Payments For A Future Generation

Tokenising credit as an alternative to stablecoins or tokenising deposits

Coverage of stablecoins and tokenised deposits in the media among journalists, academics and practitioners is heating up, driven by increasing usage and spurred on by the STABLE and GENIUS Acts1 being formulated in the USA for stablecoin regulation. For example, recently articles and letters in the Financial Times2 have debated among other things whether stablecoins are bank deposits or stablecoin issuers are banks.

As often happens, this debate and analysis have lost sight of how money is created, instead assuming it is just there, ready to be tokenised digitally. This is a mistake, as going back to basics reveals a better alternative to tokenised deposits and maybe stablecoins too – tokenised commercial bank credit.

In this article, for context I summarise how commercial bank money is created and used in payments. I look at the status of stablecoins and tokenised deposits and I propose tokenised commercial bank credit as a safer, more efficient and elegant alternative.

Money Creation

A commonly-held view is banks attract deposits to lend them out, creating loans, whereas the reverse is true. Loans are created (from nothing) by banks and deposited into the borrowers’ bank accounts, from which the funds are used in payments.

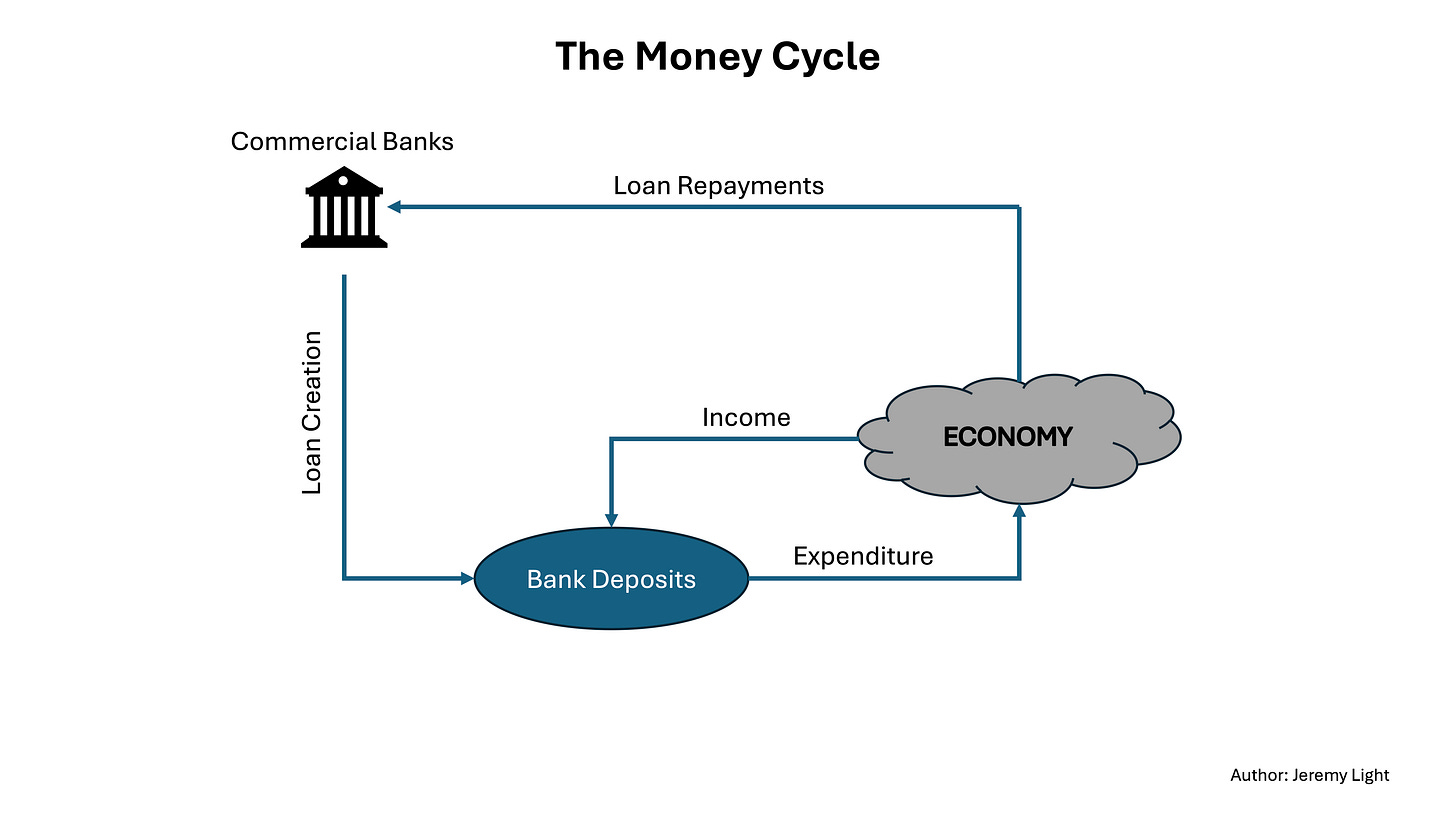

The Money Cycle in Figure 1 shows the process. Bank deposits are the result of loan creation and circulate in the economy through payments, both as income and expenditure. As individuals and businesses accumulate bank deposits through their productive activities, they are able to pay off any loans they have over time, completing the cycle, which then repeats on a continual basis.

Figure 1 – The cycle of money creation, circulation (payments) and retirement

It is counterintuitive and odd to believe that the money in your bank account, even if you have never had an overdraft, was borrowed into existence originally by someone else or by a company.

However, if in doubt about this, visit the Bank of England website for a great video and paper explaining money creation3.

Payments

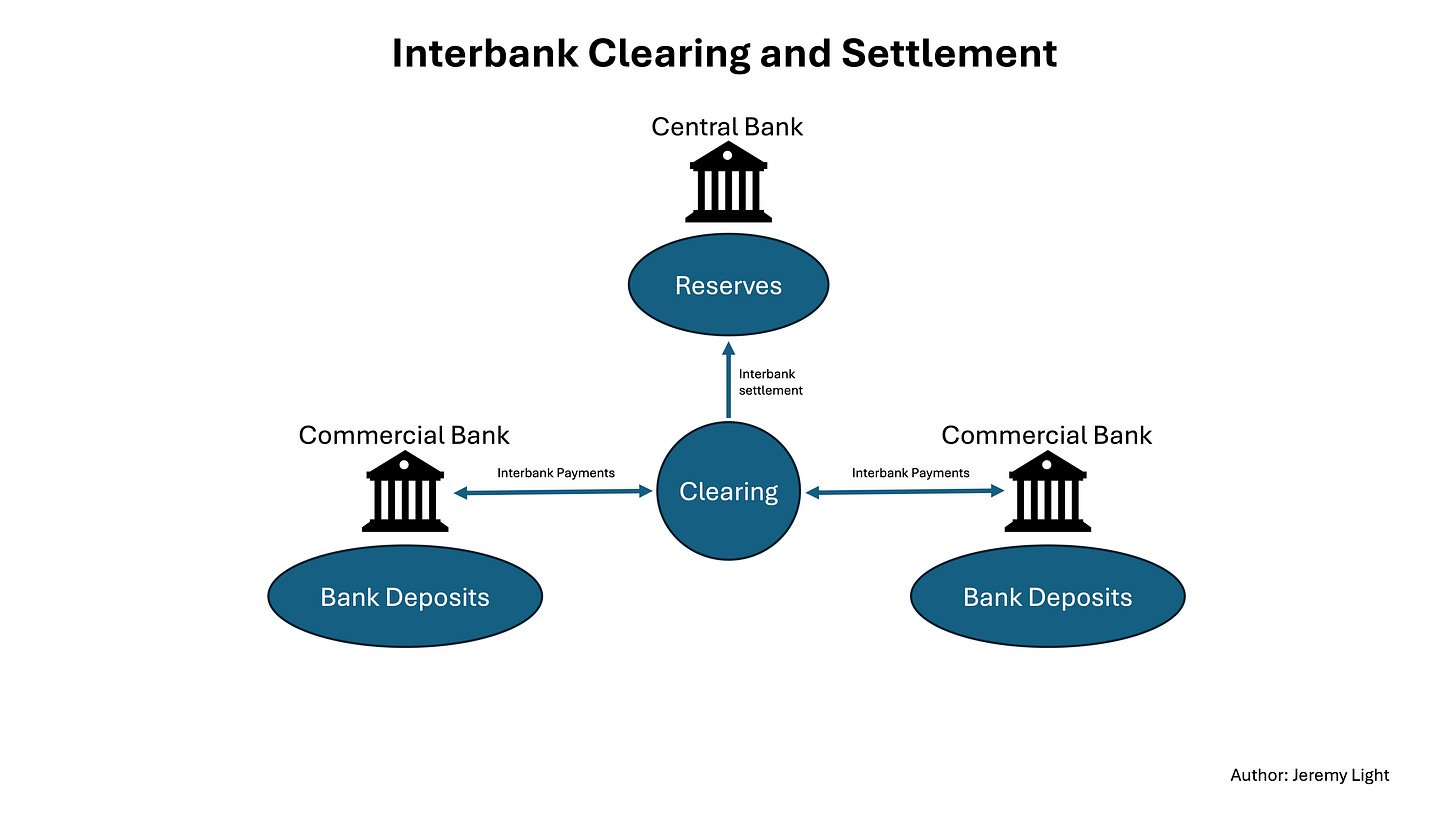

Although banks create their own loans, the resulting deposits are fungible and exchangeable between banks, traditionally through a central clearing system. See Figure 2 and also a previous article4 which explains clearing and settlement.

Figure 2 – Traditional interbank clearing and settlement for payments

Clearing causes imbalances between banks, where a bank may owe money to, or be owed money by other banks. These imbalances are settled at the central bank through reserve accounts held there by the commercial banks. Imbalances are a feature of payment systems today and a source of risk. Their settlement is an operational and liquidity overhead, which as we will see later, can be eliminated.

Stablecoins

In January, I reported5 that $200bn was transacted in December 2024 in low value stablecoin payments, using data from Orbital6. The same source shows $247bn transacted in May 2025. This is still only 8% of the total $3trn stablecoin transactions that month7 but shows stablecoin payments outside of crypto trading as an alternative to traditional payment methods are increasing, as shown in Figure 2, although still tiny in comparison.

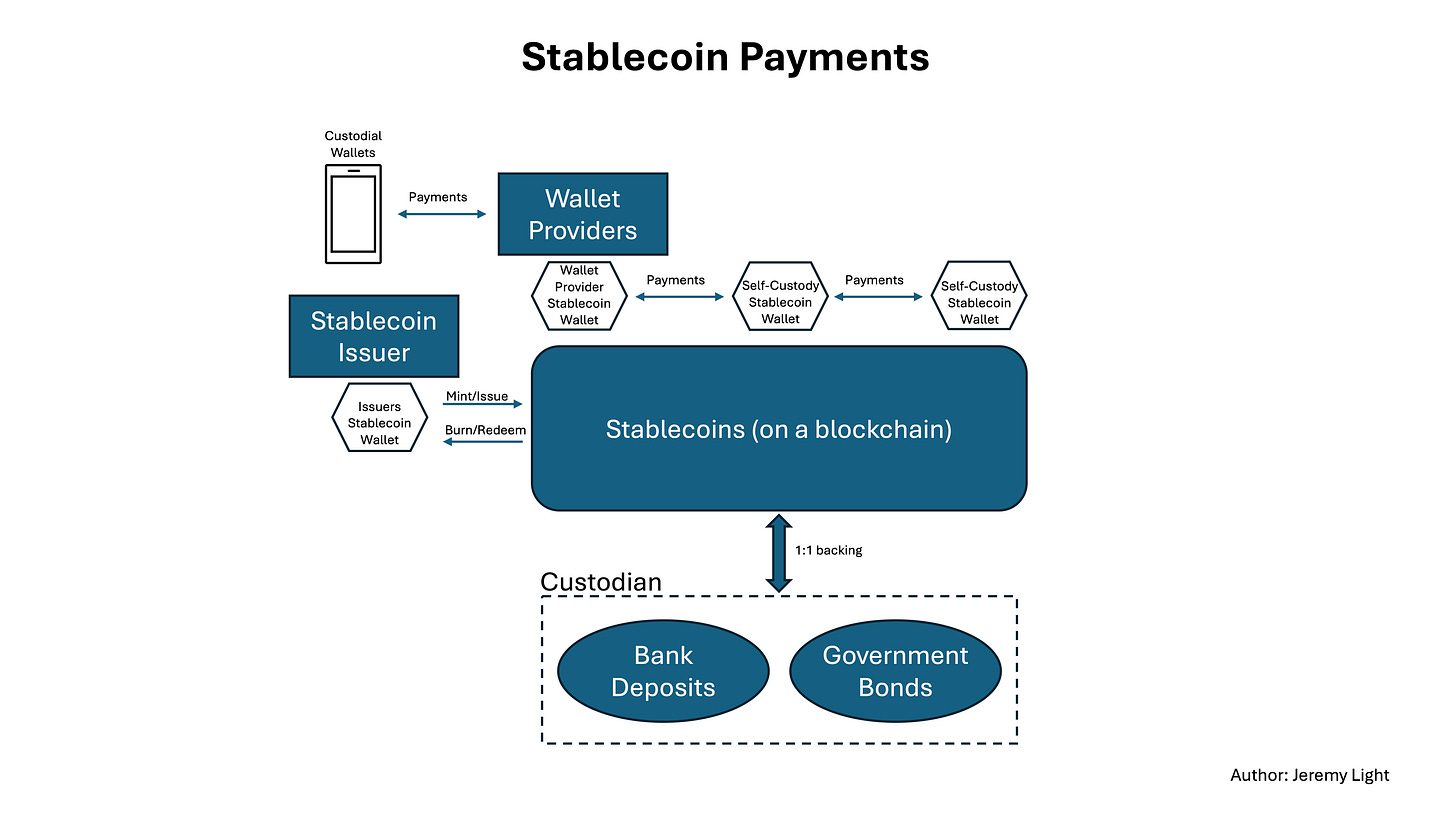

Stablecoins (fiat) are backed 1:1 typically by a mixture of bank deposits and short-term government bonds, as shown in Figure 3. As such, stablecoins are a derivative of deposits and bonds. Commercial bank deposits are integral to stablecoins – they are needed to buy stablecoins and then to back them, or to buy government bonds to back them.

Figure 3 – The cycle of stablecoin issuance, circulation (payments) and redemption

Stablecoins are ideal for cross-border payments in USD (which is used typically in each leg of a FX transaction), making it easy and fast to receive USD payments anywhere in the world without having a USD bank account.

Stablecoins have richer programmability than centrally cleared payments. As automated business models requiring programmable payments such as agentic commerce emerge, stablecoin usage is likely to take off in parallel.

A key challenge to be resolved in stablecoins is interoperability between different types and between different blockchains, while keeping it invisible from the user. Currently, if USDC for example, is sent to a USDT wallet, or if USDT on one blockchain is sent to a USDT wallet on another blockchain, the funds are typically lost. With stablecoin issuers and blockchains proliferating, this is a critical issue.

Another challenge is the dynamics of backing stablecoins with government bonds. It generates huge seigniorage profits for issuers at the expense of taxpayers, introduces the risk of de-pegging, as seen with USDC in 20238 and brings government bonds into the money supply with unknown consequences. In the USA, government interest in stablecoins through the proposed STABLE and GENIUS Acts seems more about creating demand for Treasury Bills than a desire to improve the US payments landscape.

Tokenised Bank Deposits

Tokenised deposits, a bank-alternative to stablecoins are also getting traction, with JP Morgan stating9 it processes more than $2bn per day through its internal Kinexys (formerly JPM Coin) platform. Citi also uses tokenised deposits for its customers using Citi Token Services.

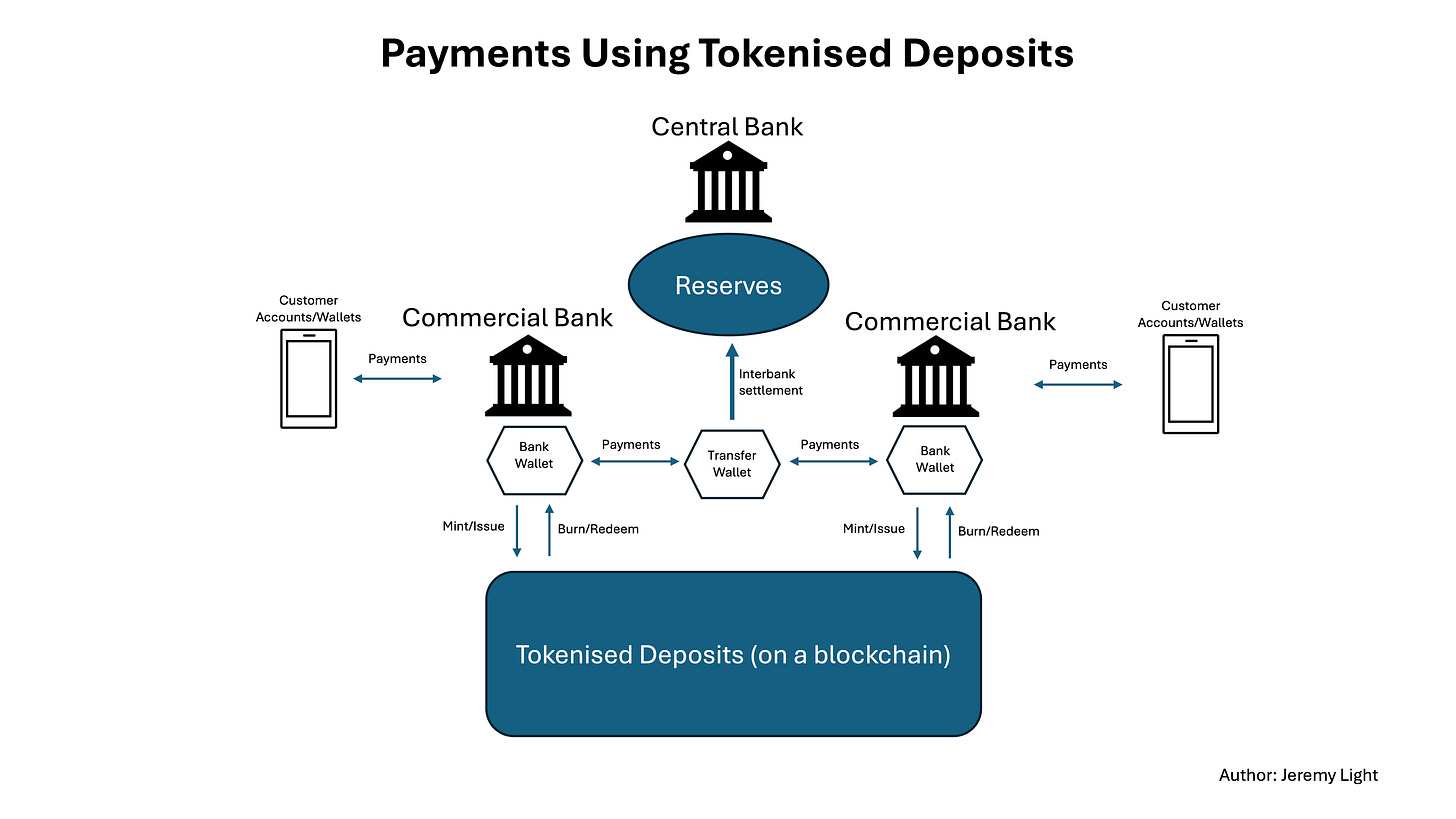

Tokenising deposits on a blockchain within a bank for its own customers is straightforward but payments between banks using tokenised deposits is difficult. It requires all banks to be on the same ledger or an interoperability mechanism to be in place.

Figure 4 illustrates how interbank interoperability might work, based on the German Commercial Bank Money Token (CBMT) proof of concept10. In this model, all banks are on the same blockchain and issue the same deposit token which is tagged to identify the issuing bank (coloured tokens in CBMT). Payments between wallets are sent first to a transfer wallet which checks if the recipient is at the same bank. If so, the token is credited to the recipient’s bank wallet. If different, the token is held in the transfer wallet and the receiving bank issues a token to credit the receiver. The token in the transfer wallet is burned when the sending bank settles with the receiving bank at the central bank using reserves.

Figure 4 – The cycle of tokenised deposit issuance, circulation (payments), settlement and retirement

Fungibility and interoperability of deposits tokenised by different banks are complicated. In addition to CBMT, there are other examples such as the USDF consortium11 in the USA and those which accommodate all forms of digital asset including CBDCs on the same ledger – specifically, the Unified Digital Payments Network, the BIS Unified Ledger and the Regulated Liability Network12.

These tend to be difficult to understand and their complexity will be a barrier to adoption. In my view, they seem to be trying to replicate current clearing and settlement processes on a blockchain, preserving the use of central bank reserves, rather than optimising blockchain capabilities.

Tokenised Commercial Bank Credit

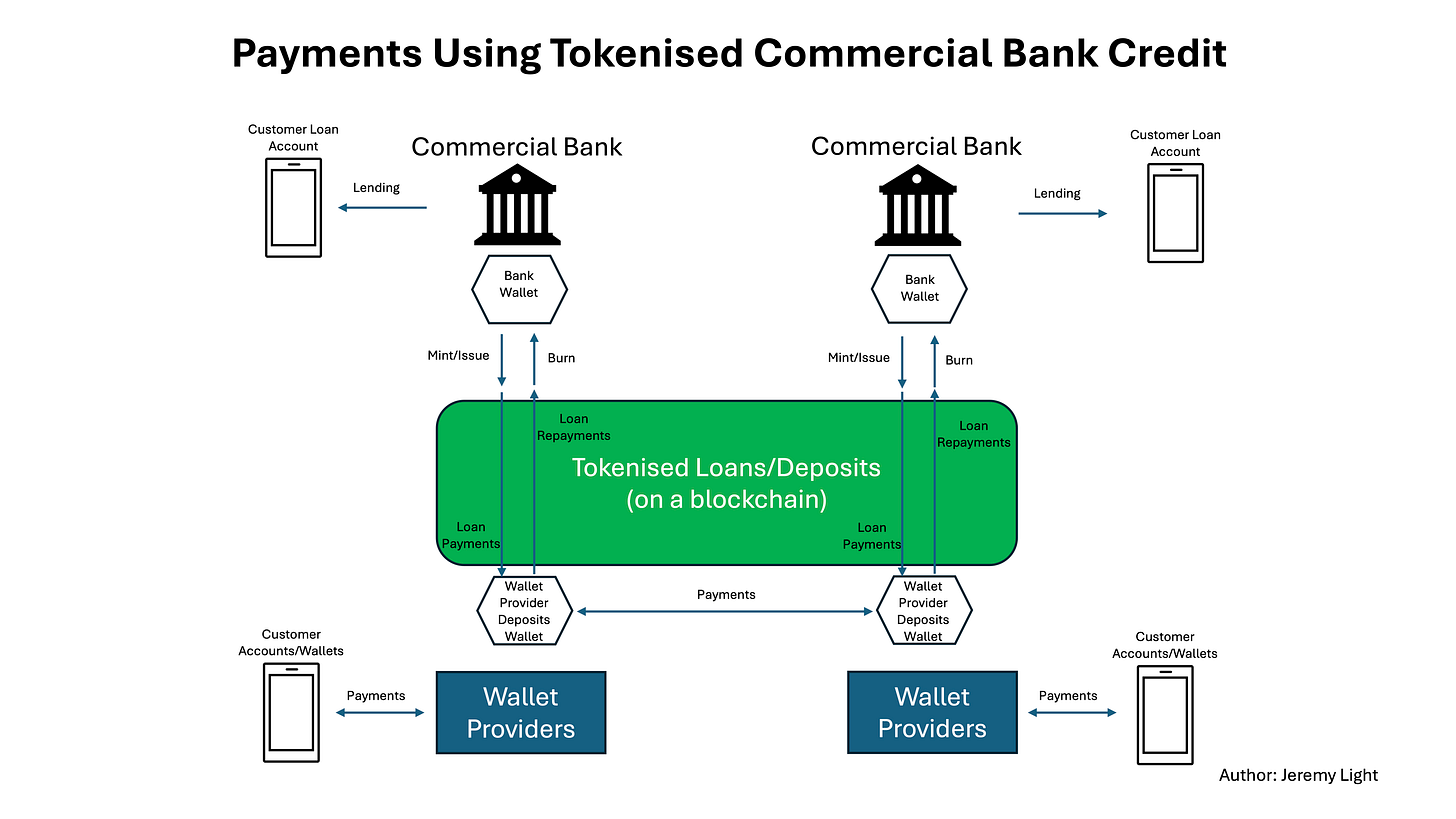

My alternative proposal is to use a blockchain to match the process in the money cycle in Figure 1 by tokenising commercial bank credit.

Commercial banks have wallets on the same blockchain and issue tokens on it to the value of each loan they make. The loans are credited to the borrower for use in payments. Consumers and business have wallets to make payments over the blockchain. Loans are repaid by the borrower by sending tokens to their lender, who burns them to extinguish the loan.

The process is shown in Figure 5 (assuming non-custodial wallets for customers but self-custody wallets are feasible).

Figure 5 – A self-contained, credit-backed token system for payments

Key points to note with this model are:

- No central bank or central bank reserves are required as no imbalances build up between commercial banks. No interbank lending is required and there is no interbank credit risk

- Tokens are created only via lending (none via deposit-taking or asset backing)

- It works as a payment system because it preserves today’s situation where all commercial bank money is credit and used in 95%+ of all transactions

- Tokens are destroyed (burned) upon loan repayment

- Interest on loans is determined by market forces without central bank influence

- Only borrowers need a banking relationship

- Deposit account holders and savers access the blockchain through wallets from non-bank wallet providers (banks may also be wallet providers)

- Although tokens issued by different banks are comingled on the blockchain, there is no mutualisation of credit risk. Banks may issue loans with different risk profiles, but the credit risk is only between them and their borrowers (unlike the current system)

- Should a loan default, the bank originating the loan burns its own tokens to extinguish it, hitting profits. Should a bank become insolvent, the tokens of its defaulted loans remain in circulation on the blockchain, keeping the supply of tokens at a heightened level, causing inflation rather than systemic insolvency (unlike the current system which can cause both)

- Banks have no need to attract depositors but a market-based finance sector would develop where non-bank lenders offer lending and saving products.

Conclusion

The use of digital assets for regular payments is gaining momentum, specifically stablecoins and tokenised deposits.

Both digital assets have challenges that need to be resolved before mass adoption is possible, especially around interoperability. Additionally, tokenised deposit models which preserve the role of central banks in settling payments are complex and convoluted.

An approach that aligns with the money cycle where digital asset tokens are issued as loans is a simpler, better alternative to tokenised deposits and probably better than stablecoins. Such a self-contained, credit-backed token system is coherent, internally consistent and efficient. It is an elegant alternative monetary construct as well as a resilient payment system.

Central banks of course will loathe such a system as their role in settling payments disappears and the role of commercial bank in deposit taking changes. They are unlikely to champion it despite its benefits. Additionally, it exposes the flaws and contradictions in retail CBDCs that many central banks are exploring.

However, whatever the pros and cons of tokenising commercial bank credit, the brief analysis presented here and the general discourse in banking and payment circles on stablecoins and tokenised deposits show there is a long way to go and much to be resolved and considered before digital assets have a major role in high volume regular payments.

the STABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy Act of 2025, in the House) and the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025, in the Senate).

Financial Times, recent articles and letters on stablecoins (paywall):

https://www.ft.com/content/625f9f0e-0144-4bc4-99e2-571ab64ccbe9

https://www.ft.com/content/504d88d5-a14a-4f53-b275-ee57aad55348

https://www.ft.com/content/321321b3-55ab-4152-88dd-bee3d41b5b6a

https://www.ft.com/content/212f6edb-e7d4-41d3-b7b4-6b3910a6ae2f

Bank of England on money creation: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Clearing and settlement article: https://jeremylight.substack.com/p/you-oughta-know

Stablecoin article: https://jeremylight.substack.com/p/stablecoin-to-heaven

Coinmarketcap.com daily reads for May

Commercial Bank Money Token: https://die-dk.de/media/files/240716_DKBDI_position_CBMT_final.pdf

Unified Digital Payments Network: https://www.udpn.io/home/io

The BIS Unified Ledger: https://www.bis.org/publ/arpdf/ar2023e3.htm

The Regulated Liability Network: https://regulatedliabilitynetwork.org/

The UK Finance Regulated Liability Network: https://www.ukfinance.org.uk/regulated-liability-network

Hi Jeremy, thank you describing an alternative model which solves many issues. Stablecoins bridge between the blockchain infrastructure and traditional finance, but bridges always lead to congestion. As we already see with liquidity issue.

The coloured money model is again inefficient.

Your model is what I usually describe as "all my money sits on the blockchain in my wallet. I lend my money to a commercial bank for yield and vice versa. But my money (meaning my tokenised deposits) are freely interchangeable and fungible. Or simply said: we just move the worldwide deposit and payment infrastructure onto blockchains. Why do we need any central ledgers anymore?

If given the choice between holding a token backed by the central bank or a token backed by the fractional reserves of a commercial bank, surely people would choose the central bank version.