The Ideal Payment System

How and why iDeal is a great Dutch and payments success

Background

19 years ago to the day, on 4th October 2005 a group of eight Dutch banks launched the iDEAL payments system for online payments.

At the time, ecommerce, a €3bn market1 was growing fast at 28% per year, but the only way to pay was by a credit card, PayPal, separate bank transfer or by in-person payment on delivery. Neither credit cards nor PayPal had a high penetration in the Netherlands and the debit card system, PIN was unusable online.

Rather than adopt Visa and Mastercard debit cards for online payments, a route taken by other countries in the same position, the Dutch decided to build their own payment system for online purchases and iDEAL was born.

Rapid Adoption

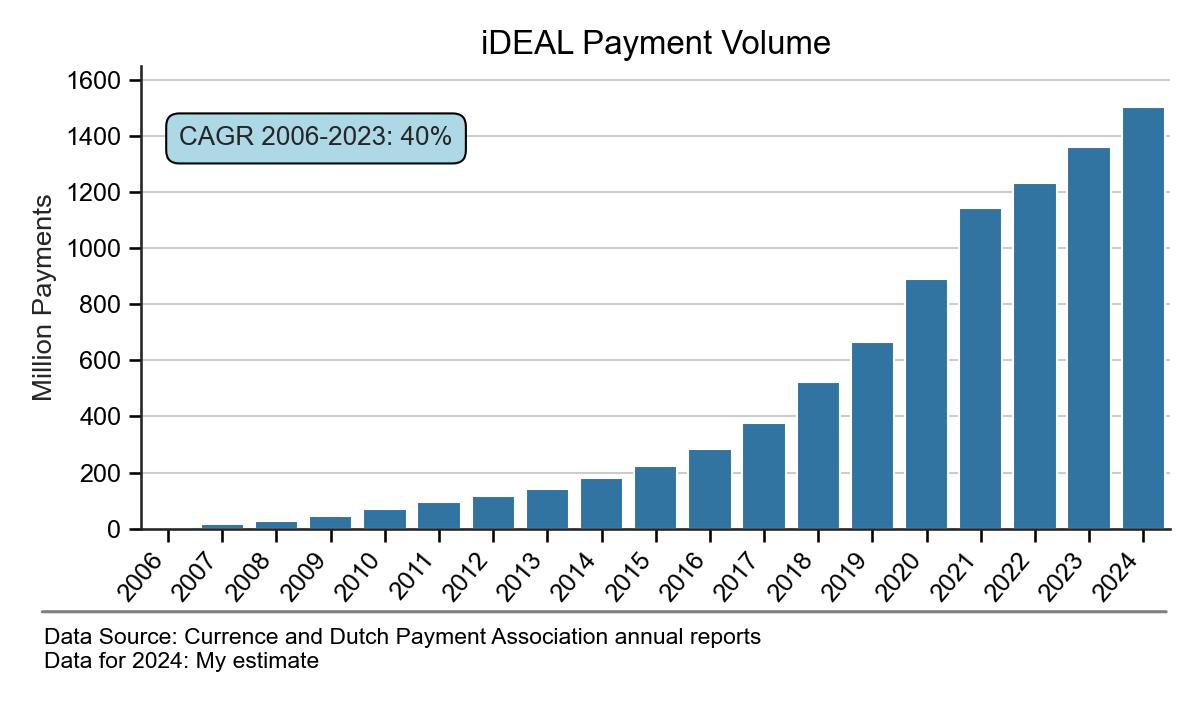

iDEAL was adopted rapidly from the start. From 4.4m payments in its first full year, 2006, to 1.36bn payments in 2023, with 1.5bn payments I estimate for 2024. Figure 1 shows how volumes have grown since launch, with a CAGR of 40% over 17 years to 2023.

Figure 1 – Growth in iDEAL payments since launch

iDEAL Uses

iDEAL is used extensively in the Netherlands for ecommerce and today accounts for 73%2 of all ecommerce payments by transaction volume (credit cards 8%, PayPal 2%3).

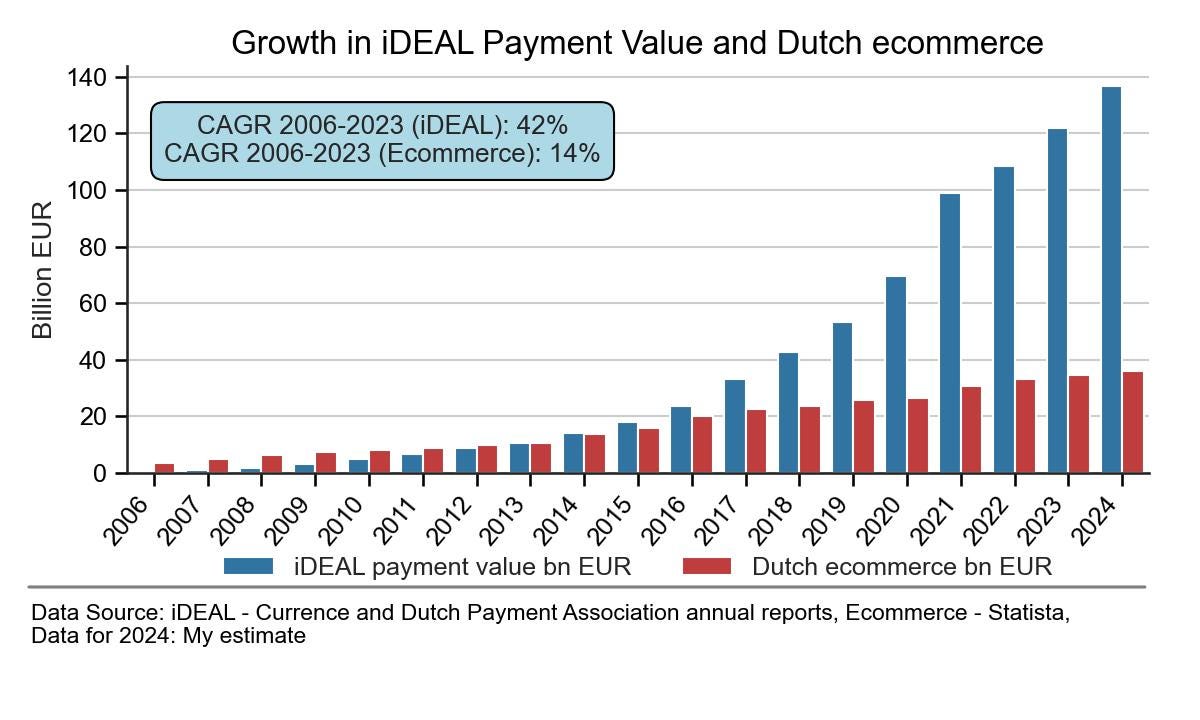

However, ecommerce is just one use case for iDEAL. Figure 2 shows how the value of iDEAL payments outstrips Dutch ecommerce, having overtaken it in 2015. In 2023, iDEAL accounted for 60% of ecommerce purchases by value, which I estimate to be €21bn.

The last published figure for the value of iDEAL payments that I can find is €99bn in 20214 and from this I estimate the figure for 2023 to be €122bn. Thus, in 2023, €101bn of iDEAL payments were made outside of Dutch ecommerce, roughly five times as much.

There is no breakdown of iDEAL payment values I can find except for Dutch ecommerce, but in 2015 3% of iDEAL payments by value were on non-Dutch websites (almost 25%of these were to China, 16% to Germany and 15% to Great Britain – at the time, iDEAL was available in 60 countries)5. Say that proportion has grown to 5%, then perhaps €6bn of iDEAL payments were for international ecommerce, leaving €95bn for other areas such as payment of invoices, mobile top-ups, tax and government services, public transport, donations to charity and person-to-person payments.

Figure 2 – iDEAL payments are much larger in value than Dutch ecommerce

Tikkie Payment Requests

iDEAL is also used for consumer-to-consumer payments, such as Tikkie, the hugely popular request-to-pay service provided by ABN Amro. Anyone can send a payment request using the Tikkie app, which can be paid by return by the recipient, using iDEAL. €5.5bn was paid through 130m payments for Tikkie requests in 20226, a 30% increase over 2021, so it is possible that the figure was €7bn in 2023.

The average Tikkie payment value was €42 in 2022, but they can go to as low as a few cents – for some amusing examples, go to this Reddit discussion forum.

iDEAL Features and How it Works

The customer experience using iDEAL is similar to open banking. On online checkout, the customer clicks the iDEAL option, selects their bank, logs in to their account, approves the payment and returns to the retailer website.

Unlike open banking the iDEAL platform is connected directly to the Dutch banks (14) rather than through APIs. Once an iDEAL payment is initiated, real-time confirmation is sent to the iDEAL platform by the bank and then onwards to the retailer. Settlement is through the normal Equens Worldline or Target2 interbank clearing. The retailer receives the funds either instantly or same day.

Retailers and billers need to use their (acquiring) bank, an acquirer or a PSP (collecting payment service provider) to accept iDEAL payments (through an iDEAL API or SDK provided to them). Larger retailers/billers typically use a bank or acquirer, requiring a specific iDEAL contract, smaller ones use CPSPs where no specific iDEAL contract is needed. Currently, there are 18 acquirers, 62 CPSPs7 and 210,000 retailers/billers8.

Over the years, steadily iDEAL has added new features and capabilities, including:

- Initiation through mobile banking apps – more than 80% of iDEAL payments are made this way

- iDEAL ID - a personalised, reusable id linked to the user's bank account for faster checkout and recurring payments

- iDEAL QR – captured within a banking to initiate an iDEAL payment

- iDEAL Checkout – faster checkout using saved preferences such as delivery address

- iDEAL in3 – the payment is split into three equal installments, one paid immediately, one paid 30 days later, the last paid 60 days later, at no extra cost to the consumer

- iDEAL Scheduling – to schedule future payments to a business e.g. subscriptions

- iDEAL Payment Link – payment requests sent via email, Whatsapp etc by agreement with a biller

- iDEAL C2C – for consumer-to-consumer payments such as Tikkie

Consumer Protection and Fraud

iDEAL has very low levels of fraud – no figures are published, but there are no consumer protection measures specific to iDEAL, such as chargebacks. 19 years of operation and dominance in Dutch payments are evidence that such measures have been unnecessary.

The key reason is that payments can be initiated only through strong customer authentication using banking apps and payments can be received only by vetted retailers/billers onboarded by acquirers and PSPs. They are responsible for ensuring that their retailers/billers use iDEAL for legitimate purposes.

iDEAL also shares information on suspicious actors with acquirers, CPSPs and C2C providers through the National Internet Fraud Complaints Desk. It is very difficult for scammers to slip through the net – for example, in 2014 just 19 suspicious websites were detected, 17 were fraudulent and removed from iDEAL.

Why iDEAL is Successful

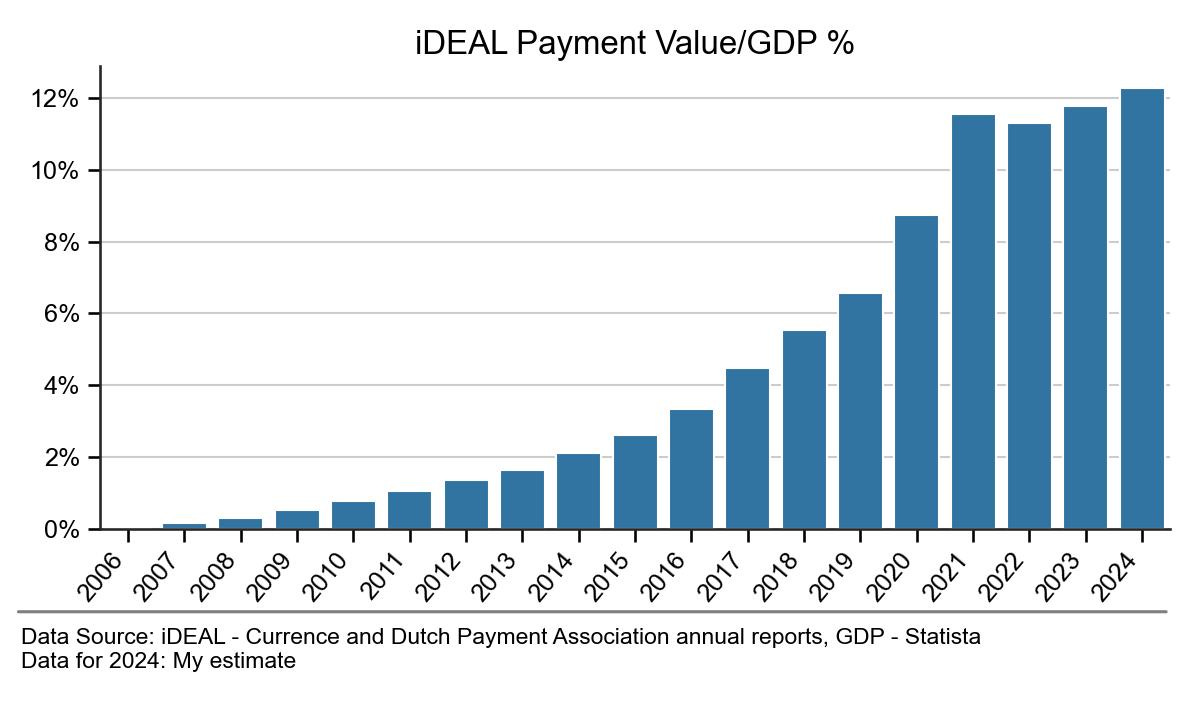

The scale of iDEAL’s success can be seen in Figure 3, which compares the value of iDEAL’s payments to Dutch GDP9. From nothing in 2005 to 12% today, iDEAL is a major feature of the Dutch economy.

Figure 3 – iDEAL has become a significant feature in the Dutch economy

iDEAL’s success is due to a strong product-market fit since its launch. It is available automatically to all Dutch consumers with a bank account and almost all online Dutch retailers accept iDEAL (as well as many other billers and retailers/billers outside the Netherlands).

The consumer experience is good. With ecommerce growing strongly in the early years, a low penetration of credit cards and PayPal and Dutch debit cards (PIN) unusable online, online retailers adopted iDEAL rapidly. As a result, the acceptance network for iDEAL reached critical mass quickly and strong network effects took hold.

Critically, the Dutch banks were behind iDEAL. They had no significant debit card interchange revenue streams to protect, no appetite to use Mastercard and Visa for online debit card transactions and were bold and innovative enough to design and build iDEAL instead.

iDEAL’s resilience to fraud is a key factor. It has allowed it to grow without a constant battle to contain fraud with ever-increasing costs as has happened with the card networks. Cards are inherently prone to fraud (they can be stolen and counterfeited) and the chargeback mechanism to deal with it generates its own significant first-party fraud problems. The lack of an iDEAL chargeback mechanism is considerably attractive to retailers and billers.

iDeal also has a commercial model that works well for all parties. Acquirers, CPSPs and C2C providers pay10 an entry (licence) fee, a fixed annual fee and variable transaction fees which cover the cost of operating and developing the iDEAL platform. In turn, acquirers, CPSPs and C2C providers charge their retailers and billers fees in a competitive market. These fees are typically low compared to other payment methods.

For example, Adyen11 charges online retailers no onboarding fee, a €0.11 processing fee for every transaction independent of payment method and a payment method fee of €0.22 for an iDEAL payment. Its payment method fee for Mastercard debit cards is at least 0.8% of transaction value (€0.40 on a €50 payment) and at least 0.9% for credit cards. Its American Express payment method fee is 3.95%.

As you can see, iDEAL is a good deal for retailers and billers.

The Wero Digital Wallet

A year ago, iDEAL was acquired by The European Payments Initiative (EPI)12 from its previous operator Currence (owned by the Dutch banks), together with its technology provider Payconiq International (Luxembourg). EPI’s mission is to rollout a digital account-to-account real time payments wallet, the Wero13 across the Eurozone. It launched in France last month, with Germany and Belgium to be added shortly.

EPI’s plan for the Netherlands is to replace iDEAL with Wero starting in 2026 (although this could change). It is a huge sacrifice for the Dutch banks to allow this, no doubt made for the greater good of a common European payment mechanism. It is also a bold undertaking, but so was the original development of iDEAL.

Whether it proves to be an ideal move, or otherwise, time will tell.

ecommerce in the Netherlands 2005 - 2023: https://www.statista.com/statistics/558214/yearly-online-consumer-expenditure-in-the-netherlands/

Dutch Payment Association annual report 2023: https://www.betaalvereniging.nl/wp-content/uploads/Jaarverslag-Betaalvereniging-Nederland-2023.pdf

iDEAL website: https://ideal.nl/en/online-consumentenbestedingen-nemen-toe-vooral-vanwege-run-op-vakanties

Currence annual report 2016: https://www.currence.nl/wp-uploads/2016/07/Cu_CurrenceJVUK2015.pdf

ABN Amro News 29 Dec 2022: https://www.abnamro.com/en/news/new-annual-record-tikkie-payment-volume-reached-eur5-5-billion-in-2022

iDEAL website: https://www.ideal.nl/en/acquirers-and-cpsps

iDEAL website: https://www.ideal.nl/en/about-us

GDP is used as a comparator only to gauge the size of the iDEAL payment system. There is no implication that iDEAL represents 12% of the Dutch economy.

iDEAL website, fees: https://www.ideal.nl/en/ideal-fees

Adyen website, pricing: https://www.adyen.com/pricing

iDEAL press release 31 October 2023: https://ideal.nl/en/epi-successfully-completes-acquisition-of-ideal-and-payconiq-international note - this acquisition may be why publicly available data about iDEAL has tailed off since 2022

Wero website: https://wero-wallet.eu/

Petra - try a Fintech that offers virtual debit or credit cards branded Mastercard or Visa which are usable on Substack (with a virtual card, it is always on your mobile, no plastic card and you should be issued with it immediately).

Your readers in the Netherlands should be able to use iDeal to fund a virtual card online from a Dutch Fintech such as Bunq. Revolut NL or Wise may also be worth a look.

Do you know if there is any workaround on Substack for iDeal? It's so common in The Netherlands that soms of my subscribers want to go to premium but the don't have a creditcard, only iDeal.