Soldier On

A five-year forecast for UK open banking payments and what's needed to change its trajectory

Open banking has been in the UK for almost eight years, since January 2018, a regulatory initiative to make retail banking more competitive and innovative. Now, the UK government (Treasury) is prioritising open banking for the future of UK payments.

A year ago, I published a five-year forecast for UK open banking payment volumes1. In this article I present an updated forecast for the next five years with an idea, backed by compelling evidence, on how to grow open banking payments at a faster rate - applicable to the UK, Europe and other countries with open banking initiatives.

This time last year, I forecast 225m UK open banking payments2 for 2024 and 375m for 2025. The outcome for 2024 was 224m and my new forecast for 2025 is 349m (currently 188m year-to-date as of July), split 300m single payment initiations and 49m Variable Recurring Payments (VRPs). This is a 56% increase on 2024 volume.

As often happens in new payment systems and methods, the annual rate of increase starts high then reduces as volumes grow. This is seen in UK open banking – 2022: 171%, 2023: 90%, 2024: 72%, 2025:56% (forecast).

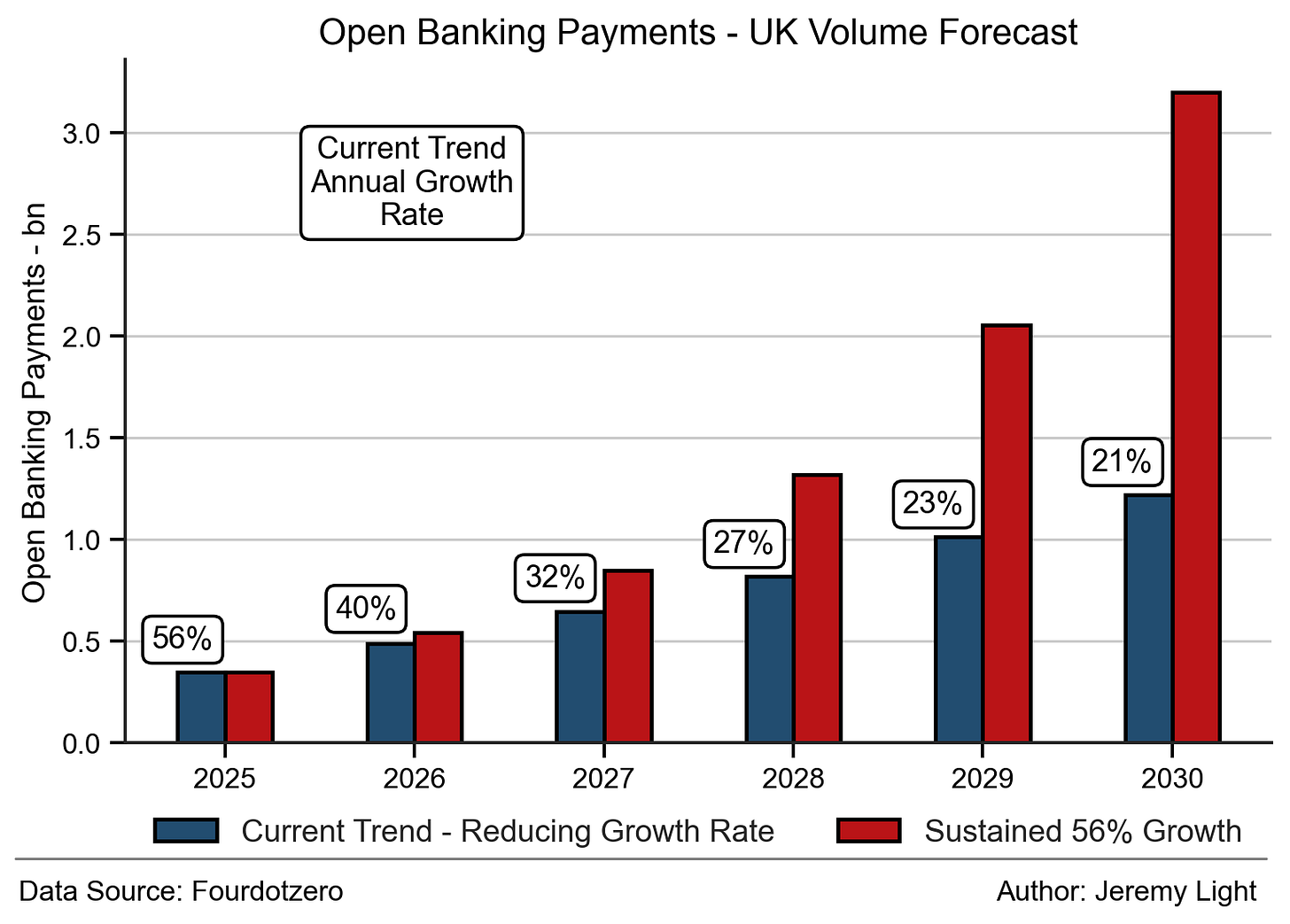

Using the same format as last year, Figure 1 shows a five-year year forecast under a scenario where the annual growth rate continues to reduce and another scenario where it is steady at the forecast 2025 growth rate of 56%.

Figure 1 – UK open banking five-year payment volume forecasts under two scenarios

I explained a year ago that 2.5bn transactions is a reasonable milestone for open banking to demonstrate it is making an impact in the UK. Last year I showed this could have been achieved by 2029 with a steady annual growth rate of 73%. However, with the annual growth rate continuing to reduce, this is now unlikely. Figure 1 shows that this target is still possible by 2030 if the annual growth rate remains steady at this year’s forecast 56% for the next five years, otherwise it will take a lot longer (and may even be unachievable under current trends).

Achieving Sustained High Growth Rates in Open Banking

There are no examples elsewhere in the world where open banking has been a huge success in payments. Brazil has perhaps the most advanced open banking programme (Open Finance) with 97bn API calls3 in 2024 but this has developed in parallel to its highly successful Pix payments system without being a driver for it (only 156m payment initiation API calls in 2024 – footnote 3).

Another parallel is UPI which processes 98% of instant payments in India4. UPI volumes run at more than 19bn payments per month and have grown at a CAGR of 69%5 over the past five years. This is the type of growth that open banking in the UK needs.

UPI is similar to open banking in that it allows third parties to initiate payments from user bank accounts. It differs from open banking through channelling third party initiation through a single UPI interface, whereas in open banking, banks have their own interface for third party access, usually through publishing their own APIs which redirect users to initiate payments from their mobile banking app. This results in as many interfaces as there are banks, each with their own characteristics and apps. As a result, open banking has led to a proliferation of businesses aggregating bank APIs, causing competition in back-end processes instead of competing for end users. In contrast, UPI has led to fierce competition for consumers through third party apps such as Paytm, Phone pe and Google wallet.

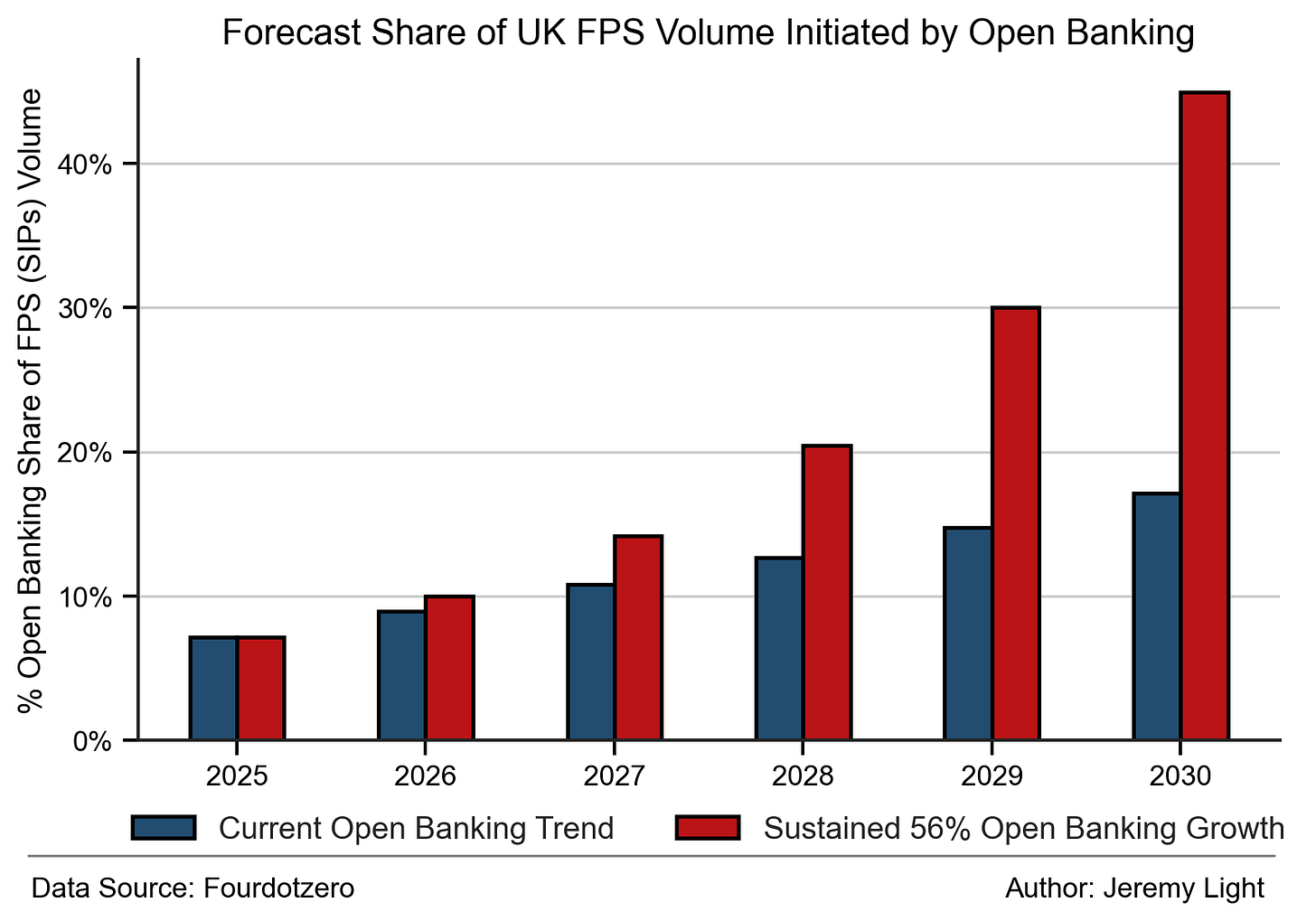

UPI initiates 98% of an enormous volume of instant payments in India but open banking payments in the UK initiate just 7% of a relatively low number of instant payments. Figure 2 shows how this percentage in the UK grows over the next five years under the same two scenarios as Figure 1.

Figure 2 – UK open banking five-year payment volume share forecasts under two scenarios

Figure 2 shows that open banking payments can reach a reasonable share of 40%+ in initiating instant payments by 2030 only with a sustained annual volume growth rate of around 56%, or higher. Even then, it is far off the 98% share seen in UPI.

For open banking to be a success, something needs to change. Observations of India, Brazil and elsewhere suggest that this change needs to be a shift to competition for consumers and away from competition in API aggregation. This needs to be done at the front-end through digital wallets initiating open banking payments, online, in-store and person-to-person, provided by both banks and non-banks. In another previous article6, I outlined possible open banking models that could be used to achieve this.

Innovating with Open Banking

The challenge for the UK and for those building new payment services is the dependency on the National Payments Vision7, led by the Treasury, which prioritises open banking payments but from an infrastructure and regulatory perspective. Its goals are to enable innovation and competition, which can come only from the private sector and from commercial propositions using the infrastructure.

A key strand of work to implement the National Payments Vision is to develop VRPs, a mechanism which the UK payments industry has been waiting for regulatory clarity for many years. I showed in my article (footnote 6) on digital wallet open banking models that VRPs could be used in a merchant-of-record model to minimise dependencies on redirection to bank apps. However, it requires a third-party to handle customer funds, which is a kludge for a way to avoid redirection.

Additionally, none of the leading real-time payment systems globally have built their success on recurring payment mechanisms. The closest equivalent is perhaps UPI’s Autopay, launched in 2020. Autopay adoption is growing strongly but it accounts for just 175m payments per month8, or 0.01% of UPI volumes. In Brazil, the Pix Automático recurring payment service was launched only in June this year as an add-on feature to enhance the Pix real-time payment system.

VRPs may eventually move the needle on UK open banking payments but evidence from round the world indicates that they are unlikely to do so soon, especially since the initial VRP focus in the UK is for low-risk utility bills, a payment problem that was solved decades ago by direct debits.

A more elegant solution for the National Payments Vision, which removes the need to hold customer funds is an equivalent to Brazil’s JSR - Jornada Sem Redirecionamento or non-redirect journey9. JSR is an open finance directive published in August 2024 by the Brazil Central Bank (BCB) to allow payments to be initiated from a third-party app without redirection to a bank. Instead, a user links their bank account to a third-party app using their Pix key (an address held on a directory managed by BCB) with embedded authentication to initiate payments.

The first propositions started using JSR in February this year, such as PagBrasil’s 1-Clix-Pix payments service10. In the 24-week period from the end of February 2025 to mid-August 2025, payment initiation API calls are up over five times the same period last year, averaging over 15m API calls per week compared to 3m API calls per week (footnote 3). Non-redirect JSR payments look like they are making a big impact.

It strikes me this is exactly what the UK needs, let’s hope the Treasury has considered something similar to JSR for the National Payments Vision when more details emerge later this year.

Conclusion

Adoption of open banking in the UK may be increasing but the rate of payments volume growth is slowing down. On current trends, open banking will still account for less than 20% of all UK real-time payments in five years’ time, which themselves are low volume compared to other countries.

For open banking in the UK to flourish and to benefit consumers and retailers with a better alternative to cards, it needs to power digital wallets with initiation of real-time payments at point-of-sale, in-person (micro-vendors) and online. VRPs may be one way to enable this but a non-redirect journey like JSR in Brazil is probably better.

Either way, the long-established UK banks are unlikely to take much action to grow open banking, they depend too much on cards. Instead, for the path of sustained growth shown in Figures 1 and 2 to be realised, it requires easy-to-use digital wallets using open banking payment initiation provided by Fintechs.

The future of UK payments is dependent on them.

the data and forecasts presented here are based on the statistics provided by Open Banking Limited https://www.openbanking.org.uk/api-performance/. These are collected only for the CMA 9 banks, representing perhaps 95% of all UK payments, but exclude data from the non-CMA 9 banks. Therefore, strictly my forecasts are for the CMA 9. Also, they assume all payments are initiated through FPS.

Brazil Open Finance API calls: https://dashboard.openfinancebrasil.org.br/open-data/api-requests/evolution

using RBI Payment System Indicator statistics for July 2025, combining UPI and IMPS for instant payments https://rbi.org.in/scripts/PSIUserView.aspx?Id=50

open banking value chains article: https://open.substack.com/pub/jeremylight/p/behind-the-wallet?r=axqgy&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

National Payments Vision: https://www.gov.uk/government/publications/national-payments-vision/national-payments-vision

PagBrasil 1-Click-Pix: https://www.pagbrasil.com/blog/pix/1-click-pix-what-it-is-how-it-works/