The US economy is enormous and so are the volume and value of payments. Given the scale, it can be difficult to visualise the payments landscape in the USA. This article helps bring a perspective on its size and shape.

Overall, in the USA I estimate there were 271bn payments in 2023, totalling $1,677trn.

These figures mix high volume, low value payments and very low volume, very high value payments – Table 1 provides more clarity by separating payments into the three categories shown.

The sources of data and the assumptions behind them are listed in footnote 11. The US payments market is more competitive, hence more fragmented and distributed than other markets, with multiple sources of data of varying quality, transparency and recency. Please look at the analysis method in footnote 1 closely to understand the accuracy and limitations of the data and how the table is constructed.

Table 1 – Payment methods in the USA, volumes and values – 2023 (see footnote 1 for sources and assumptions)

Cash, Cards and Real Time Payments

The majority of US payments, 231bn transactions or 85% by volume are made using cards, cash and real-time payments.

For this article, I have assumed that real-time payments are made mainly through PayPal (including Venmo), Zelle2 (a real-time payment network connecting around 2,000 different banking apps in the USA) and The Clearing House’s Real Time Payment (TCH RTP) service which reaches 65% of direct deposit accounts3.

The FedNow real-time payments system launched last year but no figures are published and volumes in its early years are likely to be very low compared to those shown in Table 1. There are other real-time payment mechanisms including, I believe bilateral connections between banks, but no information is available on these and I doubt the volumes are significant.

Table 1 has no separate figures for Buy Now Pay Later (BNPL). BNPL is more an installment service for POS loans than a payment method. The installments are likely to be paid by debit card, check, PayPal/Venmo, Zelle or ACH payment so will be embedded in the figures anyway. The BNPL market in the USA is around $36bn4 which is just 0.6% of the value of the credit card market.

Figure 1 shows how the 2023 payment volumes for cash, cards and real-time payments compare. Card usage (debit card and credit card) dominates, with three times the volume of cash and nine times the (combined) volumes of real-time payments.

Figure 1 – Cash, Cards and Real Time Payments Volume in the USA 2023

Figure 2 shows how the value of payments in 2023 for the category compare. Again, card usage (debit card and credit card) dominates, transacting seven times the value of cash and six times the (combined) values of real-time payments.

Cash is declining at a strong rate, with all other methods showing growth. However, overall, there was no change in the total volume of payments across all these payment methods.

Figure 2 – Cash, Cards and Real Time Payments Value in the USA 2023

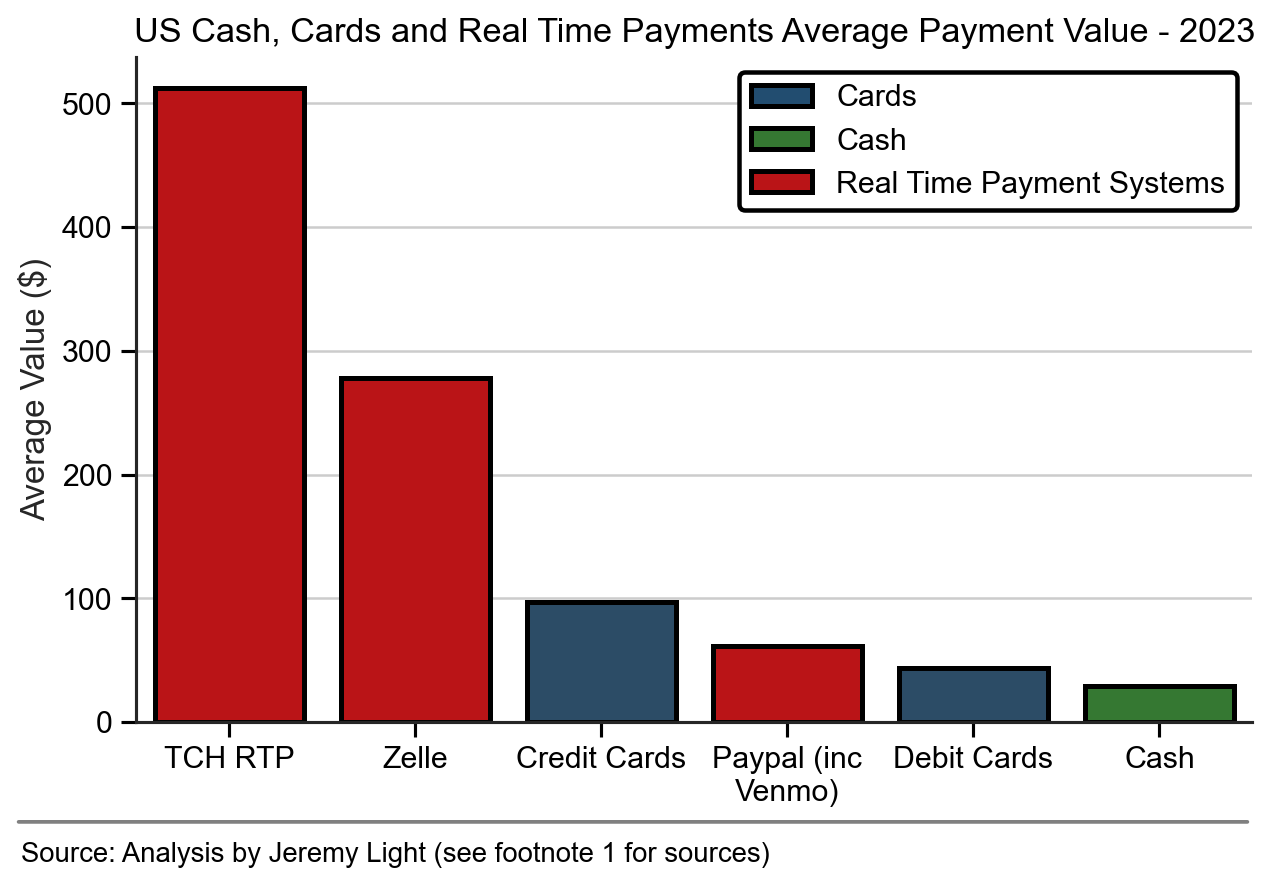

Figure 3 shows the average payment values. TCH RTP and Zelle have much higher average payment values than the rest, indicating they are used more for paying bills (rent, utilities etc) whereas the other methods are used mainly for in-store purchases and ecommerce.

As shown in the previous figures, TCH RTP and Zelle are growing at the fastest rates, up respectively 65% and 28% in 2023 by value, most likely due to substitution of checks when paying bills.

Figure 3 – US Cash, Cards and Real Time Payments Average Payment Value 2023

ACH and Check Payments

ACH payments are same day, next day or two-day payments processed in batch, through the ACH Network connecting all banks and credit unions (around 8,000 in total, although up-to-date figures are difficult to find). The ACH Network is open for processing 23¼ hours every business day, settling payments four times a day through the Federal Reserve National Settlement System. All payments are processed by either The Clearing House’s EPN5 or the Federal Reserve FedACH6 service.

The ACH Network is overseen by the Nacha association which sets the rules. The two payment types supported are ACH Debits - pull payments used for example in billing; and ACH Credits - push payments used for example for payroll.

Since at least 2014, ACH payments have grown steadily every year, increasing 72% by volume and 100% by value between 2014 and 2023.7

In 2016, Nacha introduced same (banking) day payments which are growing at a much faster rate than other ACH payments, up 22% by volume and 41% by value in 2023. However, the volumes and values were only 3% of the ACH payment totals and have a long way to go before they become mainstream.

Checks are still common in the USA. Although they are in a long-term decline, falling 7% by volume and 6% by value in 2023, the volumes are significant at around 25% those of ACH payments by volume and value. As checks decline, this helps fuel the growth of the other payment mechanisms.

High Value Payments

The USA has two systems for processing very high value payments (in the $millions), the Federal Reserve’s Fedwire and The Clearing House’s CHIPS. Fedwire is a traditional RTGS system with an average payment value of almost $6m, whereas CHIPS combines net and real-time settlement on a continual intraday basis to optimise liquidity, with an average payment value of around $3m.

On business days, Fedwire operates 22 hours a day and CHIPS 21 hours a day. Fedwire is the larger of the two, processing 2.5x CHIPS’ annual payment value in 2023.

For completeness, Table 1 includes the Federal Reserve’s National Settlement Service, although this is used only for settling obligations between banks, rather than directly for processing payments between end-users.

Market Shares

As you would expect in a large and mature economy, the payments landscape in the USA depicted here is very stable.

Very high value payments are supported by Fedwire and CHIPS and have been for decades - this works well and looks set to continue.

Table 2 – US payment methods market share (excludes very high value payments)

For the remaining payments, Table 2 shows the market shares of each payment method.

ACH payments have been available for decades and account for 12% of all payments by volume and 70% by value (excluding the very high value payments). They are growing gradually, 5% last year, as payments transition away from checks. Check volumes are still substantial, with an 18% share by value (excluding the very high value payments), but 3% by volume.

The retailing side of payments is dominated by cards, with a share of 60% by volume and 9% by value. Although in decline, cash is also used extensively for very low value payments, a 19% share by volume but only 1% by value.

Cards hold a fortress-like position in the USA. Their closest competitors are the real-time payment systems led by PayPal (including Venmo), but even after 25 years of operation, PayPal in the USA is still only 1/12 the size of cards by volume and 1/9 by value.

The Future of US Payments

As evidenced by their higher growth rates, the real-time payment systems domain is where innovation and change are happening. However, taking share off cards has proved to be a very difficult challenge. This leaves cash displacement and check displacement, together with digital wallets embedded in digital services as the drivers of growth - with the USA’s version of open banking8 and stablecoins adding impetus.

Even so, given its sheer size and stability, it could take at least another decade before substantial change in the make up of the US payments landscape becomes apparent.

data sources and assumptions used to construct Table 1

i). Cards: the Federal Reserve’s payments study provides US debit and credit card data up to 2022: https://www.federalreserve.gov/paymentsystems/fr-payments-study.htm. Table 1 calculates volume and value data for 2023 by applying 2023 growth rates to the 2022 data from Mastercard’s US cards business (assumed to be representative of card growth rates across the USA) : https://s25.q4cdn.com/479285134/files/doc_financials/2024/q1/1Q24-Mastercard-Supplemental-Operational-Performance-Data.pdf

Values extracted from this report are 4.2% volume growth and 3.1% value growth for debit cards and 9.5% volume growth and 8.5% value growth for credit cards.

ii). Cash: the Federal Reserve’s Diary of Consumer Choice report 2024 finds (p4) that cash transactions were half debit card transactions in their survey, therefore cash volume is assumed half debit card volume. https://www.frbservices.org/binaries/content/assets/crsocms/news/research/2024-diary-of-consumer-payment-choice.pdf. The value of cash transactions is calculated from the volume figure assuming a $29 average cash payment (the same method is applied to 2022 to calculate YoY decline).

iii). ACH Payments: https://www.nacha.org/content/ach-network-volume-and-value-statistics

iv). PayPal: 2024 annual report, p.4 for global volume/value metrics, p76 for US share (58%) of global revenue (Table 1 assumes volume/value share is the same). The figures may include card txns, but Table 1 assumes they are all real-time payments between PayPal accounts https://s201.q4cdn.com/231198771/files/doc_financials/2024/ar/PayPal-Holdings-Inc-Combined-2024-Proxy-Statement-and-2023-Annual-Report.pdf

v). Zelle: press release 4 Mar 24: https://www.zellepay.com/press-releases/zelle-soars-806-billion-transaction-volume-28-prior-year

vi). TCH RTP: https://www.theclearinghouse.org/payment-systems/rtp

vii). Checks: FedACH data https://www.federalreserve.gov/paymentsystems/check_commcheckcolqtr.htm Table 1 assumes FedACH processes 40% of all US check volume (EPN 40%, others 20%)

viii). Fedwire: https://www.frbservices.org/resources/financial-services/wires/volume-value-stats/annual-stats.html

x). National Settlement Service: https://www.frbservices.org/resources/financial-services/national-settlement-service/volume-value-stats/annual-stats.html

Zelle is operated by Early Warning Services LLC, a US fintech owned by Bank of America, Capital One, JPMorgan Chase, PNC Bank, Truist, U.S. Bank and Wells Fargo. Early Warning Services also runs the Paze digital wallet launched in 2024, which combines debit and credit cards into a single wallet, designed to compete with Apple Pay, PayPal etc.

The Clearing House RTP: https://www.theclearinghouse.org/payment-systems/rtp/institution

US BNPL: https://www.custommarketinsights.com/report/us-buy-now-pay-later-market/

The Clearing House EPN: https://www.theclearinghouse.org/payment-systems/ACH

FedACH: https://www.frbservices.org/financial-services/ach

Nacha statistics: https://www.nacha.org/content/ach-network-volume-and-value-statistics

CFPB open banking: https://www.consumerfinance.gov/about-us/newsroom/cfpb-finalizes-personal-financial-data-rights-rule-to-boost-competition-protect-privacy-and-give-families-more-choice-in-financial-services/