Can Y'See It Now?

Deciphering stablecoin transacted values and volume

Last week I wrote about the uses and supply of stablecoins1.

This week I quantify stablecoin transaction values (and some volumes).

Trading Crypto with Stablecoins

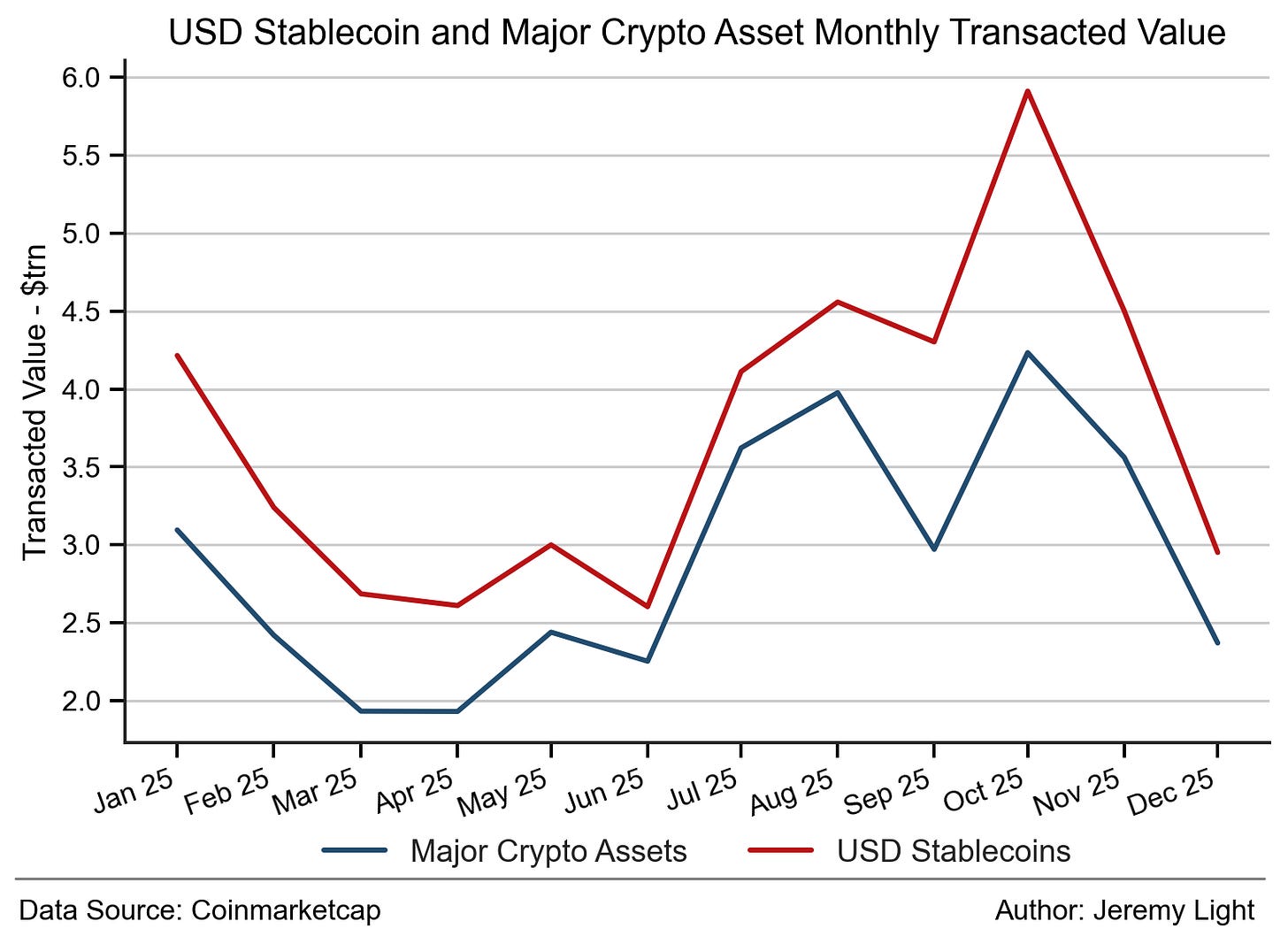

Figure 1 shows the combined transaction value of five leading USD dollar stablecoins for each month in 2025 and that for five leading crypto-assets2. The graphs show a clear correlation between trading in crypto-assets and stablecoin transaction value. In aggregate, the total transacted value for the five stablecoins was $45 trn in 20253.

In comparison, the trading value of the five crypto-assets was $35trn in 2025, 78% of USD stablecoin transaction value. However, the use of stablecoins in crypto-trading is likely to be a higher than this 78% figure as, in addition to buying and selling crypto-assets, stablecoins are used to move funds rapidly between exchanges to take advantage of arbitrage opportunities. This was the original driver for stablecoin adoption, starting with USDT in 2014.

Figure 1 – Comparison of USD stablecoin and crypto asset transacted values

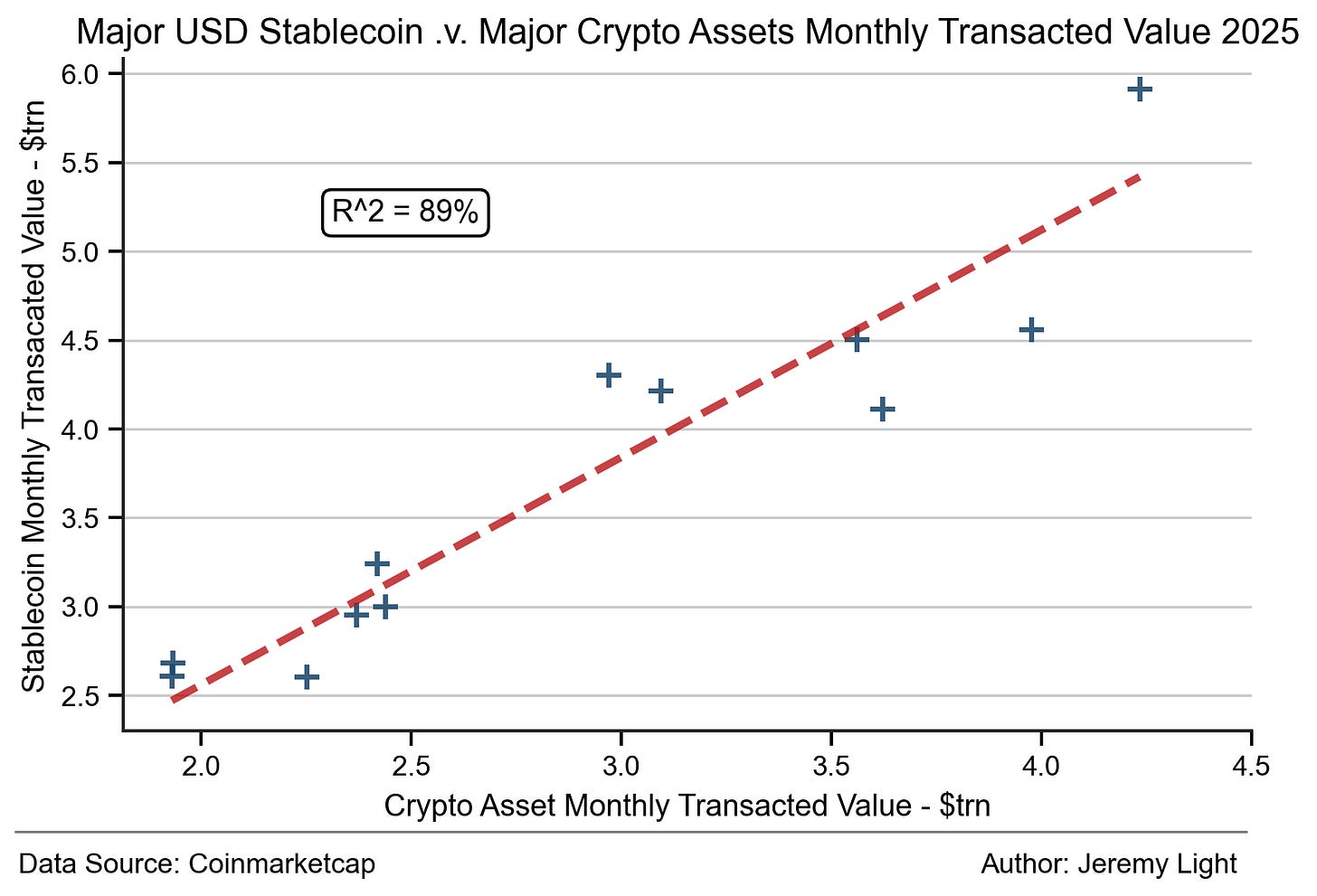

Figure 2 shows stablecoin transacted value plotted against the crypto-asset traded value for each month of the year, using the same data as in Figure 1. This confirms the strong dependency of stablecoin transacted value on crypto-asset traded value. The R^2 of the line of best fit is 89% (an indication of the degree of correlation). It suggests that on average, every $1bn of crypto-asset trading required $1.3bn of stablecoin transactions (buy/sell and movement of funds between exchanges).

Figure 2 – Correlation between USD stablecoin and crypto asset transacted values

A similar plot a year ago had an R^2 of 98% and in July 2025, 96%4, suggesting that the correlation is getting weaker over time as non-crypto stablecoin use increases.

The line of best fit in Figure 2 intercepts the y-axis at $167bn per month indicating that excluding crypto-trading (x value = 0) the total non-crypto transacted value in 2025 was on average $167bn per month or $2trn for the year, or 4% of the total stablecoin transacted value. This should be taken somewhat with a pinch of salt but it shows that perhaps at least 90% - 95% of stablecoin usage may have been solely for trading crypto-assets.

Stablecoin Consumer Transactions

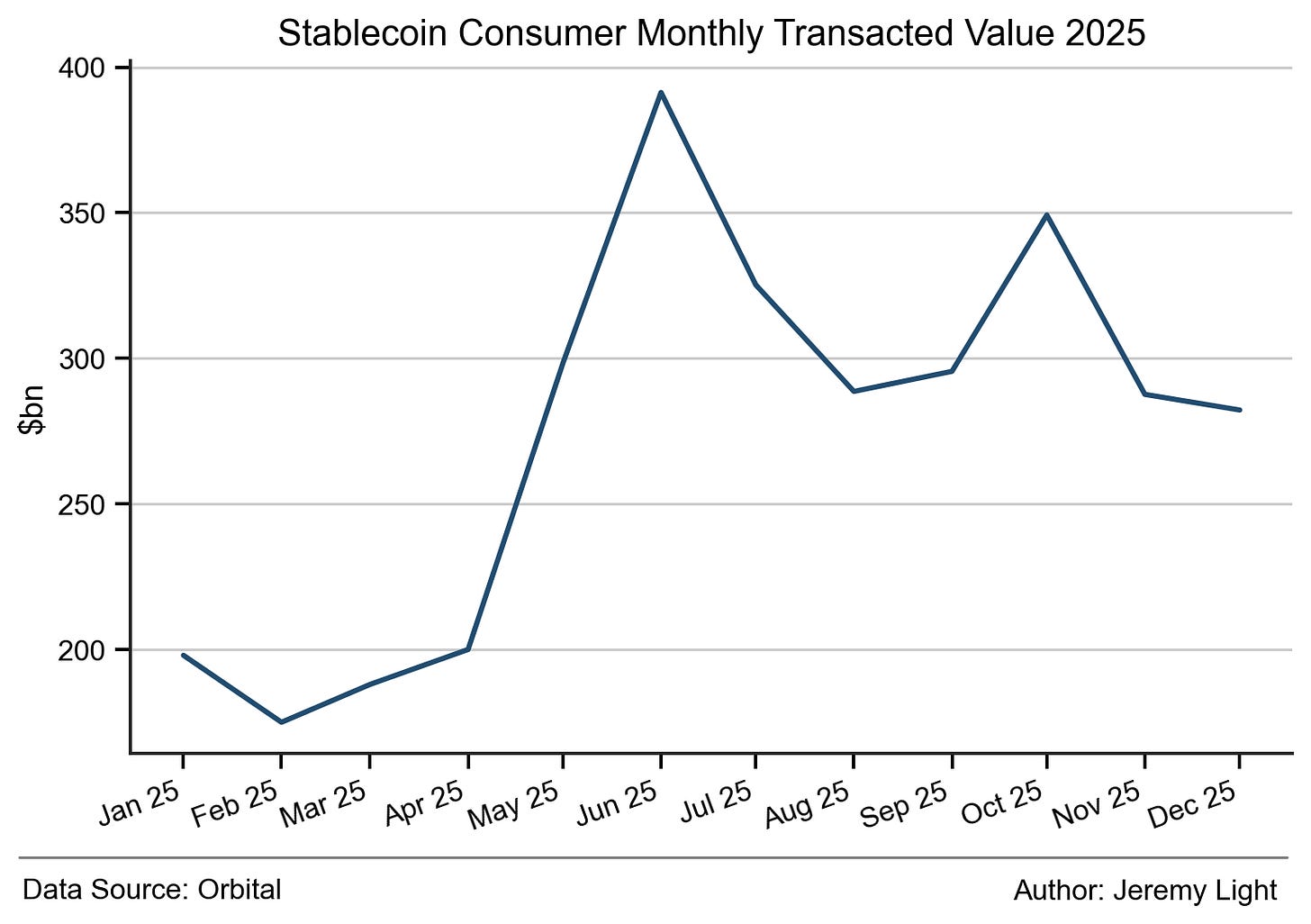

The challenge is to separate out the crypto-asset trading values to reveal the transacted value of other stablecoin uses. Orbital5 helps in this with a dashboard that filters out stablecoin transactions below $10,000 that are likely to represent consumer-sized payment activity (but which may still contain some crypto-asset purchases and sales).

Figure 3 shows Orbital’s monthly transacted values for consumer stablecoin payments, a total of $3trn for 2025, or 7% of the $45trn total stablecoin transacted value.

Figure 3 – Stablecoin consumer monthly transacted values

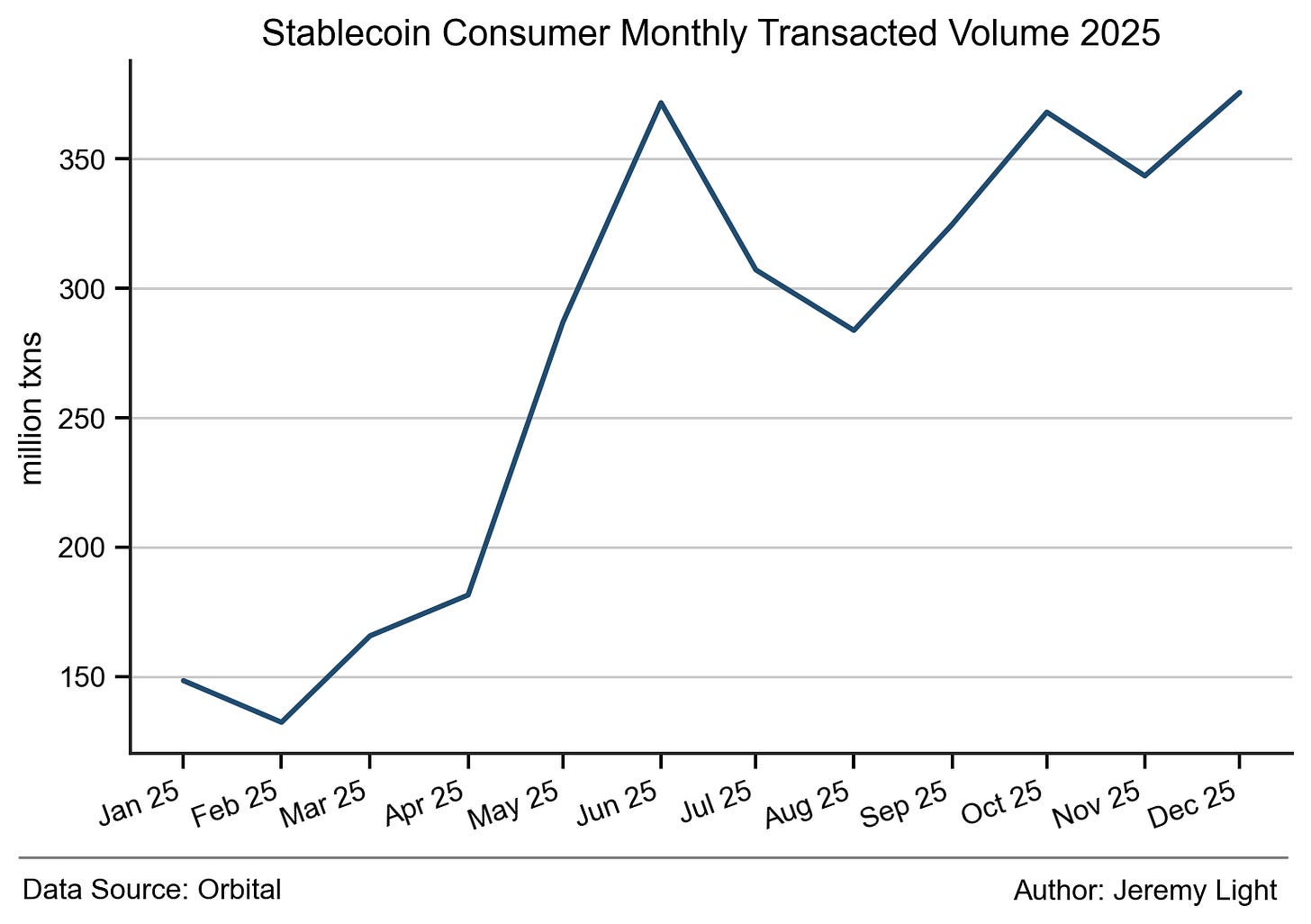

Figure 4 shows the number of consumer stablecoin transactions by month, a total of 3bn for 2025 with an average value of $1,125.

Figure 4 – Stablecoin consumer transacted volumes

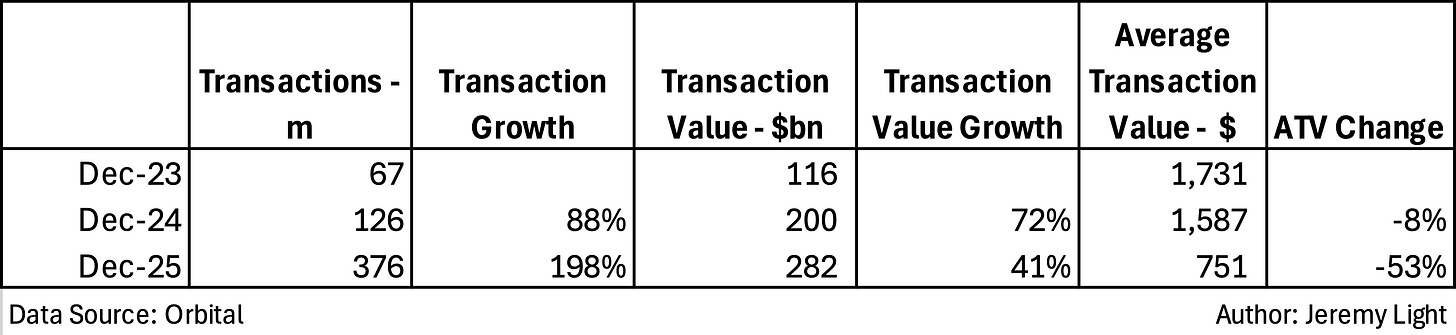

Table 1 shows a different view of the Orbital data with a snapshot of December figures for the past three years. It shows strong transaction growth, much higher than value growth with average transaction values reducing as transaction volume increases.

Table 1 – 12-month comparison of consumer stablecoin December transacted values

Tokenisation of Real-World Assets

A recent entrant to the digital asset domain is the tokenisation of real-world assets (RWAs). RWAs are IOUs issued on blockchains for physical and financial assets such as government bonds, corporate bonds, private credit, structured credit, commodities, equities (public and private). The idea is that these IOUs can be traded 24/7, on a crypto or DeFi exchange, or peer-to-peer. Stablecoins are ideal for this trading. RWA token trading started to take off in mid-2024 and is likely to continue growing strongly, boosting stablecoin use.

The website rwa.xyz tracks about 600 RWA tokens. As RWA token trading grows, this will obviously impact stablecoin volumes. rwa.xyz shows there are about $20bn RWA tokens in circulation that can be traded peer-to-peer, with $88bn transfer volume transacted in 2025 ($15bn in December 2025).

Conclusion

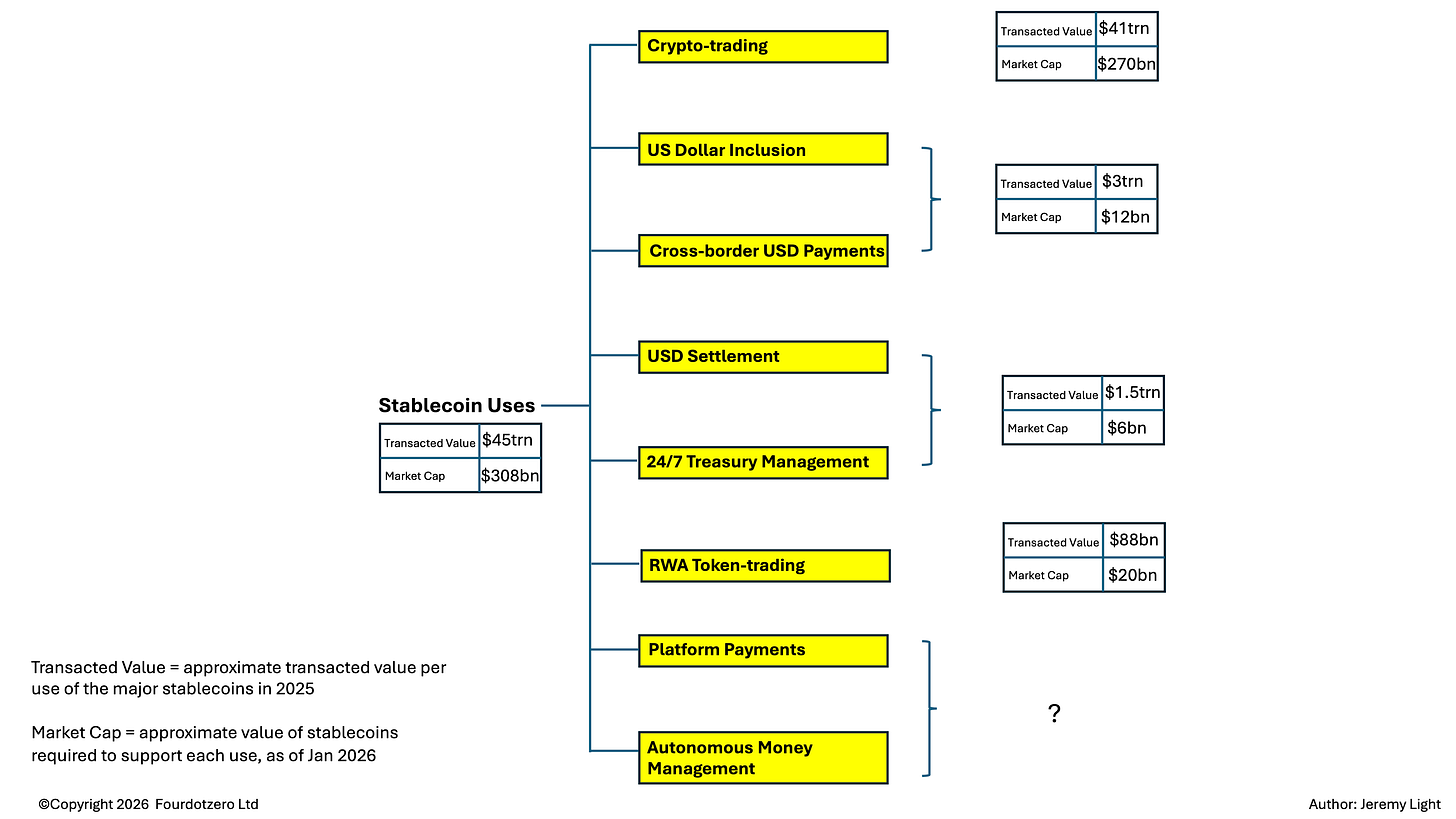

Stablecoin usage is complex to decipher. The headline figures of $45trn transacted value in 2025 and $308bn market cap are readily available. However, breaking these figures down into underlying uses is difficult.

I have shown that possibly 90% or more of stablecoin transacted value was for crypto-asset trading, or $41trn in 2025. However, crypto-asset trading is a unique and specific use which masks the developments and growth in non-crypto trading, the area that is most relevant to those interested in next generation payments and finance.

Figure 5 shows a summary of the analysis in this article using the diagram I shared last week (showing eight categories of stablecoin use, that can overlap6). In addition to the estimated $41 trn of crypto-asset trading, there was $3trn in consumer transactions (7% of the total) in 2025, $88bn (0.2%) in RWA token trading, leaving $1.5trn which I assume was for wholesale uses – treasury management, card network and interbank settlement and merchant payouts7.

Figure 5 also shows the estimated market value (market cap) of stablecoins required in 2025 to support each use.

Figure 5 – Approximate distribution of stablecoin transacted value in 2025

This breakdown is only approximate but the important point is that the headline numbers are distorted by crypto-asset trading which dominates stablecoin usage. The emerging use of stablecoins in consumer and wholesale payments and in new financial market infrastructure such as RWA token trading can be understood and quantified only by stripping out the crypto-asset trading figures.

The results may be considerably less impressive than the headline numbers but this is the only way to analyse these emerging uses objectively and get a true picture.

Annual stablecoin transacted values for these emerging uses still run into the $ trillions, requiring $ billions of stablecoins – both numbers are growing and it is clear that stablecoins are on their way to become a significant feature in payments and financial infrastructures.

Hard facts about stablecoins: https://jeremylight.substack.com/p/sweet-dreams-are-made-of-this?r=axqgy

USD stablecoins used in the data: USDT, USDC, PYUSD, FDUSD and RLUSD; crypto-assets used in the data: BTC, ETH, XRP, BNB, SOL

Calculated from daily 24-hour volume data from Coinmarketcap.com throughout 2025

January 2025 article: Stablecoins for retail payments

July 2025 article: Stablecoin update

Orbital stablecoin dashboard: https://www.getorbital.com/stablecoin-index

RWA token-trading is an addition in this version, given its growing prominence (in last week’s version it was assumed to be included in crypto-trading and autonomous money management)

For example, Visa is trialling bank settlement using stablecoins: https://investor.visa.com/news/news-details/2025/Visa-Launches-Stablecoin-Settlement-in-the-United-States-Marking-a-Breakthrough-for-Stablecoin-Integration/default.aspx