When the British negotiated a treaty in 1819 for a trading station in Singapore, the total population of the island was around 1,000. As the port grew, the population rose past 100,000 in 18711 – today it is around 6m people2.

Singapore derives from the Sanskrit Singa (Lion) Pura (City), named by a Sumatran prince in the 14th century, who purportedly saw a lion on the island (and presumably, a city). Since the 1960s, it has become known also as the Garden City, due to urban planning for green spaces, such as Gardens by the Bay, the Botanic Gardens and vertical greenery on buildings.

Today, you could call Singapore the Digital Wallet City.

Singapore is unique from a payments perspective as it has its own sovereign payment infrastructure used by a population that is 100% urban. There is only one city and no rural population, but it sits in the middle of Southeast Asia, the world’s most populous region.

Singapore’s Payment Infrastructure

There are three distinct domains in Singapore’s retail payment infrastructure:

1. Local cards, plastic and in mobile wallets, using the long-established NETS (Network for Electronic Transfers – owned by the Singapore banks) debit and credit cards for POS and online (NETS credit card only).

2. Stored value cards and wallets using e-money, mainly on the mass rapid transit system MRT, light railway transit LRT and buses, but used also for food delivery, taxi rides etc.

3. Wallets using real-time bank transfers under the PayNow scheme for P2P transfers, payroll, bills and increasingly for retail purchases at POS and ecommerce.

PayNow is the most exciting and dynamic of the three domains, driving adoption of real-time digital wallet payments.

There are two types of payment providers, banks and non-bank financial institutions (NFIs). Banks operate across all three domains, whereas NFIs issue wallets with e-money and some additionally use PayNow. Perhaps the most recognisable NFI is GrabPay, originating from the ride-hailing service Grab, which has extended into a digital wallet for rides, food deliveries, online shopping and in-store purchases.

Bank wallets using NETS cards include DBS PayLah!, OCBC Digital, UOB TMRW and NetsPay. In 2017 NETS launched NETS QR, now in widespread use, allowing wallet holders to scan QR codes at retailers to make payments with NETS cards.

SimplyGo EZ-Link wallets and Nets FlashPay cards, both loaded with e-money, are used on the public transport system and are accepted by many retailers for food and beverage purchases.

PayNow is an overlay service on top of the FAST (Fast and Secure Transfers) real-time clearing and settlement system run by NETS. FAST uses the ISO20022 clearing and settlement system that VocaLink exported until it was acquired by Mastercard in 2016. FAST went live exactly 11 years ago on 17 March 2014.

PayNow is similar to UPI in India - banks embed it into their banking apps and non-bank financial institutions (NFIs) into their digital wallets. PayNow was launched by the Association of Banks in Singapore (ABS) in July 2017, for real-time P2P payments. This extended to B2B and B2C payments in 2018 and QR codes in 2019. There are 10 banks (local and international) registered to offer PayNow for individuals and 15 banks for corporates and businesses.

In 2021, since the Payment Services Act (2019), NFIs have been able to embed PayNow into their digital wallets, licenced as major payment institutions, extending their capabilities beyond e-money. The NFI wallets using PayNow are GrabPay, Singtel Dash, Liquid Group and Xfers. Additionally, PayNow is interoperable with other wallets in the region. Visitors from India with UPI wallets, Malaysia with Duitnow wallets and Thailand with Promptpay wallets may use them at Singapore retailers who accept PayNow. Interoperability is planned with Indonesia and the Philippines but there is no evidence from ABS3 these are live yet.

There are other wallets in operation in Singapore, such as FavePay, ShopeePay, Google Pay, Apple Pay, Nium and others. Given the relatively small size of Singapore, many wallets operate across the Southeast Asia region and beyond rather than solely in Singapore. WeChat Pay and Alipay are accepted also by retailers catering for the large number of tourists from China (although these have no interoperability with PayNow, but retailers can accept WeChat Pay using NETS QR).

To complete the infrastructure picture there are BNPL service providers Atome, Hoolah and Grab PayLater, Giro direct debits and the MEPS+ RTGS system for high value interbank payments.

Additionally, Singapore has a form of open banking, SGFinDex (Singapore Financial Data Exchange), launched by the Monetary Authority of Singapore (MAS) in 2020. Built on Singpass, the national digital identity system, it allows individuals to consolidate financial data from different banks, government agencies and insurers into financial planning apps; and APIX (API Exchange) developed by ASEAN Financial Innovation Network (AFIN) to be a cross-border API marketplace allowing financial institutions and fintechs to collaborate, test, and integrate financial APIs for digital payments, lending and financial inclusion.

However, these seem to have very low take-up, with very little impact on the payments landscape.

Singapore Payment Volumes4

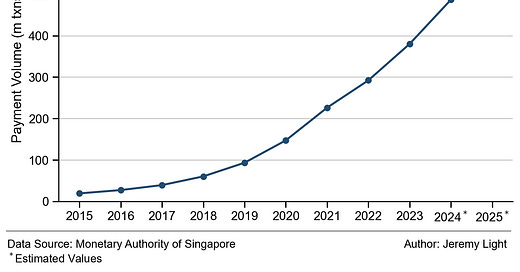

FAST real-time payment volumes have grown strongly since launch at 45% CAGR between 2014 – 2023, see Figure 1. I estimate 487m payments in 2024, or 80 payments per capita, with a value of 653bn SGD (490bn USD) and an average payment value of 1,342 SGD (1,007 USD). This compares with, say, UK Faster Payments which had 63 payments per capita in 2024, with an average value of 1,197 SGD (694 GBP, 897 USD).

Figure 1 – Singapore real-time payments volume processed by the FAST real-time system

FAST volumes are driven by normal online/mobile banking payments and increasingly by PayNow transactions from bank apps and NFI digital wallets.

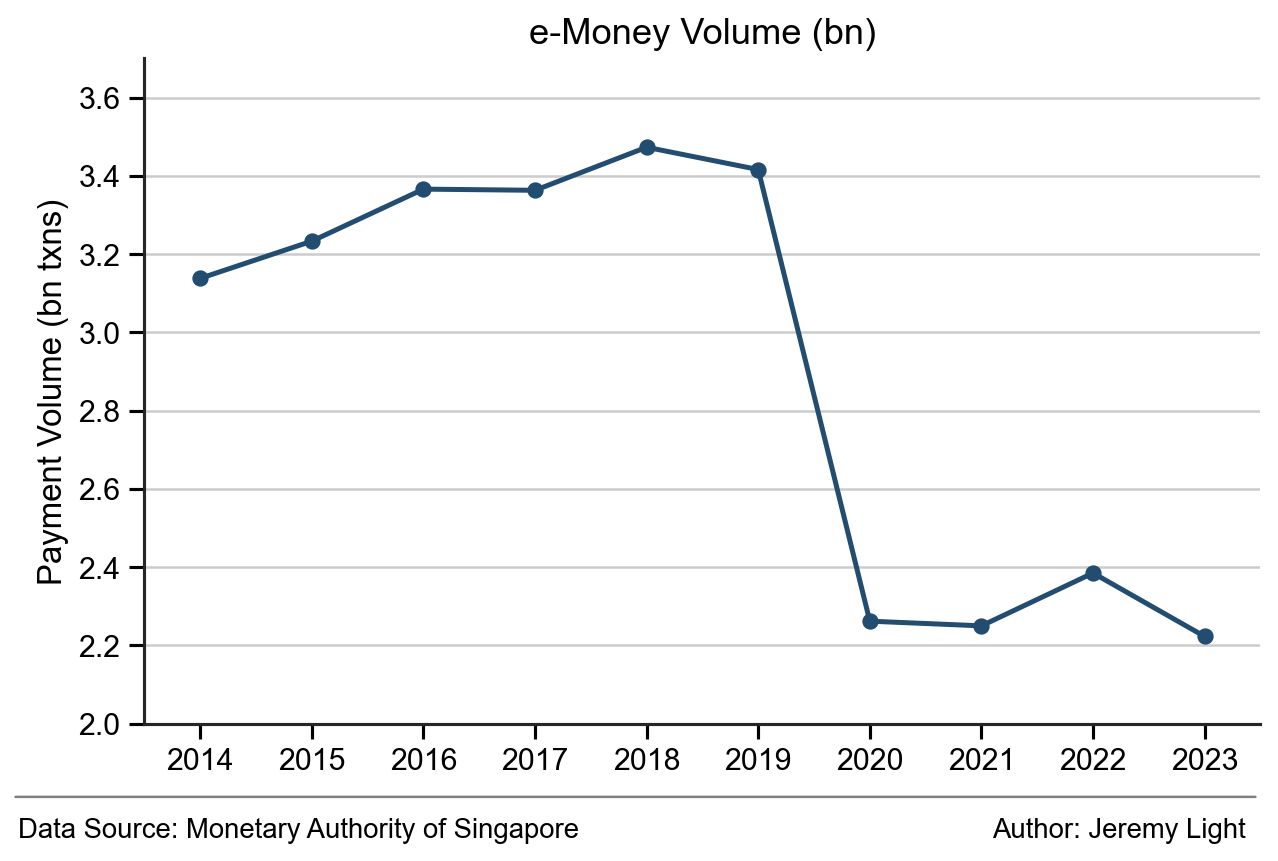

e-Money volumes are significant, at 2.2bn transactions in 2023, almost six times the volume of FAST transactions that year. This figure compares with 2.6bn public transport (MRT/LRT and buses) journeys annually (7.2m daily5). Most e-money payments are for these journeys, with the average payment value (in H1 2024) at 1.22 SGD (0.92 USD).

Figure 2 shows e-money payments grew slowly from 3bn payments in 2014 to a peak of 3.5bn in 2018, dropping 34% in 2020 to 2.3bn and have remained around this level ever since.

Figure 2 – Singapore e-money payment volume from prepaid wallets and transport cards

The Covid lockdowns in 2020 caused the drop – fewer public transport journeys, fewer digital wallet and prepaid card purchases and likely an exodus of temporary workers leaving the island to return to their home countries.

However, why the level of e-money payments has remained flat since 2020 is unexplained. Public transport journeys rebounded to 83% of the 2019 peak in 2022 and to 94% in 2023 (footnote 5), in contrast to the flat e-money figures. It is possible that when NFI digital wallets gained access to PayNow in 2021 they moved away from e-money to bank payments using FAST, countering the rise in public transport usage. However, the MAS figures for e-money payments have no usage breakdown to verify this.

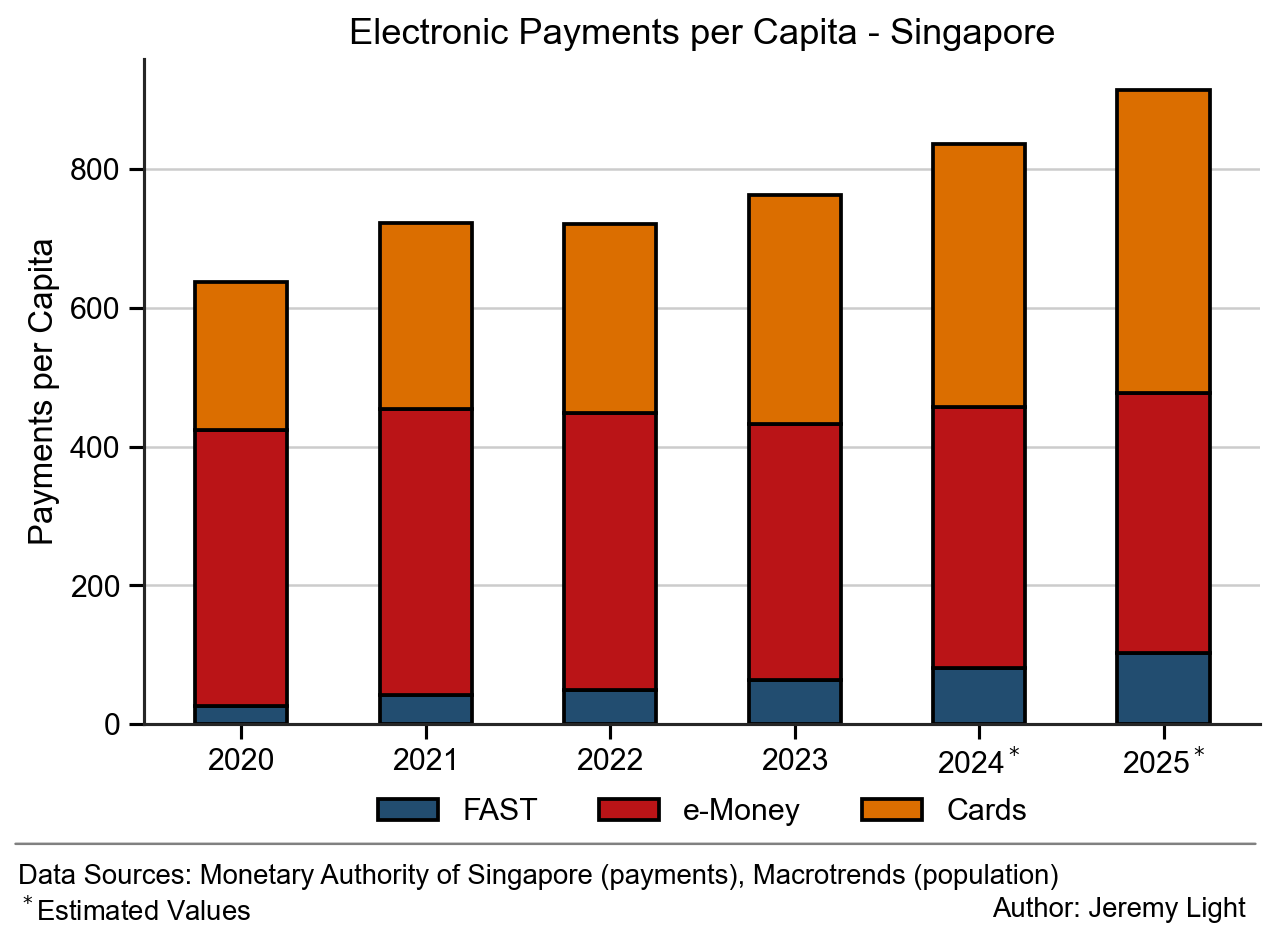

Card payments have significant adoption and are growing strongly. In H1 2024, there were 1.1bn card payments6, growing in volume at 16% per year, with an average value of 67 SGD (50 USD). In Singapore, the cards in issue include local NETS debit and credit cards as well as international cards such as Visa, Mastercard and Amex.

Across all types of electronic payments, I estimate by adding FAST, e-money and cards transactions on a per capita basis, there were 836 electronic payments per capita in 2024. See Figure 3.

Figure 3 – Payments per capita in Singapore (excluding cash)

In addition, cash is used widely still, with around 170m ATM withdrawals in 2023 worth 59bn SGD (44bn USD), with one estimate suggesting 15% of retail payments are cash7. If this is the case, then the total payments per capita in 2024 is 984, including cash and electronic payments.

This seems high, it equates to 2.7 payments per person for every inhabitant every day of the year. However, at 7.2m journeys a day (footnote 5), on average more than half the population uses public transport twice a day, every day of the year. It could be that as a 100% urban population, Singapore has a much higher payments per capita than other countries, whereas in previous articles I have shown it averages around 650 per year. Either that, or the actual Singapore population is much higher than the published 6m figure.

PayNow, a Driver of Change - How It Works

PayNow is a service that sits within a bank app or a NFI digital wallet – there is no separate PayNow wallet.

To use PayNow individuals register for it by linking their bank account or wallet account to the service using a virtual payment address (VPA). This can be a mobile number, NRIC (National Registration Identity Card) for citizens/permanent residents or FIN (Foreign Identification Number) for temporary residents. Individuals are unable to create their own VPA, restricting to two the number of wallets and bank apps they can use with PayNow (unless they have more than one SIM).

Business users register in a similar way using their UEN (Unique Entity Number) as the VPA and may customise their VPA to be customer friendly/recognisable.

Once registered, individuals may send money to others and to businesses by entering the recipient’s VPA or by scanning a retailer’s PayNow QR code containing their VPA at POS.

The user’s app/digital wallet presents the recipient’s name decoded from the VPA before confirming payment. After payment, both the sender and recipient get a real-time confirmation. Authentication is through the bank app or digital wallet with biometrics or PIN.

All QR codes in Singapore use the Singapore Quick Response Code (SQRC) standard. Until 2018, NETS and every NFI (and every bank before NETS QR) had their own QR code with retailers displaying a confusing array of QR codes. Now they can display just one QR code which can be scanned from within an app/wallet, or if the app is closed, it opens the app/wallet if a default is specified (otherwise an error). This had a positive impact on PayNow adoption – retailers displaying the NETS QR code upgraded to the SQRC standard allowing them to accept PayNow as well with the same QR code (once they had signed up to it).

Some bank apps and digital wallets also work with NFC at POS, but this is their own enhancement rather than a feature of PayNow. However, most POS interactions use SQRC.

PayNow payments also work online, by entering the merchant UEN in an app/wallet, or by capturing a QR code on screen or through a deep link in-app.

PayNow supports most payment types including P2P, retailer payments, payments to government, payroll, billing and ecommerce.

Lessons from Singapore

1. PayNow is a well-recognised acceptance brand that has been critical to its adoption, a common anchor within multiple bank apps and digital wallets, like Visa or Mastercard for cards.

2. Real-time payments are critical in consumer payments, as evidenced by the strong growth of FAST and adoption of wallets using PayNow. These wallets are encroaching on the NETS cards domain with a far greater range of services and payment types.

3. Clearing and settlement is less important than user-facing apps – FAST has a “fire and forget” clearing system, meaning there is no finality confirmation passed to the sending bank. In the early days of FAST there were instances of payers finding out days later that a payment had failed due to an unknown account or other error. This design flaw is mitigated through PayNow features such as VPA addressing which has allowed mass adoption of real-time payments through apps and wallets.

4. Acceptance is a key point of interoperability - the SQRC has enabled interoperability within Singapore and abroad with India, Malaysia and Thailand. ISO20022 is often seen as core to interoperability of modern payment systems, it helps, but UPI in India is on a different standard. It is the acceptance interoperability and cross-border settlement arrangements that matter.

5. The Payment Services Act (2019) Act opened the payments industry to non-bank competition. The government reacted to the fast pace of innovation in the region and due to the Act, the payments landscape in Singapore is vibrant and competitive.

6. Open banking was left out of the PSA and has so far failed to take off in Singapore, with instead market forces driving payments innovation in digital wallets.

7. All-in-one payment wallets that cater for multiple payment needs from P2P to POS to ecommerce to billing are viable. PayNow has extended the capability of mobile banking apps to do this and enriched the functionality of NFI digital wallets.

8. Addressing is critical – the VPA addressing system makes it easy to route payments without using or sharing bank account details (although it is missing a privacy option to avoid sharing mobile numbers and government identifiers publicly).

9. PayNow works with and without a bank account, ensuring non-bank competition, choice and ubiquitous usage.

10. PayNow’s instant notifications to payer and receiver make it viable for use in commerce.

Conclusion

Payments in Singapore are dominated by cards, e-money and real-time digital wallets/banking apps.

Cards are still big and growing with the legacy NETS infrastructure embedded deeply in the Singapore economy. Uniquely, e-money is used extensively in Singapore with a significant share of all electronic payments, in contrast to most countries where e-money has a low share of payments. This is due to a 100% urban population using prepaid cards and wallets on the public transport system.

As PayNow gains traction, especially through the NFI wallets, real-time digital wallet payments in Singapore will grow and grow, driving up volume in FAST. It is too early to say if PayNow will displace NETS for POS and ecommerce payments, but that is a possibility and FAST’s strong sustained growth and the popularity of NFI wallets point to it.

The innovation in Singapore’s payment industry is clear to see. It has far more market participants and wallet providers than a 6m population would sustain normally. The fact that it does, shows that rather than an island, Singapore’s payments landscape is interoperable and in tune with the Southeast Asia region.

Singapore is indeed, the Digital Wallet City.

History of Singapore: * https://en.wikipedia.org/wiki/History_of_Singapore, https://www.britannica.com/topic/history-of-Singapore

Singapore population size: https://www.macrotrends.net/global-metrics/countries/sgp/singapore/population

Association of Banks in Singapore PayNow: https://abs.org.sg/consumer-banking/pay-now

Payment statistics published by MAS, for between 2014 and H1 2024. Figures for the whole of 2024 and 2025 are my estimates. https://www.mas.gov.sg/statistics/payment-statistics/semi-annual-retail-payment-statistics

The MAS card statistics (footnote 4) may include card payments from international visitors with foreign cards, but there is no information or split between foreign issued and domestic issued cards.

Cash usage - the 15% is by value, the % by volume is likely to be higher https://fintechnews.sg/99508/payments/cash-transactions-in-singapore-projected-to-fall/