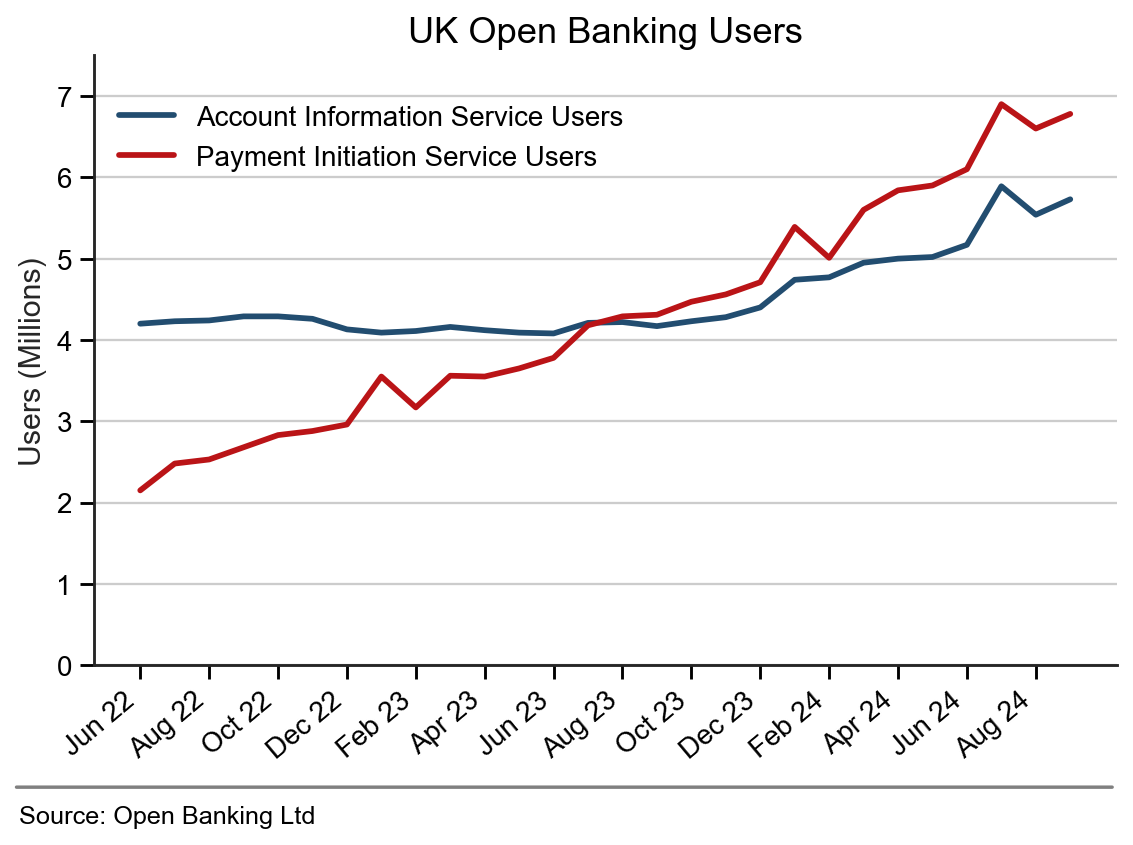

Figure 1 shows the number of AIS users since June 2022 and for comparison, the number of PIS users. The number of AIS users was static for over a year at around 4m until July 2023 and have increased steadily since by 118k per month to 5.7m in September 2024. PIS users are increasing at a faster rate, at about 177k per month and overtook AIS in August 2023.

Figure 1 – UK AIS and PIS monthly users

Users can, of course, use both AIS and PIS services. Figure 2 separates out the users into those who are pure AIS users, pure PIS users and those who use both. Currently, about 24% of all AIS users also use PIS.

Figure 2 – Total UK open banking users and their use of AIS and PIS

Figure 3 shows the monthly volume of AIS API calls since November 2020, which have grown at an average of 13m calls per month reaching over 1.3bn calls in September 2024.

Figure 3 – UK AIS monthly API calls

The number of AIS calls per user, shown in Figure 4, has fluctuated in an approximate range between 200 - 250 calls per user per month over the last two years. This is far higher than PIS, which averages around 12 API calls per user, or 4 calls per payment. This indicates that either AIS users use AIS services more frequently than PIS users, or they use the data-intensive APIs more heavily such as transaction history and multi-account view – or both.

Figure 4 – UK AIS calls per user

Figure 5 shows new AIS users are growing steadily, running at about 600,000 new users each month and climbing. Analysis of the data shows that on average 88% of all AIS users in any month have returned to use the service. This has been in a consistent range of 86% - 90% since June 2022, indicating that AIS services are sticky (returning PIS users have averaged 85% over the period, although had been down to 67% in Jan 2022).

I am unable to find an explanation for the big spike in new AIS users in July 24, but it may be due to heightened interest in AIS that month when the 10m user milestone was announced for all UK open banking, reached the previous month.

Figure 5 – New AIS Users

Figure 6 shows the proportion of AIS users who are also PIS users – this proportion has tripled from 8% in June 2022 to 24% today. There is no data on how these users use AIS and PIS and they could use them independently. However, the trend suggests a growing integration of PIS and AIS in third party applications. For example, the addition of payment initiation to accounts payable in accounting packages and to PFM apps using AIS; and from the other direction, the addition of a balance display for example in the PIS payment flow.

Figure 6 – proportion of AIS users who also use PIS

AIS Product Market Fit

In my prior article on the product-market fit of open banking payments, I concluded that PIS lacks a really strong fit and unless the industry moves to a more competition-led path, open banking payments may be overtaken by something more market-driven.

It is more difficult to assess AIS but, given that PIS has overtaken AIS in terms of user numbers and continues to grow at a faster rate, it is logical to conclude that AIS’s product-market fit also could be better.

Like PIS, AIS has become regulatory-led instead of market-driven making it inevitable it struggles for product-market fit. It is very apparent in press articles and conferences where there is far more talk about getting regulation right rather than on exciting new uses for AIS services. As an example, there are high expectations4 that the UK’s proposed Data (Use and Access) bill5 will catalyse open banking, but few details on why, other than it puts open banking into a long-term framework under the FCA. I assume it extends open banking to other account types such as credit card and savings accounts and enables open finance generally, with the hope demand for AIS services will increase as a result.

Even so, the UK is in a better position than Australia where its version of open banking is the Consumer Data Right (CDR) initiative6. Since 2020, Australians have had the right to share data with service providers, but there is no demand to do so, reflected in very little take up (0.31% of bank customers were using it by the end of 2023)7 . CDR has failed to live up to expectations.

In reality, data is less important than technologists lead us to believe. The use cases for sharing bank account data are limited as evidenced by the list above. Some uses, such as business financial management, automated income verification and credit analysis are powerful ones, but few, other than balance display at the point of purchase are needed for frequent consumer use.

AIS looks more niche than mainstream and more business than consumer.

Generally, why would anyone want to share details of their bank account transactions and balance with third parties other than on an infrequent, tightly controlled, exceptional basis? The data is highly personal and private which most people want to protect. TPPs need to be careful to avoid coercing UK consumers into giving AIS consent to get access to other services that have no need for it. There seem to be very few controls to limit data accessed through AIS to a specific need or on its subsequent use or on continued access to data. This may be holding back consumer adoption - AIS services for consumers have a future only with consumer trust.

A Forecast

Despite my reservations, AIS is here to stay and its use in the UK is increasing, even if growth is unspectacular. Figure 7 shows my forecast until the end of 2025 made by extrapolating growth trends. From 5.7m AIS users in September 2024, with 24% also using PIS and 1.3bn AIS API calls, I forecast 7.1m/28%/1.7bn in June 2025 and 8.1m/28%/1.9bn in December 2025. This equates to a user growth of 37% in 2025.

Let’s see if the industry can beat these figures.

Figure 7 – Forecast AIS users

You may be wondering about the title of this article.

Have you noticed how the term “unlocking” is appearing everywhere, including in open banking8? The word is overused, especially in a business and economic context. It makes an implied, misleading assumption that value and capabilities already exist, waiting to be unlocked (for example by regulation).

Rather than unlocking the future of open banking and AIS, banks and TPPs need to create it.

CMA Open Banking Order: https://www.gov.uk/government/publications/retail-banking-market-investigation-order-2017

Open Banking API performance statistics: https://www.openbanking.org.uk/api-performance/ - data for this article is up to date as of September 2024, going back to November 2020 for API calls and to June 2022 for AIS users (and to November 2021 for PIS users)

The precise definition of an AIS user is unclear – TPP or end-user? Also OBL is unable to identify individuals consuming services through more than one brand “reporting therefore represents the number of user connections with the brands providing reporting, rather than individual users” (see the User section of footnote 2).

OBL Chair Speech 4 Oct 24.

Consumer Data Right (Australia): https://www.cdr.gov.au/

Some “unlocking” examples:

https://navigate.visa.com/europe/future-of-money/unlocking-the-value-of-open-banking/

https://davies-group.com/consulting/blog/unlocking-opportunities-with-open-banking/

https://fintechreview.net/open-banking-unlocking-innovation-and-consumer-empowerment/

https://www.experian.com/blogs/insights/unlocking-insights-open-banking/