Contactless payments in the UK are a remarkable success story. Free from regulatory headwinds, they have quietly, yet rapidly, grown from zero to 37% of all UK payment transactions by volume in just 17 years.

Barclaycard issued the first contactless credit cards in September 20071, the OnePulse which also included Transport for London’s (TfL) proprietary Oyster card (separate technology but on the same plastic). Barclays then launched the first contactless debit card in January 20092. Other banks followed swiftly and today there are 150m contactless cards in issue, 95m debit and 55m credit/charge.

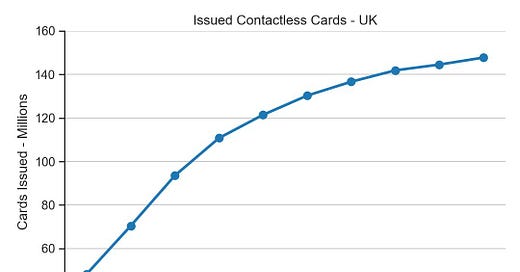

By 2014, there was already one contactless card on average for every adult in the UK - today the average is around three contactless cards per adult. Figure 1 shows how issuance has grown over the past 10 years.

Figure 1 – Total UK Contactless Debit and Credit/Charge Cards

Contactless Transactions

In 2023, there were 2.6bn contactless credit/charge card payments and 15.7bn contactless debit card payments, 18.3 bn in total. Contactless credit card volumes are growing at 7% per year and debit card volumes have slowed to a 1% annual growth – my forecast for 2024 are 2.8bn and 15.9bn payments respectively, 18.7bn payments in total. See Figure 2.

Figure 2 – UK annual contactless transaction volume

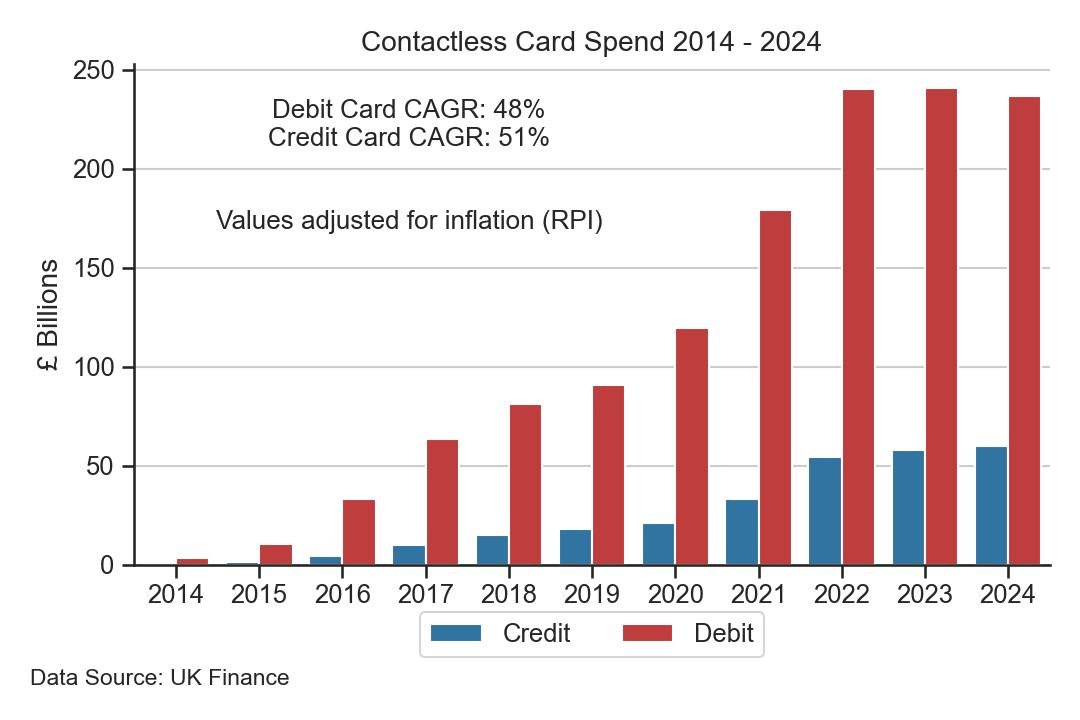

The aggregate value of spend using contactless payments is levelling off. I estimate a total of £297bn for 2024, £60bn for contactless credit and £237bn for contactless debit, an increase on an inflation-adjusted basis of 4% and -2% respectively on 2023, compared to 65% and 34% growth two years earlier in 2022. Perhaps this is an indication of an incipient recession? See Figure 3.

Figure 3 – Annual contactless transaction value

Contactless Network Effects

Many credit TfL as the key driver behind the widespread adoption of contactless card payments in the UK. However, by the time TfL introduced contactless bank cards as an alternative to its Oyster card, first on buses on 12 December 20123, then on the underground on 16 September 20144, contactless technology was already well-established. In 2014, there were 53 million contactless cards in circulation, with two million new ones issued each month. That year alone saw 321 million contactless transactions, tripling in volume annually over each of the previous three years. These payments were processed at over 198,000 contactless point-of-sale (POS) terminals across the country, with new ones being installed at the rate of 6,000 each month.

The momentum was fuelled by powerful network effects (which became very apparent in 20135): as more retailers and services like TfL adopted contactless payments, the system attracted more and more users, leading to more and more transactions. Marks & Spencer, for example, piloted contactless payments in September 20126 across 25 London stores, before rolling them out nationwide to 644 locations in May the following year.

Despite the rapid uptake, some retailers and banks lagged behind. Even as late as 2017, when 5.5 billion contactless payments were recorded, certain large retailers had still to embrace contactless. A major consumer electronics chain, for instance, displayed handwritten "no contactless" signs on POS terminals for some time, even at Heathrow Airport.

Today, contactless payment acceptance is nearly universal, with even unexpected institutions adopting the technology. A recent example is the Church of England, which announced7 the completion of its rollout of contactless devices for donations across 2,200 churches this week.

Contactless Limits, Average Values and Mix

At launch, contactless cards had a limit of £10 which was increased to £20 on 1 June 2012, £30 on 1 September 2015, £45 on 1 April 2020 and £100 on 15 October 2021. Cards held virtually on mobile phones are more secure than plastic cards and any limits are at the discretion of the issuer. The increase in limits and introduction (Apple Pay launched in the UK on 14 July 2015) of mobile card payments has led to an increase in average transaction values.

The average contactless debit payment is £14.89 and contactless credit/charge is £21.72. Initially until June 2016, the average contactless debit card payment was higher than the average contactless credit, which was unusual as typically credit cards have higher average payment values than debit cards – see Figure 4.

Figure 4 – Average contactless payment value by year

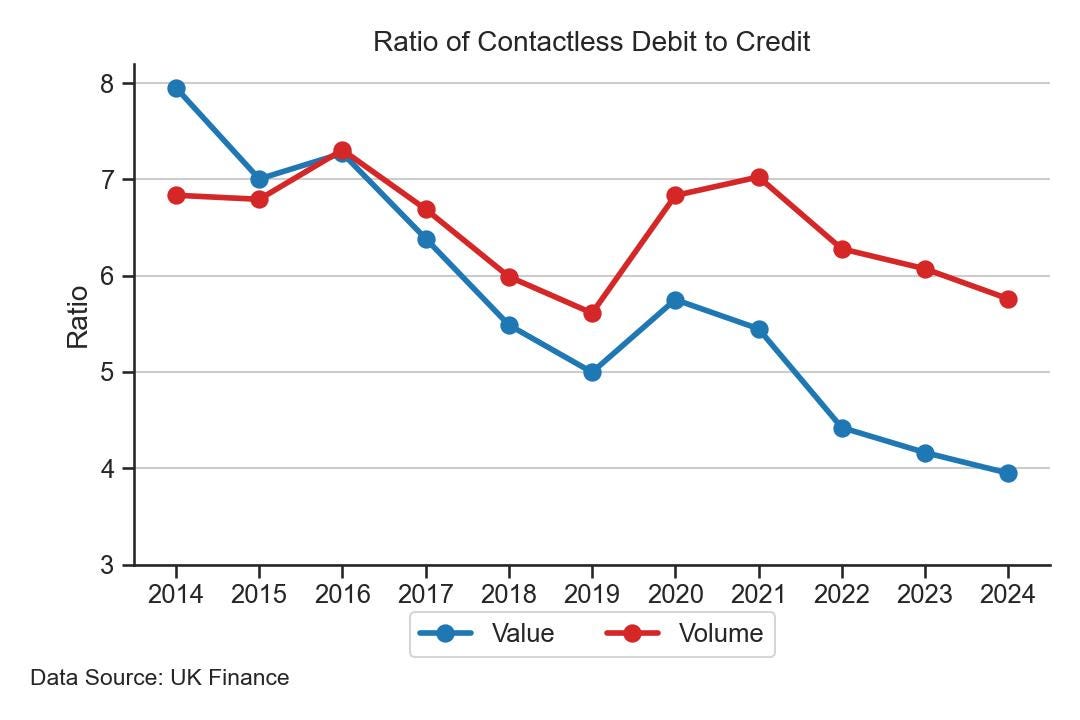

Figures 2 and 3 showed that annual contactless debit card volumes and values have always exceeded those for credit/charge cards. Currently by a factor of 4 by value and 6 by volume but credit is slowly creeping up – the ratios were 8 and 7 in 2014 – see Figure 5.

Figure 5 – Ratio of debit to credit/charge contactless payment volume and value by year

Contactless Share of UK Payments

Contactless payments account now for around 37% of all UK payments by volume, having risen from zero in 2008, but have levelled off at this figure for the past two years – see Figure 6.

Figure 6 – contactless share of all electronic UK payments by volume

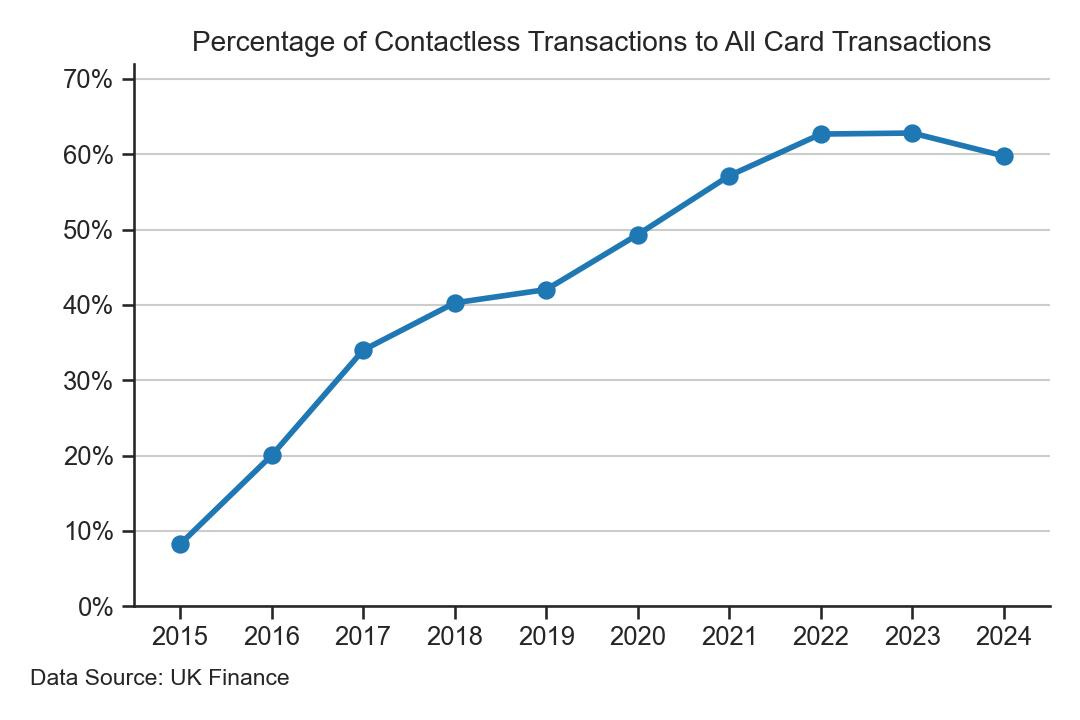

Contactless today accounts for 60% of all card payments, a share that has plateaued at this level and may be in a gentle decline as ecommerce card payments continue to grow strongly. See Figure 7.

Figure 7 – contactless share of all UK card payments by volume

Contactless Usage

Dividing the annual number of contactless transactions by the average number of contactless cards in 2023 gives an average of 10 transactions per card per month in 2023. With 150m contactless cards issued in the UK, that is about three per adult, suggesting each user makes 30 contactless transactions per month, totalling almost £500. My bank statements corroborate that.

I was an early user of the Barclaycard OnePulse card back in 20088 and have been using contactless cards ever since.

Contactless Fraud

Ever since contactless cards were launched in 2007, the press9 has liked to scare the public by highlighting the risk of fraudsters tapping people’s cards unknowingly when in back pockets, bags etc. This may help sell news, but the risk is exaggerated greatly and I am unaware of any significant losses suffered this way.

The main fraud risk comes from stolen or lost cards. Since contactless card transactions are made by tapping a card without entering a PIN10 a stolen or lost card can be used with impunity by a fraudster until the issuer is alerted by the card holder or by fraud monitoring software. The risk of losses has increased with increased transaction limits, jumping over 80% in 2022 after the transaction limit was raised to £100.

According to UK Finance11, the fraud-to-turnover ratio for contactless cards was 1p in 2023 compared to 5.8p for all cards (I am unsure how this is calculated). Contactless fraud losses were £41.5m in 2023, up 19% on 2022, compared to £551.3m total card fraud losses, down 1% on 2022.

Drivers of Contactless Success

Contactless card and mobile payments are a success story in the UK, across Europe and in many other countries. They provide useful lessons on how to achieve similar success in new payment innovations in the future.

In my view, the reasons for this success can be summarised as:

1. Automatic enrollment - contactless cards were issued to consumers typically when existing debit and credit cards were re-issued on expiry – with the exception of the original Barclaycard OnePulse card, generally consumers have had no need to apply for a contactless card

2. Better experience - the contactless experience is a significant improvement over entering a PIN – after tapping a card for the first time, the desire to do so again is strong, leading to the all-important second and third transactions that trigger repeat paying behaviours

3. A large and growing acceptance network - banks with acquiring businesses made concerted efforts to equip retailers with contactless terminals – as with issuing cards, often POS terminals were upgraded to contactless when renewed, without requiring any specific change to retailer software

4. A tried and tested commercial model - once retailers had contactless POS terminals, commercially there was little difference to their costs or economics, so there was no resistance to accepting contactless cards – in fact initially, interchange fees were set lower than for normal CHIP and PIN transactions, which provided some incentive for retailers

5. Transaction value limits - which have kept a lid on fraud

6. Network effects - all the above created ripe conditions for powerful network effects to take hold rapidly and naturally – there was little need for advertising, although Barclays produced a memorable TV ad in 200812

7. No regulatory intervention - none was needed. Contactless cards are essentially the same product as a normal credit or debit card from a regulatory perspective

8. Re-usable technology - contactless cards paved the way for contactless NFC card payments on mobile phones using the same POS terminals – Apple Pay, Android Pay etc

The analysis in this post is based on publicly available UK Finance data (UK Card Association prior to 2017). Where 2024 data or plots are shown, these are estimates for the full year based on extrapolating published data from January – April 2024. There may be some small differences between figures I derive and those derived in UK Finance publications.

news article: https://staging.finextra.com/newsarticle/17318/barclaycard-signs-retailers-for-contactless-payments

news article: https://www.marketingweek.com/barclays-launches-first-contactless-debit-cards/

2013 Finextra video - contactless prediction (2min 30s in)

news article: https://www.fstech.co.uk/fst/Church_of_england_completes_rollout_of_contactless_giving_devices.php

LinkedIn article: https://www.linkedin.com/posts/jeremylight1_payments-contactless-barclaycard-activity-7209841443874459649-T7Pf?utm_source=share&utm_medium=member_desktop

news article: https://www.bbc.co.uk/news/technology-24743920

sometimes a user may be asked to enter a PIN after using a card multiple times in a row, but this is a CHIP and PIN transaction rather than contactless

UK Finance Fraud report 2024 pages 19 and 31: https://www.ukfinance.org.uk/system/files/2024-06/UK%20Finance%20Annual%20Fraud%20report%202024.pdf

Barclaycard TV ad 2008: