Last month, in the UK, Open Banking Ltd declared to the Competition and Markets Authority (CMA) that the roadmap for the development of open banking payments and account information services by nine mandated banks was complete1.

Over the past seven years, an ecosystem of open banking services and service providers has developed - today, there are 88 account providers (including the CMA 9) and 233 third party providers (TPPs) registered with the FCA and enrolled on the Open Banking Directory2.

With the ecosystem in place, how will open banking develop from here and is it the answer to a next generation of payments that will make a real difference to UK consumers, businesses and the economy?

The State of UK Open Banking Today

In open banking, payment initiation services are very different from account information services, with different commercial uses. Payment initiation services allow users to initiate payments from mobile or online banking within a third-party application, for example to pay a credit card bill. Account information services enable real-time access to bank account data in third party applications – for example, accounting software providers who use open banking to feed and reconcile entries in their accounting packages.

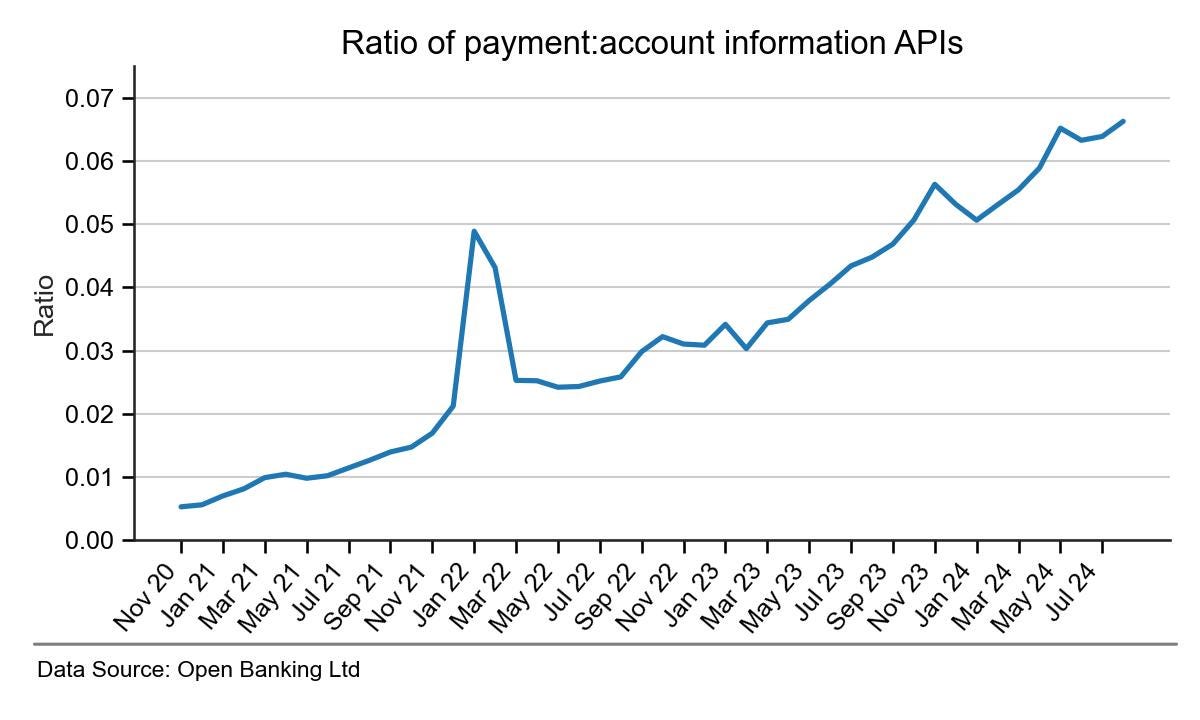

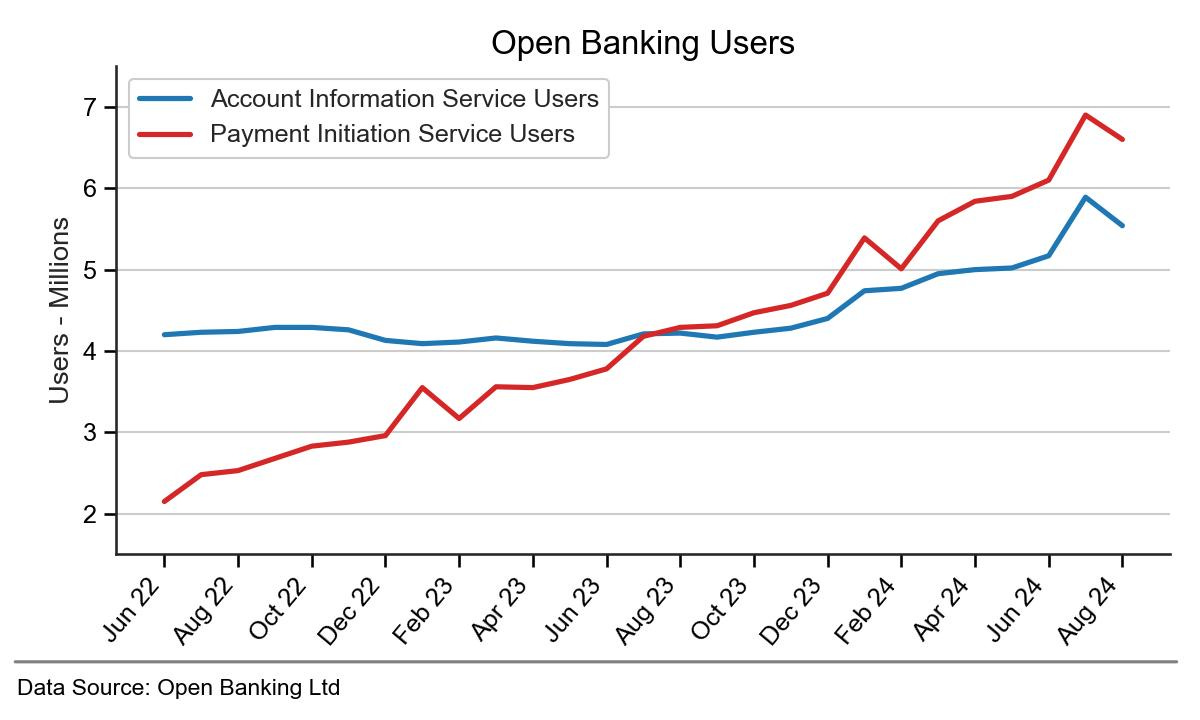

Account information API calls have always been far higher in number than those for payments, but payments are in the ascendancy – see Figure 1 showing the ratio of payment API calls to account information calls and Figure 2 showing how payments user numbers overtook account information users in August last year and are growing faster.

Figure 1 – Increasing Ratio of Open Banking Payments APIs to Account Info APIs

Figure 2 – UK Open Banking Payments Users Exceed Account Information Users

This article focuses on payment initiation services, a later one will focus on account information.

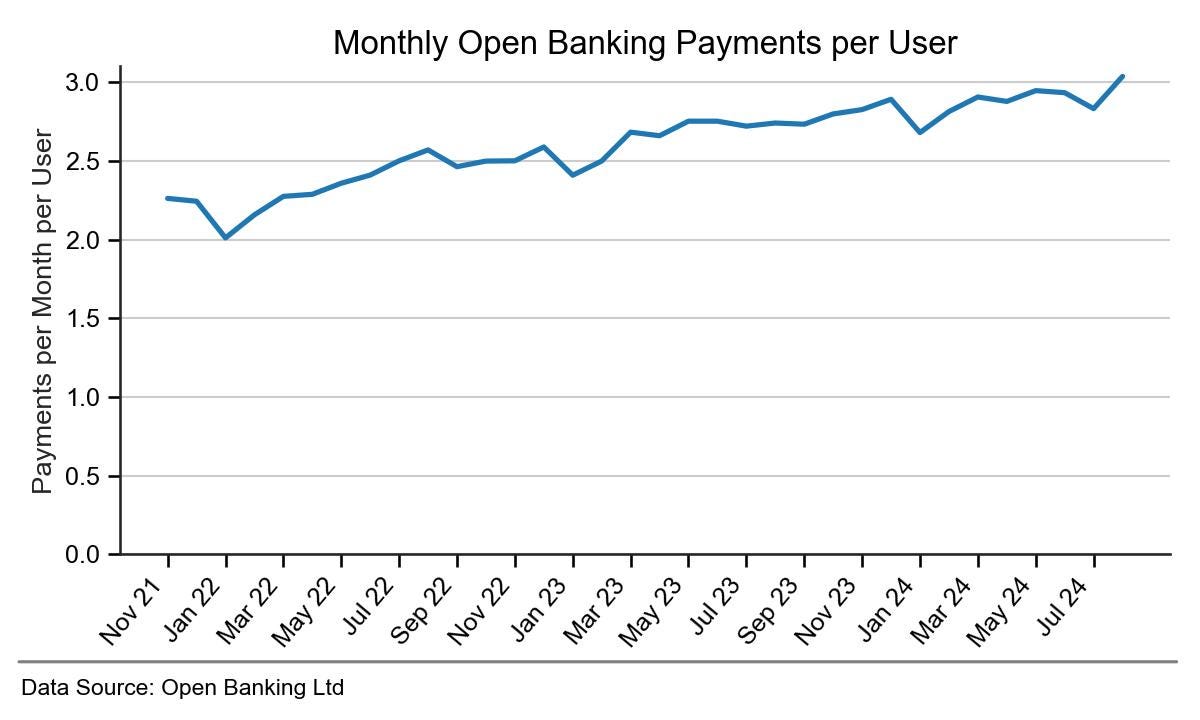

As open banking payments users grow, transactions are reaching a new high each month, reaching 20m payments in August 243. However, payments per user, although creeping up slowly, have been stuck in a range between 2 and 3 per user per month for two years - see Figure 3.

There are only a limited number of open banking payment use cases such as paying bills online and hence only a limited number of websites and services accepting open banking payments. Users are growing in number but growth in payments per user is weak – this has to change.

Figure 3 – Payments per User Are Range-bound

Open Banking Service Providers

Such change is dependent on open banking service providers and their ability to expand use cases and acceptance points. Some provide open banking as a service to companies such as retailers, others use open banking in their own products.

Both types are important to the growth of open banking payments, but it is those providing open banking as a service that have the best potential to drive growth. There are 21 open banking providers on the UK government’s Dynamic Purchasing System Marketplace4, including 18 Fintechs, three banks, Mastercard and Visa (Tink). These are likely to be among those leading the way in commercialising open banking payments.

Product-Market Fit in Payments

There are many factors in achieving product-market fit when introducing a new way of paying, proven in practice by past successes such as with contactless payments5.

How does UK open banking measure up against some of the key factors?

Strong Fit

1. Automatic enrollment – everyone with a UK bank account in the top nine (CMA) banks and others (I count 13 different bank groups in my credit card app) automatically is enabled to initiate open banking payments. Over 95% of the 130m UK current accounts are covered.

2. Re-usable technology – connectivity to banks is through open APIs. Any third-party can build on these APIs and re-use them as they build new products or upgrade their own technology.

Partial Fit

3. Better consumer experience – open banking provides a much better paying experience compared to obtaining and entering payee bank details in mobile or online banking or entering card details for online/mobile purchases. However, the experience is poor and slow compared to in-person, on-file and in-app card payments. It requires re-direction to mobile or online banking needing 5 – 10 taps, with a different experience depending on the bank and is no match for a single tap or biometric card authorisation.

4. A commercial model that works for all parties – retailers and billers are accustomed to paying fees for card payments (although they find them complex and excessive). Thus reasonably, open banking service providers can charge them similar fees, but fees need to be far below those for cards, rather than equivalent, to be compelling. Additionally, banks are mandated to provide APIs at, in effect zero cost, so they have no incentive to provide anything other than the bare minimum, which is a problem for open banking service providers dependent on bank APIs, controls and processes.

5. Resilience to fraud – open banking payments have good anti-fraud characteristics as they require bank authorisation (in contrast to unauthorised fraud on cards, a problem with stolen and counterfeit cards). Although authorised push payment (APP) fraud is a problem with online/mobile banking, this is more controllable with open banking as the recipient must be registered for a bona fide purpose with the payment provider. However, there is a weakness to be addressed where bank APP controls block open banking payments.

6. No onerous recipient liability – retailers and billers have no liability if an open banking payment is fraudulent. This is a big advantage compared to card payments, where any dispute resulting in a chargeback is a huge cost and inconvenience to the retailer, even though they may have no way to prevent it e.g. “friendly” fraud where a customer uses their card online for delivery to another address, claiming it is a fraudulent transaction. However, there is a risk regulators will require open banking consumer protections similar to chargebacks in the future – a mistake in my opinion, that instead would encourage fraud and reduce retailer adoption.

Weak Fit

7. The acceptance network – there are few use cases with proper traction outside government tax payments, credit card bill payments, same-user account sweeping and account-to-client-account payments e.g. for FX, prepaid cards, stockbrokers. A broader, bigger and growing acceptance network is required.

9. Network effects – the network effects are moderate or weak. Users and payments-per-user need to grow strongly, but in the absence of a large acceptance network payments-per-user remain low and range-bound (Figure 3), preventing strong network effects from taking hold.

10. Regulatory dependency – UK open banking is a regulatory initiative, but the innovation it intended to enable has yet to reach escape velocity - progress into new use cases has stalled as the industry awaits regulatory guidance6 on commercial models, liability frameworks and consumer protection, along with the Treasury’s anticipated vision for UK payments, expected to be released later in 2024.

11. Independence from bottleneck monopoly – open banking payments service providers are dependent on banks for access to accounts and on individual bank mobile and internet banking applications to make payments. They have yet to enable “blue water” use cases that are compelling and unserved by cards and direct debits, but which must surely exist as the digital economy expands.

Industry Actions to Boost Growth

Actions I believe are required to boost UK open banking payments growth are:

1. User experience – make this much better and more compelling. Instead of using regular mobile banking apps to initiate open banking payments, open banking versions of these apps are needed enabling one-tap payments, especially when paying a regular retailer or other payee. Banks could also offer open banking credit accounts to work with open banking or offer overdrafts specific to open banking payments.

2. ecommerce – create a single, common interface independent of mobile banking apps for ‘on-file’ payments and one-off payments in ecommerce. Either as an alternative to open banking versions of mobile banking apps or in addition to them.

3. Easy adoption - make it easy for retailers and billers to accept open banking payments online or in their mobile apps, including easy integration into back-office processes which historically are geared to single daily card settlements and daily card settlement file reconciliations (with open banking there is a bank account entry for every sale, potentially a large volume of entries, but no settlement reconciliation is needed).

4. Costs - keep the costs for retailers and billers below those for cards, for on-boarding, transactions, exceptions and add-ons and keep them simple.

5. Retailer/biller liability – avoid making retailers and billers liable for fraud by default. Contrary to regulatory concerns about the lack of consumer protection in open banking payments, retailers need to be certain there are no onerous requirements such as chargebacks. iDeal7 in the Netherlands shows the way, almost 20 years old, processing 71% of Dutch online payments with very little fraud, well below that for cards and no chargeback mechanism.

Additionally, the industry, including the regulators should be more ambitious. Currently, the focus is on variable recurring payments as an alternative for direct debits with big billers – this is a low risk but commercially unexciting use case, where the demand will be restricted mainly to those paying insufficient funds fees. As an immediate step, variable recurring payments should be enabled8 for ecommerce without imposing consumer protection, liability and complex commercial pricing requirements – let market forces prevail and regulate based on experience.

Regulatory Interventions

Even so, regulators have an imperative to create a level playing field for banks and non-banks, with a fair and competitive commercial model proving to be a thorny issue in achieving it.

Ideally, regulatory intervention should be kept to a minimum, but such are the factors at play that regulators need to act decisively on variable recurring payments to get competition moving.

In my opinion, the best solution is for regulators to mandate all banks who already have open banking capability to provide open APIs immediately for non-sweeping variable recurring payments either:

1. at no cost to open banking service providers. As a quid pro quo, remove the cap (0.2%) on debit card interchange and instead, impose something similar on open banking service providers. Banks (with the card networks) may be tempted to raise interchange, but the more they do, the more incentive for retailers and billers to accept open banking payments, with open banking services providers competing for them; or

2. at a cost to open banking payment providers up to say 80% of the debit card cap (0.2%) for each payment they initiate, but only once a provider generates a minimum transaction volume (which perhaps could be increased each year) to allow them to establish their service. Open banking service providers may charge their customers - retailers and billers what they want but will need to price below debit cards to be competitive.

Others, better informed than me have spent far more time thinking about this than I have, so my suggestions are likely to over-simplify what is required – however, I am certain that more ambition and speed are needed, much more, if open banking payments are to be the basis of the next generation of payments in the UK.

The Future

On the current trajectory, open banking payments are following a regulatory/government-led path. Inevitably, this risks being slow, inefficient and lacking a strong product-market fit. Unless the industry moves to a more competition-led path, open banking payments may be overtaken by something more market-driven. There is already competition between the 20+ open banking as a service providers and differentiation in services is appearing - for example NatWest Payit’s refunds and business payouts and Revolut Pay’s checkout experience and buyer protection. It is evident that open banking service providers are ready and hungry to move fast.

Interestingly, Visa announced Visa A2A recently9 , a new service in collaboration with five Fintechs and four banks, giving consumers a “smarter, digital user experience for paying recurring bills with bank transfers”, starting in the UK early next year, with the Nordics following. Details are sketchy, but I would expect more such initiatives to appear in the next 12 months.

The market waits for no-one.

Open Banking Ltd letter to CMA (8 Aug 24): https://assets.publishing.service.gov.uk/media/66de9781e87ad2f1218265ca/obl_letter_to_cma_remaining_roadmap_items.pdf

Open Banking directory of UK regulated providers: https://www.openbanking.org.uk/regulated-providers/

UK open banking performance statistics: https://www.openbanking.org.uk/api-performance/

Contactless Substack article: https://jeremylight.substack.com/p/uk-contactless

The FCA, PSR, CMA and HM Treasury have formed the Joint Regulatory Oversight Committee which published commercial principles in June 2023 for open APIs. The PSR consulted on variable recurring payments in December 2023, attracting 39 responses covering 416 pages published in August 2024 with the PSR’s summary, but still with no firm direction.

iDeal fraud: https://www.ideal.nl/en/fraud and service status (28 Sep 23): https://www.ideal.nl/en/latest

Sweeping variable recurring payments between accounts held by the same user are already in operation and can be expanded easily to non-sweeping uses.

Visa A2A announcement (5 Sep 24): https://www.visa.co.uk/about-visa/newsroom/press-releases.3340254.html#:~:text=Visa%20A2A%20will%20be%20based,modernise%20open%20banking%2Dbased%20payments