This month marks two anniversaries for payments in Switzerland.

A year ago, on 20th August 2025, SIX, the interbank payment processor switched on real-time payments in SIC5, its latest version of the SIC clearing and settlement system launched the previous year (November 2023).

10 years ago, on 6th August 2015, Twint, the hugely popular mobile payments wallet was introduced in Zurich at the delightfully named Riff-Raff cinema1.

60 financial institutions accounting for 95% of Swiss transactions are connected to SIC5 for instant payments, with the remaining ones due to connect by the end of 20262. According to the Swiss National Bank, SIC5 averaged 7,100 instant payments per calendar day in 2024 since its launch3. Assuming the daily average in 2025 is two or three times this number, then I estimate five to eight million instant payments through SIC5 for the whole of 2025. This is tiny compared to the 1.1bn other payments (RTGS and same day/next day batch) processed by SIC5 in 20244.

In comparison, SIC5 is almost matched by Twint mobile payments, which reached 773m payments in 20245. Twint has over 6m users in Switzerland (population 9m) and is used for in-person, in-store, person-to-person, transport and bill payments.

Users link their bank account (or card) to their Twint wallet to use it. Twint payments are cleared real-time (using its own clearing system) and settled between banks once a day using SIC5.

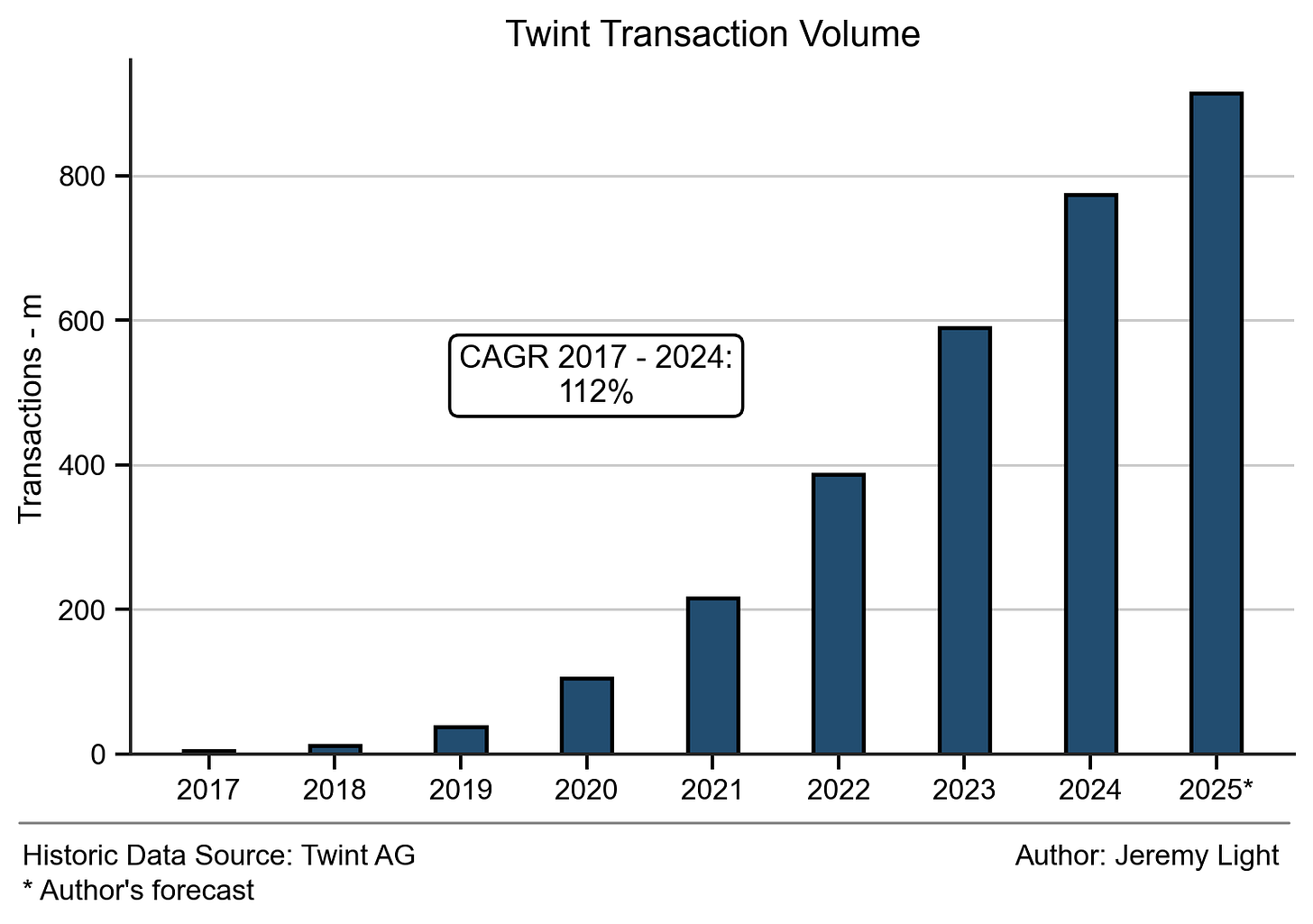

Figure 1 shows the rapid growth of Twint volumes since 2017 (the earliest year with published figures – 4m payments), with a CAGR of 112%. For 2025, I forecast 914m Twint payments, an 18% increase over 2024.

Figure 1 – Twint payment volumes

Originally a subsidiary of PostFinance (the post office bank), Twint is owned jointly now by PostFinance, SIX and the largest Swiss banks.

Twint is a leader in Europe in real-time payments using digital wallets and is up there with the best such as Bizum, Blik and Swish. It dominates real-time payments in Switzerland and was launched years before the banks started processing real-time interbank payments (on SIC5).

With Twint having captured the demand in Switzerland for mobile real-time payments and driven its growth, I expect that the transition from batch payments in SIC5 to instant payments will take a long time. Only modest total transaction growth (batch and real-time) in SIC5 is likely over the coming years – the action will continue to be in Twint.

Erratum

In preparing this article I realised I had made incorrect assumptions in my analysis of real-time payments in Switzerland in my previous articles on Europe6 and global rankings7. My revised figure for real-time payments per capita in Switzerland in 2024 is 86 real-time payments per capita, less than the 122 real-time payments per capita I have stated previously. This drops Switzerland’s ranking to number 21 from 14 in the global ranking and from no.1 to no.3 in Europe, behind Sweden and Denmark.

SNB 2024 Annual Report p76: https://www.snb.ch/en/publications/communication/annual-report/annrep_2024_komplett

SIX payment volumes (SIC5) – high value RTGS payments and same day/next day (2pm cut off) batch payments: https://data.snb.ch/en/topics/finma/cube/zavesic?fromDate=2024-01&toDate=2024-12

European Payments: https://jeremylight.substack.com/p/the-times-they-are-a-changin?r=axqgy

Global Real-time Payment Rankings: https://jeremylight.substack.com/p/mirror-mirror-on-the-wall-who-is?r=axqgy