We need a Wero!

Digital wallets in Europe

European Payment Harmonisation

The European Union has long had an ambition to harmonise payments among its members, moving from national payment systems to a more integrated European-wide payments market in support of a single market for trade. The process started with the standardisation of rules and fees for cross-border Euro payments in 20011 and the formation of the European Payments Council2 in 2002 by the banking sector to harmonise non-cash Euro payments.

There are at least three dimensions to payment harmonisation:

1. Infrastructure (inter-bank interoperability)

2. Regulation

3. Payment initiation/acceptance.

Flagship infrastructure initiatives were the Target2 RTGS system for high value payments, live in 2007 and SEPA, the Single European Payments Area3 which started in 2008 for interbank transfers (SCTs) and continued with direct debits (SDDs) in 2014 and instant payments (SCT Inst) in 2017. With SCT Inst, the ECB launched TIPS (Target Instant Payments Service) in 2018 to settle instant payments in Euros between SEPA banks. There is also a thriving private sector with large payments processors (mainly bank-owned) processing SCTs, SDDs and SCT Insts between banks such as STET – France and Belgium, Equens Worldline – Netherlands and Germany, SIA – Italy, SIBS – Portugal, Iberpay – Spain, EBA Clearing – Eurozone.

The Payment Services Directive provided the initial legal framework for SEPA in 2007. Since then, the EC has used further regulation to nudge the pace of harmonisation4 and enable competition, with the PSD2 (2016) providing a framework for non-bank payments services providers and for open banking, with PSD3 now in the works.

However, harmonisation of payments initiation and acceptance has proved more problematic. It seems to have missed the attention of regulators, passing them by and banks have given it little attention. The key issues are the dominance of card networks and the fast pace of technological change over the past 20 years which has driven innovation in payment initiation and acceptance and exciting changes in the way we pay.

European Payments Initiation and Acceptance

In the UK, over 60% of payments by volume are on Visa and Mastercard cards5, a similar proportion is likely in Europe. It has always concerned the European Commission that US companies dominate European payments to this extent.

Less so European banks who benefit from lucrative interchange fees and shared €21bn between them when Visa Europe was sold back to Visa Inc in 20166. The EC missed the boat harmonising debit cards in the early 2000s, where each member had their own debit card scheme. Most countries chose Visa/Mastercard to get interoperability, hence their dominance today.

The cards industry is hugely successful with a lucrative business model and strong network effects resulting in continued growth at over 5% p.a. today, more than 50 years after cards first became popular.

There have been several attempts to introduce a European card scheme as an alternative to Visa and Mastercard, such as Monnet and The Berlin Group, but none succeeded.

However, new technology - mobile, smartphones, cloud, real-time, APIs, blockchains etc are starting to break the dominance of card networks and expose their limitations. New digital payment services and wallets using account-to-account payments instead of cards have developed steadily in Europe, starting as far back as 2005 and today are a significant force in European payments.

Digital Payment Brands in Europe

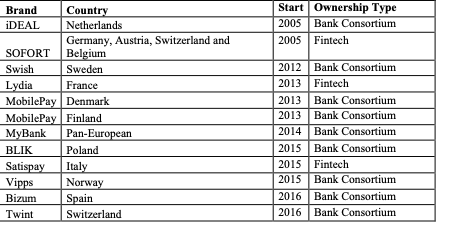

The table below lists the main digital payment services in Europe that use account-to-account transfers.

Penetration of these brands in their respective countries tends to be high. Most are used by at least 40% of their respective populations, with the highest, Swish, used by over 80% of the Swedish population. See Figure 1.

Figure 1 – Penetration of European digital payment brands

The value of payments processed by these brands is significant and runs into billions of Euros annually, with iDEAL in the Netherlands highest at €124 bn. Figure 2 shows the values processed where published (or can be estimated reasonably), with the percentage of these values compared to the total value of card payments in the respective country. These average 32% of cards value, with a high of 81%, showing how these brands are a real challenge to card dominance.

Figure 2 – Payment values by brand, with card comparison

Perhaps a more important measure is transaction volume – every transaction is a customer interaction, indicative of customer behaviour and preferences. Figure 3 shows these volumes, where published, with a percentage comparison to card volumes. The order has changed a little compared to value in Figure 2, with BLIK the highest at almost 1.8 billion payments in 2023. On average, these volumes are 23% of card volumes, again showing how these brands are catching up with card usage.

Figure 3 – Payment volumes by brand, with card comparison

On an annual per capita basis (a different metric to per user), transactions range from 21 per capita (Bizum) to 98 (Vipps) in 2023, indicating considerable room for further growth in these payment methods, as shown in Figure 4, with annual growth rates ranging from 10% to 53%.

Figure 4 – Payment volumes per capita (domestic population) and annual growth

These successful digital payment brands share common characteristics:

1. Bank-owned (all except Lydia, Satispay and SOFORT) – a group of banks gives a large percentage domestic populations automatic access to the service.

2. Large acceptance networks – a critical mass of domestic retailers and billers where consumers make payments gives the service a high utility.

3. Mobile-first – mobile has become the dominant device for initiating payments.

4. Cash-like – immediate finality, use anywhere, pay and get-paid (as a person or as a business).

5. Popular with consumers – convenient and easy to use.

MyBank is an exception (perhaps accounting for its lower value transacted) being available online only and seems to be mainly for B2B payments.

On the whole, they also have a common set of functions:

- Online payments – ecommerce and bills

- Point-of-sale payments (usually using QR codes)

- Person-to-person payments

- ATM cash withdrawals

- Payment requests (links, text messages)

- Recurring/ scheduled payments

- Refund requests and refund payments

- Split payments

- Balance visibility with real-time updates.

Most are digital wallets separate from banking apps, although BLIK and iDEAL operate from within banking apps. Cards can support most of these functions, but the key factors that differentiate these wallets from cards are:

1. The functions are easier to bundle together into a coherent user experience and integrate into a digital wallet.

2. The ability to receive payments as well as pay using the same wallet – like cash (whereas receiving card payments requires additional software, hardware, contracts).

3. Real-time balance information, before and after paying/receiving (with cards, the payee receives funds usually at least a day later and the payer has pending charges for at least a day creating uncertainty on their real balance).

They have also followed a proven, successful adoption path:

1. Launch with free person-to-person payments to gain consumer adoption (iDEAL is an exception, launched specifically to address a gap in ecommerce payments in the Netherlands).

2. Expand the wallet use for online consumer-to-business payments and start generating revenue.

3. Enable the wallet to work for in-person payments at point-of-sale to round out its utility and generate revenue streams competing directly with cards, using QR codes for example.

This adoption path is well-trodden, also used for example by PayPal and Venmo in the USA.

These brands have developed independently and tend to be specific to a country. Some have users in multiple countries such as SOFORT (Austria, Belgium, Germany, Switzerland), Satispay (France, Italy, Luxembourg), MyBank is available for use with 250 banks and PSPs across Europe and BLIK is expanding into Romania7. Vipps acquired MobilePay in Denmark and Finland to create a Nordic mobile payment service. Acquirers also offer these payment methods to retailers wherever they are – for example, iDEAL is available in at least 60 countries to retailers selling to Dutch consumers.

However, it is evident that while these brands are successful, outside of cards there is no harmonisation of digital payments initiation and acceptance across Europe, which must be a concern for the European Commission.

This where the European Payments Initiative and its Wero wallet come in.

The European Payments Initiative

The European Payments Initiative (EPI) was born in 2021, backed by 29 banks and two payment processors, driven by a political imperative for a sovereign European payment system8 (originally with the name Pan-European Payment System Initiative, or PEPSI, changed after objections from the drinks seller).

Such is the attraction of cards9 and their economics, EPI’s plan was to build a card network for Europe, a digital wallet and P2P payments. However, in March 2022, facing funding difficulties, EPI dropped the card scheme to focus on the digital wallet. At the same time 20 banks, including all Spanish banks dropped out of EPI10. Today, the EPI has 16 members based in Belgium, France, Germany and the Netherlands.

In my view, dropping cards was a smart move, perhaps more serendipitous than planned – going head-to-head with Visa and Mastercard with a me-too card network would have had little chance of success11.

As a result, EPI is positioned to capitalise on the trend for digital wallets and account-to-account payments. In July this year, EPI launched its Wero digital wallet.

The Wero Wallet

Wero is, I believe, a portmanteau for “We” and “Euro”.

It is a digital wallet, launched first in Germany for person-to-person payments with a number of banks, with Deutsche Bank joining later this year.12 The rollout in France started in September and will continue until early 2025, supported by a marketing campaign and a very amusing series of I need a Wero TV ads.

The French banks operate a cards-based wallet called Paylib which has 35 million registered users – these will be switched to Wero and Paylib will be discontinued in early 2025. The Belgium rollout will be complete by the end of the year, with Luxembourg due later.

EPI acquired iDEAL in the Netherlands in October last year13. While for now I believe iDEAL remains as it is, it will move to Wero from 2026. This will give Wero an instant boost, while at the same time giving the Dutch an upgrade to the highly successful iDEAL system.

In my view, Wero is an exciting initiative that has the right ingredients for success:

1. Driven by large banks in its target countries, giving automatic access to a majority of consumers.

2. Supported by two big acquirers giving access to a large number of retailers for POS and online - Nexi with 2.9m European retailers and Worldline with 1.4m retailers globally including 250,000 online in Europe.

3. A wallet, designed to be standalone and within bank apps, using account-to-account payments, an alternative payment method proven to be a successful alternative to cards by iDEAL, BLIK, Vipps, MobilePay etc.

4. A gradual adoption path – country-by-country, starting with P2P payments before expanding to consumer-to-business online and point-of-sale.

5. The acquisition of iDEAL giving it a ready-made and significant market share in the Netherlands and the replacement of Paylib in France.

By focusing on individual countries with the same wallet, country adoption will lead de-facto to cross-border adoption automatically, drawing in other countries and their banks, giving Europe the sovereign payment system its politicians desire.

It will take time, perhaps five, even 10 years. To be on the right track, Wero needs green shoots of success to appear within the next 12 months. Details are sketchy, but with the right commercial model (acceptable to retailers and better than cards) and with good execution, Wero looks set up for success.

We all need a Wero!

EC regulation 2560/2001 on cross-border payments in Euro

https://www.europeanpaymentscouncil.eu/about-us

the original intent for SEPA was for the Eurozone (Single “Euro” Payment Area), but it extended quickly to all EU and EEA member states, covering 36 countries (including the UK)

Regulation (EU) No 260/2012 (March 2012), a deadline for SEPA payments and Regulation (EU) 2024/886 (April 2024), a deadline for SCT Inst

UK Finance 2024 Payment Market Summary https://www.ukfinance.org.uk/system/files/2024-07/Summary%20UK%20Payment%20Markets%202024.pdf

Visa Europe sale Nov 2015: https://www.businesswire.com/news/home/20151102005571/en/

Fintech Futures october 2024: https://www.fintechfutures.com/2024/10/polish-mobile-payment-system-blik-receives-authorisation-in-romania/

FT article June 2021: https://www.ft.com/content/61295d18-c77c-4c50-83a2-15e9ff0c4f4c

Despite high levels of fraud due to theft, counterfeiting and hacking and despite cards being a poor fit with online processes, cards have a magnetic draw. Even new alternatives such as open banking are influenced by the card industry such as fee structures.

Finextra article March 2022: https://www.finextra.com/newsarticle/39907/epi-abandons-plan-for-visa-and-mastercard-rival-as-member-banks-quit

I would be unsurprised if EPI’s hand had been forced by vested interests in the cards businesses of their founding members.

Finextra news article July 2024: https://www.finextra.com/newsarticle/44409/epi-launches-wero-wallet-in-germany;

SocGen press release September 2024: https://www.societegenerale.com/en/news/press-release/epi-launches-wero-its-european-digital-payment-wallet-france

iDEAL press release October 2023: https://ideal.nl/en/epi-successfully-completes-acquisition-of-ideal-and-payconiq-international

Hi Jeremy, thank you for the deep dive. I agree with you in many aspects but would like to add som points:

* The SOFORT figures are incorrect. SOFORT supports 85 million accounts but not 85 million consumers (Germany has around 82.7 million citizens!). In fact, the concept of a consumer is not existing in SOFORT or the open banking world as users don't have to register.

* I am curious to see how the iDeal migration will look like? The technical concept of iDeal today is an A2A solution, wero works differently. If all existing merchants, PSPs, .. have to technically and commercially migrate I am not sure if the timeline of 2026 will be met.

* wero plans to launch online-payments mid of next year, but no commercials have been published yet to the market nor merchants.

* The market share of Nexi and Wordline is rather small in e-commerce. Stripe, mollie, Adyen are all missing. And considering iDeal is about to migrate, all of those must subscribe to wero as well.

* Last but not least, banks don't own consumers. Banks need to convince users to sign up to wero and use it as well. A hard job given the sheer number of alternatives in the market for making online payments.

So I do see a lot of risks which need to be addressed and with commercials being the most critical item to convince merchants to sign up for wero. I hope the founding banks will accept that it takes many many years to make wero as success.

Love the ads. How come we never saw Paym ad like that?