Moving on Up

Stablecoin adoption for retail use

At the start of January this year I covered stablecoins1 explaining how they are being used in retail and small business payments in addition to their dominant use for buying and selling crypto currencies.

Since then, interest in stablecoins has risen enormously across the financial services industry and the press due to developments in the USA. The GENIUS Act which provides a framework for issuing stablecoins was passed by the Senate on 17 June 2025, now awaiting approval by the House. Circle, which issues the USDC stablecoin had a very successful IPO the same month.

Expectations are high that fiat-collateralised stablecoins will be adopted at scale.

As promised in January, this article is a mid-year update on stablecoin adoption presented using a series of graphs to illustrate progress so far this year.

Total Stablecoin Usage

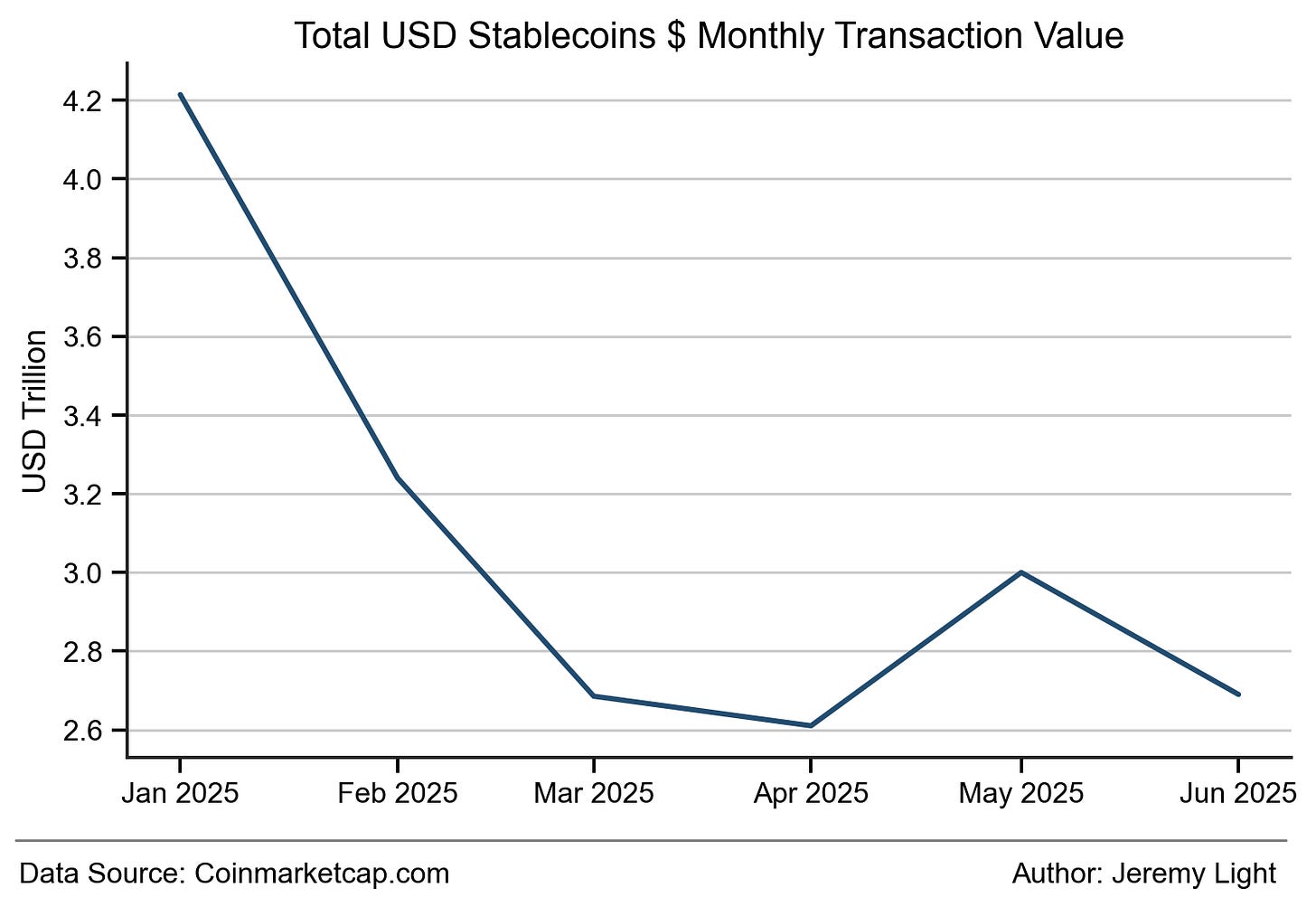

Contrary to the excitement in the press, Figure 1 shows the total transacted each month this year across the five most active USD stablecoins has been in a downward trend since the start of the year. It has dropped from $4.2trn in January 2025 to $2.7trn in June 2025.

Figure 1 – Combined monthly transacted value of USDT, USDC, PYUSD, FUSD, RLUSD.

Analysing this further, Figure 2 shows the daily transacted value of the five most active stablecoins plotted against the daily transacted value of the top five crypto currencies (by market cap). The strong correlation suggests that stablecoins continue to be used mainly for buying and selling cryptocurrencies. Therefore, the decline in monthly transacted value this year seen in Figure 1 is due to a decline in trading of the major cryptocurrencies.

Figure 2 – Correlation between stablecoin (USDT, USDC, PYUSD, FUSD, RLUSD) combined daily transacted value and the top five crypto combined daily transacted value (BTC, ETH, XRP, BNB, SOL) in H1 2025

The day with the peak stablecoin transacted value so far this year was $331bn on 20 Jan 25, the day of Trump’s inauguration and the trough occurred on 6 Apr 25 with $39bn transacted value.

Retail Stablecoin Usage

Using data from Orbital’s dashboard2 (Jan - May 2025, June data is unavailable at the time of writing) Figure 3 shows the monthly stablecoin transacted value for retail (below $10,000, non-crypto) payments. Retail transacted values have ranged from $168bn/month to $247bn/month this year - after a drop in February, the value of transactions has moved higher since.

Figure 3 – Monthly stablecoin transacted value for retail (non-crypto) payments

In May 2025, the average retail transaction value was $1,190, with the average USDT retail transaction averaging $1,242 and USDC averaging $951.

USDT and USDC Share of Stablecoin Transactions

USDT dominates stablecoin transactions but its share is falling. Figure 4 shows that USDT’s share dropped from 87% of all USD stablecoin transactions by value in Jan 2025 to 83% in Jun 2025 and for retail transactions from 91% in Mar 2025 to 81% in May 2025.

Figure 4 – USDT share of total USD stablecoin transactions and retail USD stablecoin transactions by value

Meanwhile USDC is gaining share. Figure 5 shows that USDC’s share increased from 8% of all USD stablecoin transactions by value in Jan 2025 to 11% in Jun 2025 and for retail transactions from 9% in Mar 2025 to 17% in May 2025.

Figure 5 – USDC share of total USD stablecoin transactions and retail USD stablecoin transactions by value

In June 2025, $2.3 trillion USDT and $303 billion USDC were transacted. The next highest stablecoin transacted value for June was First Digital’s FDUSD at $159 billion (issued in Hong Kong, used for DeFi and international remittances).

New fiat-collateralised stablecoins3 are being introduced all the time but none have reached yet the size of USDT or USDC. For example, PayPal’s PYUSD had a transaction value of $717m in June 2025 and Ripple’s RLUSD $2bn. The largest non-USD stablecoin is Circle’s euro stablecoin, EURC which had an equivalent transacted value of $1bn last month.

Stablecoin Retail Transaction Volumes

Regular readers know that I prefer transaction volumes rather than transaction values to analyse payment trends, as transaction volumes reflect interactions. Unfortunately, most stablecoin data is published in terms of $ value with the exception of Orbital which publishes retail transaction volumes (counts).

Figure 6 shows USDT and USDC retail transaction volumes this year – both are rising, USDC at the faster rate. Transaction volumes for other stablecoins are left out from Figure 6 as they are very small in comparison to USDT and USDC, running at about 1m payments per month in total.

Figure 6 – USD stablecoin retail transaction volume

Total retail stablecoin volume was 208m transactions in May which is tiny compared to other retail payment methods. For context, in the USA about 500m credit card and debit card payments are made daily.

Retail use of stablecoins is at a very early stage of development.

Conclusion

Stablecoin transactions are almost exclusively made in USD, dominated by USDT with USDC some way behind. Most stablecoin transactions continue to be for the buying and selling of cryptocurrencies on crypto exchanges but retail use ($<10,000) is growing, accounting for around 8% of all stablecoin transactions by value.

Both retail USDT and USDC transactions are growing, USDC at the faster rate, increasing its share of retail transactions. However, USDT still dominates with almost four times the retail transaction volume as USDC. Other USD stablecoins have low transaction volumes and non-USD stablecoin transaction volume is almost negligible in comparison.

With stablecoins a hot topic, attracting investment and new issuance, this picture is likely to change rapidly over the next six to 12 months. Many companies are likely to jump on the bandwagon by issuing and/or embedding stablecoins into their products and services.

However, the pace of adoption will be dependent on some key factors which seem to get insufficient attention in the media. These include interoperability between different (USD) stablecoins and between the same stablecoin on different blockchains, the customer experience of using multiple stablecoins and blockchains, the use of self-custody (low cost) wallets versus custodial (higher cost) wallets, the adoption of non-USD stablecoins and the level and volatility of transaction fees – lookout for how these are being addressed to get a rounded view on where the sector is heading.

I’ll publish a further update using facts and figures at the end of this year.

Stablecoin update and primer: https://jeremylight.substack.com/p/stablecoin-to-heaven?r=axqgy

Orbital’s stablecoin statistics dashboard: https://www.getorbital.com/stablecoin-dashboard

Algorithmic stablecoins are also making a come back after the Terra Luna debacle in May 2022 - for example Ethena USDe which launched in early 2024 and has $5bn in circulation. It describes itself as a synthetic US dollar, using derivatives hedging and other financial strategies to maintain its price at $1 rather than backing with USD reserves.

Nice article. I saw this week that Ripple appointed BNY as a custodian and transaction banking provider. The institutional acceptability of digital assets is nearly complete - now it's just a matter of adoption.