Last week I highlighted1 how real-time Account-to-Account (A2A) payments initiated through digital wallets are booming worldwide without using open banking APIs, while those countries with active open banking programmes have relatively low real-time payment volumes – for example, Australia, Europe, UK and USA.

However, open banking has the potential to provide the same user experience, convenience and utility of the established real-time payment digital wallets that have mass adoption already in countries like China, Malaysia, Singapore and Kenya.

In this article, I outline three possible open banking models for digital wallet A2A payments focused on payments to merchants:

1. the optimised UX model

2. the merchant-of-record model

3. the funded wallet model.

The evidence is overwhelming that consumers like paying with real-time A2A digital wallets and merchants like accepting them. In the prior article I listed seven characteristics of these wallets that wallets powered by open banking need to have, the most important being:

- A single tap/scan/click to initiate a payment

- Useable on-line and in-person, for all payment types including P2P, C2B and bill payments

- Ubiquitous adoption by consumers and merchants of all sizes.

Optimised UX

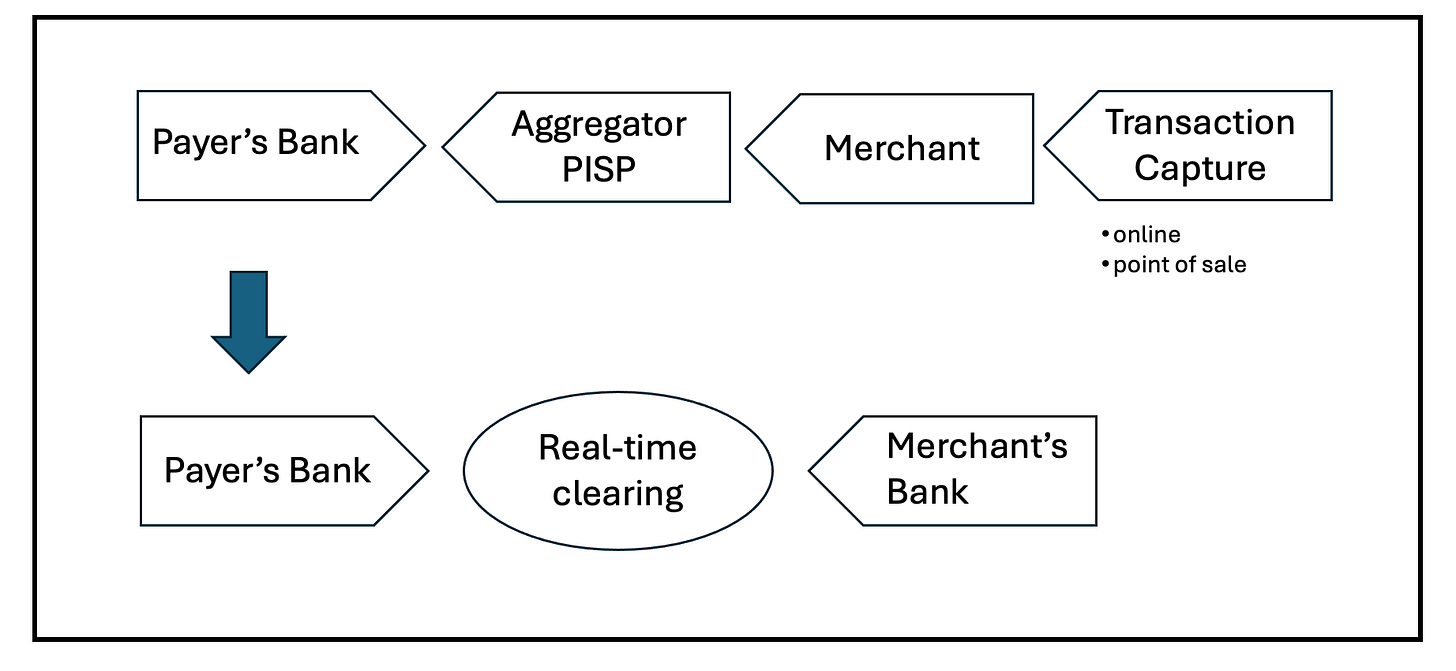

This is the standard open banking model but with a payment scheme and operator to ensure all banks provide a UX that is optimised and standardised for ecommerce and POS (as well as P2P and bill payments), rather than using their standard mobile banking journeys. This model is shown as a value chain in Figure 1.

Figure 1 – Standard open banking value chain

In this model, the payment is captured at the merchant, online or on their POS. Unless the merchant is a PISP, the merchant uses an aggregator PISP to connect the payer to the payer’s bank through an API to initiate the payment to the merchant.

The beauty of this model is that all consumers with a bank account can use it when offered by merchants at no extra effort – no sign up or opt-in process and nothing extra to download. With 350+m bank accounts enabled for open banking in Europe and perhaps 80m in the UK, that is a massive convenience. That leaves to aggregator PISPs the hard side of building an open banking network by signing up merchants to accept open banking payments.

The downside in Europe and the UK for example, is that there is no widely adopted scheme or rules to make the model work coherently. The banks may be mandated to provide APIs enabling account access through mobile and online banking but that’s all. Consequently, payers are redirected to mobile/online banking and then step through the same journey (with prompts, questions and even built-in delays) for £/€ 0.01 as for paying £/€10,000 and one which typically was never designed for ecommerce or POS payments.

This could be solved by all banks joining (voluntarily or mandated) a commercial open banking payments scheme which provides a one tap/click/scan journey for paying at POS and online. It would require a NFC/QR code activated function on their mobile banking apps to bypass the normal banking journey and go down the one tap journey, a notification to the merchant that the payment is paid into their bank account and a mechanism to charge a fee to the merchant for the service.

In Europe, the European Third Party Providers Association (ETPPA) have proposed the European Retail Payments Framework (ERPF)2 along these lines (including enhanced data transfer using Bluetooth). The ERPF is part of the SEPA Payment Account Access (SPAA) scheme and the proposed ERPF user journeys are simple and friction free. They would be a game-changer in European payments if adopted by banks.

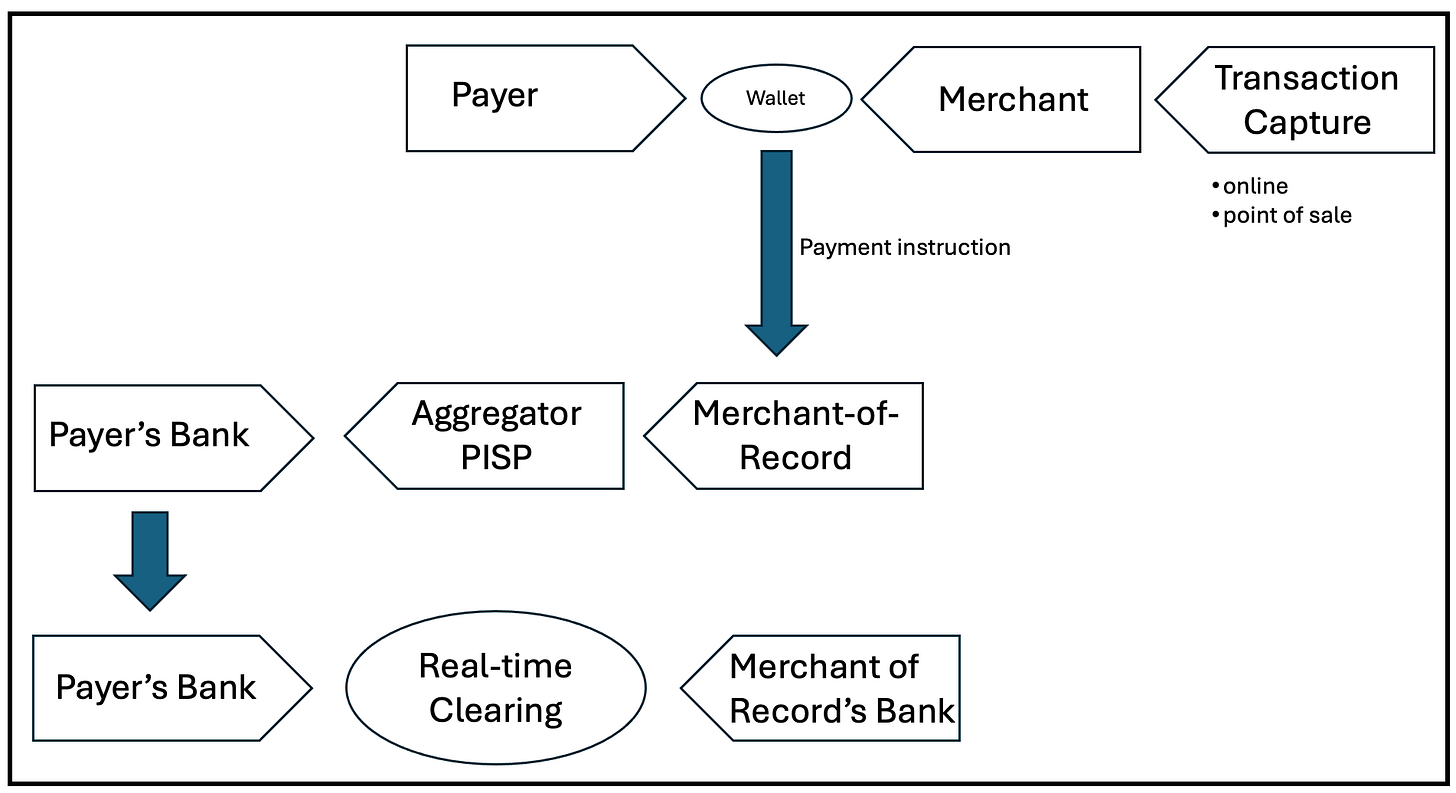

Merchant-of-Record

This model borrows from the cards world, where a single merchant connected to a cards scheme collects payments on behalf of other merchants, typically those too small or unable to get a service from a merchant acquirer. Square pioneered the approach in 2009 with its square dongle attached to a mobile phone. It had rapid take up by sole traders such as taxi drivers and street vendors. Stripe followed with its “seven lines of code” API equivalent for online payments.

The same approach can be used with open banking using Variable Recurring Payments (VRPs). In this model, see Figure 2, a consumer sets up a VRP with a Merchant-of-Record (MoR) who provides a digital wallet, authorising the MoR to initiate payments from the consumer’s bank account to pay the MoR, subject to limits (e.g. value, frequency). The MoR could use an aggregator PISP, or in a country like the UK with a manageable number of banks, could be a PISP itself connected to APIs from all banks. The MoR facilitates payments between payers and merchants. It would get paid real-time by the payer and pass on the payment, less a fee, to the merchant’s bank account.

Figure 2 Merchant-of-record open banking value chain

The benefit of this approach is that the MoR is able to provide a wallet for use by both consumers and merchants, optimised for online, POS, P2P and bill payments without relying on bank-provided UX. The MoR has connections to both consumers and merchants and also would be able to provide data analytic services to merchants based on transaction flows and data.

The downside is that the MoR would need to onboard consumers to its wallet and merchants to accept it.

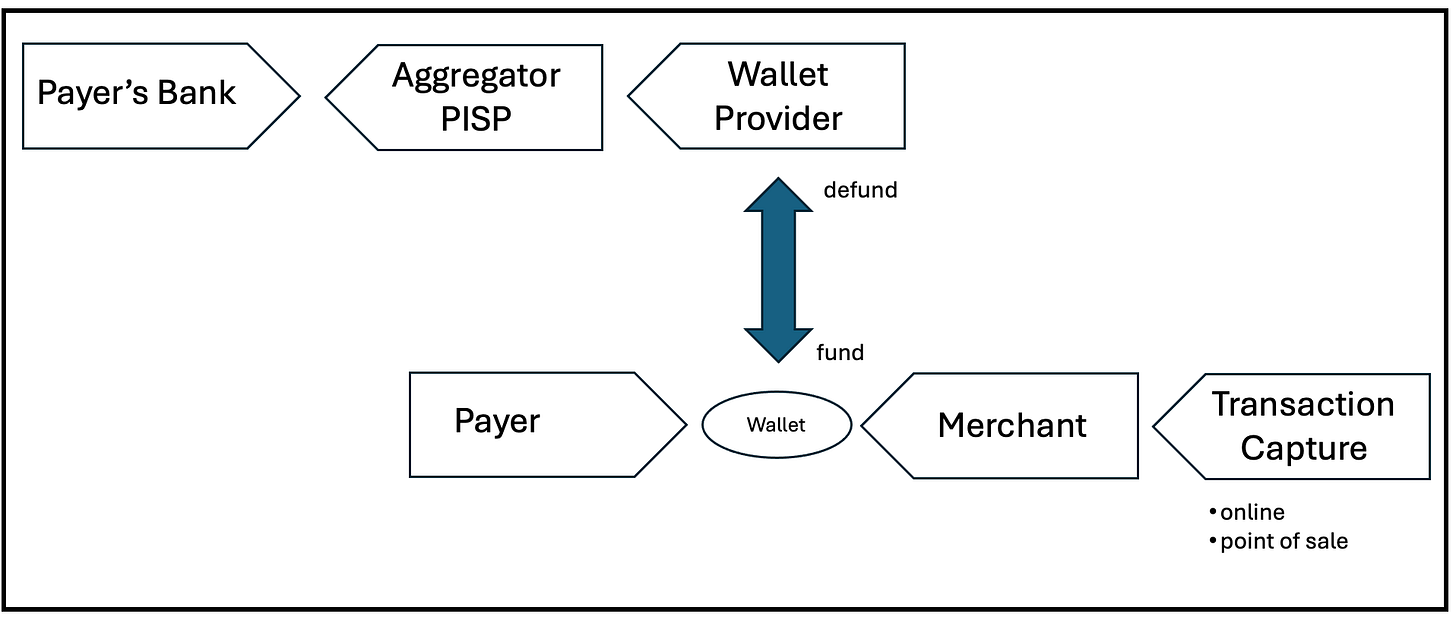

Funded Wallets

In this model, a wallet provider creates its own ecommerce and POS ecosystem by issuing a wallet to both consumers and merchants to make and receive payments. The wallet is a stored value account that is funded through open banking (see Figure 3). It could be configured so that if there are insufficient funds in the wallet on making a payment, the funds are pulled automatically from the payer’s bank account using open banking.

Figure 3 Open Banking value chain for funding digital wallets

This model is similar to the MoR model, the difference being the nature of the wallet, a stored value account. Whereas the MoR wallet is for initiating payment instructions and facilitating payments without handling money itself in the wallet, the funded wallet would hold funds.

As for the MoR model, the benefit of the funded wallet model is to optimise the wallet for ecommerce and POS independent of bank interfaces. It also has the added benefit of digital inclusion by allowing wallet holders without bank accounts (funding would be through cash or through payments from other wallets).

However, again the downside is the need to onboard consumers to the wallet and merchants to accept it.

Which Model/Value Chain?

The biggest challenge to adoption of any of these models are a country’s incumbent banks. They make healthy profits from debit cards (interchange and other fees) which are unlikely to be replicated in more efficient payment methods – resistance to change is significant.

Competition and perhaps regulatory intervention are needed to overcome this resistance. Competition from non-banks is inevitable, as evidenced in China, India and Kenya where non-banks dominate digital wallet payments. However, banks also can get innovative – embedded finance is a big opportunity for banks to generate new revenue streams from premium APIs covering for example point-of-sale insurance, product guarantees and transaction financing. If banks adopted the optimised UX model to provide a mobile banking app configured for everyday payments, then they would have a platform to launch embedded finance which could propel them ahead of non-open banking digital wallets in terms of functionality and utility.

However, in the absence of banks, the near term action is likely to come from non-banks with the MoR or funded wallet models, or something similar - there could well be other models. Recent announcements by Wollete3 and Visa A2A4, although light on detail indicate that we could see some alternative open banking models soon for real.

Conclusion

Real-time A2A digital wallet payments are the future of everyday payments. Already strongly established in Africa, Asia and Latin America, inevitably they will come to all countries. The UX of one tap/click/scan payments, the convenience of a mobile phone and the utility of the wallet in terms of ubiquity of acceptance and ancillary services in the wallet are the overriding drivers of adoption.

How this is achieved can vary and while open banking has yet to make its mark, the three models presented here show that real-time A2A digital wallets powered by open banking are possible.

Like aircraft, which if they look good and look the part, they tend to fly well, so too do value chains. You can judge for yourself which of the three here looks the best and how they compare with other digital wallet value chains but one thing is clear, they are all more elegant than the complicated extended value chains of the card networks which, despite resistance, will eventually be superseded.

Open banking real-time A2A payments: https://jeremylight.substack.com/p/under-pressure

The European Third Party Providers Association (ETPPA) proposed European Retail Payments Framework (ERPF): https://www.etppa.org/erpf. The ETPPA have made a Berlin Group API change request (partially implemented) and the EPC have included it in their # C2B-7 use case document for mobile-initiated SCT use cases. This episode of the Payments Trilogue also explains the ERPF:

.

Wollete: https://wollette.com/en/landing/ordopay

Visa A2A: https://www.visa.co.uk/about-visa/newsroom/press-releases.3389506.html