Africa is on the cusp of a sea-change in payments.

In the past five years, 16 countries have implemented real-time interbank clearing systems, 11 of them in the past three years. This is in addition to the extensive mobile money services, mostly real-time, where Africa has led the world since M-PESA launched in Kenya in 2007.

Africa is up there with the best. Perhaps unnoticed, the continent stands poles apart from the laggards (Australia, Canada, much of Europe including the UK, Middle East and the USA) in real-time Account-to-Account payments (A2A - including mobile money accounts) and is on the heels of the most advanced (Asia and Latin America).

Real-Time Payments Landscape in Africa

There are four pillars to real-time payments in Africa:

1. Mobile-money services provided by telcos e.g. Safaricom M-PESA in Kenya

2. Real-time interbank clearing e.g. IPN (Instant Payment Network) in Egypt

3. Interoperable real-time interbank clearing and mobile money e.g. NIB in Nigeria

4. Cross-border real-time clearing e.g. GIMAC in the CEMAC region1

Mobile-money services have been in Africa for decades and have established a strong presence. The GSMA estimates2 that 81bn mobile money payments were made across the continent in 2024, up 22% on 2023, 74% of the global total (108bn payments), with 286m active (30-day) accounts. Telcos throughout Africa provide mobile money services together with mobile telecoms, often using feature phones (USSD technology) although now smartphones are gaining in usage.

Major telcos operating mobile money services in multiple countries are Airtel, MTN, Orange and Safaricom/Vodacom (M-PESA). These services operate more as platforms than networks where the same platform is used to provide services in multiple countries. Historically, there has been little interoperability between countries using single unified wallets i.e. where a wallet holder in one country may send/receive payments to/from a wallet holder of the same service in another country. This is changing slowly, with M-PESA and to some extent Airtel providing some cross-border interoperability.

Interbank real-time payments have been late to arrive on the continent, but many countries have implemented them in the past few years, some very recently, with more to come3.

Historically, mobile-money services have been proprietary to the telcos that provide them. Increasingly, central banks are enabling interoperability between mobile-money service providers, driven by financial inclusion objectives, through switches including the new real-time payment systems. This enables wallet-to-wallet, wallet-to-bank and bank-to-wallet payments, all real-time. This interoperability is catalysing payment volumes and adoption, for example when TIPS in Tanzania launched in 2022, mobile payments were growing at 8%, whereas last year they grew at 41% (and 30% in 2023) while the real-time interbank payments through TIPS grew 92%4 last year.

Africa also has a number of regional cross-border clearing systems5 including GIMAC (Central Africa) which provides real-time regional clearing system.

PAPSS (Pan-African Payment and Settlement System6 ) was launched in 2022 by Afreximbank in association with AfCTA7 to provide real-time cross-border payments supporting trade and economic development across all of Africa. 15 central banks, over 150 commercial banks and 14 switches throughout Africa are connected into the PAPSS network.

To complement these four pillars, there is a thriving Fintech sector in Africa especially in cross-border remittances e.g. Flutterwave, in digital payments e.g. OnAfriq and in micro-finance e.g. Moniepoint.

Table 1 lists the real-time A2A clearing systems and mobile money services, showing where there is interoperability between them, in 18 countries (out of 54, with 41 different currencies) in Africa, covering 961m people or 62% of the region’s population (1.5bn).

Table 1 – Countries with real-time clearing systems and A2A digital wallets in Africa

Table 1 shows that 16 countries in Africa operate real-time A2A payment clearing systems with at least nine connected to mobile money services. No real-time clearing system is shown for Tunisia or Uganda. However, mobile money services in these countries are interoperable – in Uganda through bilateral connections and aggregators; in Tunisia through a switch operated by La Poste postal service8.

Recently I wrote an article9 on the use of QR codes which are boosting real-time A2A digital wallet payments across the world. The use of QR codes to initiate payments in person and online is also widespread in Africa, with Ethiopia, Ghana, Kenya, Nigeria and Tanzania leading the way.

Real-Time Payments per Capita

Figure 1 shows the real-time payments per capita for 14 countries where data is available.

Figure 1 - Real-time payments per capita in Africa, including on-us bank payments, interbank payments and mobile money payments (the average is the population-weighted average for the countries shown)

Kenya had the highest usage in 2024 at 613 real-time payments per capita (mainly M-PESA, excluding cash-in/out transactions) followed by Ghana at 266 real-time payments per capita.

I will wait until next year before publishing growth rates with an update of Figure 1 but examples of the types of current growth rates are:

1. Angola: KWiK real-time interbank payments, launched in July 2023 has averaged 35% volume growth per month over the past 12 months and 25% per month over the past three months, equivalent to 145% annual growth10.

2. Ethiopia: Ethswitch, an interbank payments operator, launched real-time payments in November 2021 providing interoperability between banks, digital wallet and microfinance institutions for P2P transfers (bank-to-bank, wallet-to-bank, bank-to-wallet, wallet-to-wallet) and reported a 251% increase in P2P volumes in its FY24 (year ending 30 June 2024)11.

3. Kenya: Safaricom has reported a 30% increase in M-PESA volumes between its FY24 and FY25 (year ending 31 March 2025)12.

4. South Africa: PayShap real-time interbank payments, launched in March 2023 has averaged 19% volume growth per month over the last six months of 2024, equivalent to 671% annual growth13.

5. Tunisia has experienced a six-fold increase in mobile payment volumes in the first three months of 2025 compared to the same period in 2024 through rapid adoption of digital wallets14.

These examples illustrate the rapid and sustained growth in real-time payments being experienced across Africa and the potential for more to come.

The total real-time payment volume for the countries shown in Figure 1 for 2024 was 91bn payments, split 1bn interbank (and on-us within a bank), 90bn mobile money (including wallet-to-wallet, wallet-to-bank, bank-to-wallet) which is consistent with the GSMA data of 81bn mobile money payments (footnote 2 – my data is taken direct from central bank and payment operator websites and annual reports). M-PESA in Kenya accounts for 35bn payments15 within this total.

International Comparison

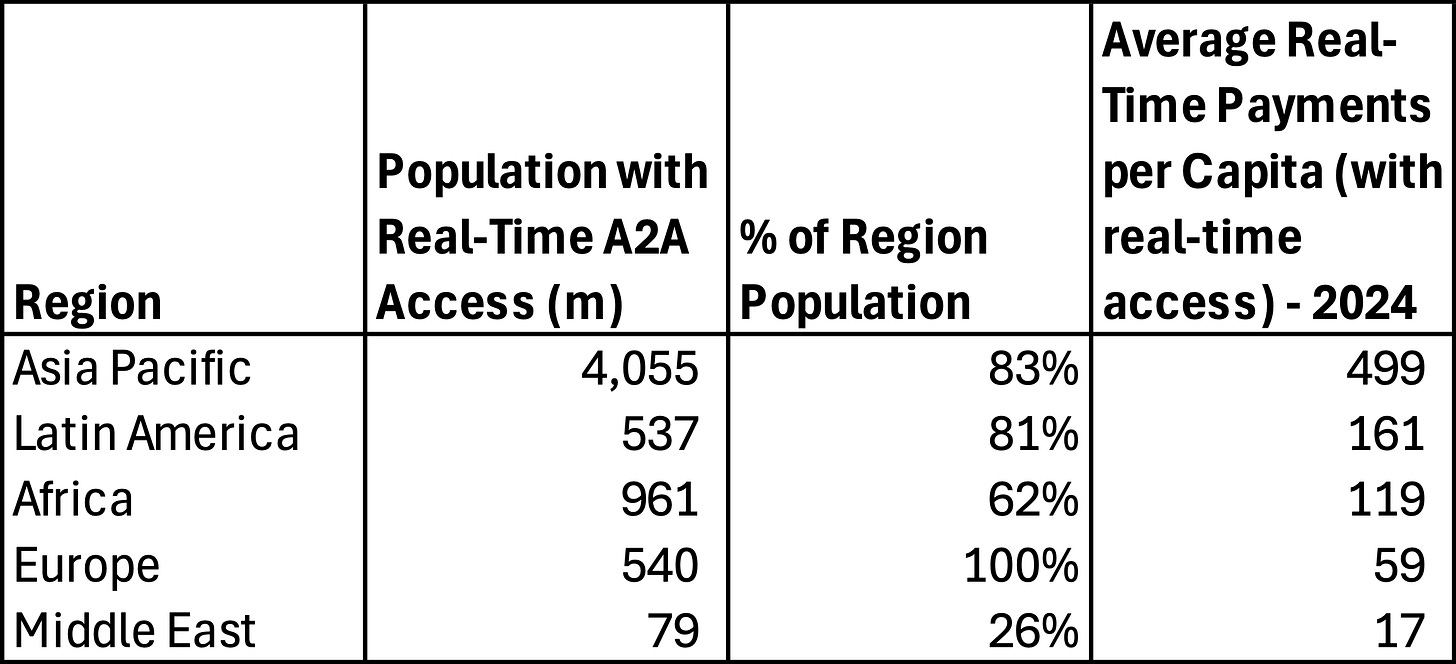

Table 2 compares the real-time payments per capita for Africa with the regions covered in previous articles. It shows that Africa is a long way ahead of Europe and the Middle East and catching up with Latin America. Even if Kenya is removed, the average for Africa is 78 real-time payments per capita, still higher than Europe and the Middle East and about the same as the UK.

Table 2 – Real-time payments per capita regional comparison (averages weighted by population for countries with a real-time payment system and/or mobile money services)

Cash Withdrawals per Capita

When analysing other regions around the world, I have used cash withdrawals per capita as a proxy for cash usage. However, as with the Middle East, data is very difficult to find for cash withdrawals in African countries and where available, figures are very low and insufficiently complete to include in the graph format I use normally.

Additionally, mobile money is used extensively in many African countries with agents for cash in/cash out payments. Where the data separates out these payments, I have subtracted them from the totals to calculate the real-time payments per capita in Figure 1. For example, the Kenyan Central Bank16 reports 2.7bn cash in/out payments in 2024 which are excluded from my figures in Figure 1.

Many countries in Africa are undoubtedly high-cash economies and it would be useful to track the decline in cash usage as real-time payments grow. However, the lack of data makes this impractical. Kenya is an exception, where cash in/out payments are 48 per capita in 2024.

Conclusion

Africa is firing on all four cylinders in real-time payments across the four pillars.

The continent is in a league of its own when it comes to real-time payments made through mobile money digital wallets provided by telcos, often using USSD on feature phones.

Recent adoption of real-time interbank clearing systems in many countries is catalysing growth in already large volumes of mobile money payments across the continent, as well as driving adoption of real-time payments with bank customers.

Access to real-time interbank clearing payment systems is being extended in some countries to mobile money operators enabling payments between operators and between operators and banks. These include Ethiopia, Nigeria, Rwanda, Tanzania and The Gambia, (although limited to P2P transfers in some cases). Given the importance of this access for interoperability and volume growth it will be interesting to see if and how this pillar expands over the next year.

With 54 countries, cross-border real-time payments interoperability in Africa is an imperative to boost trade and economic growth across the continent. PAPSS was launched to achieve these and is a key component of the African payments landscape.

When I provide an update on real-time payments per capita in Africa in a year’s time (June 2026), I expect to see strong growth in the real-time payments per capita across all the countries in Figure 1 with probably some new ones to add.

Many of the components for sustained and substantial growth are in place or being developed across Africa – the future of real-time account-to-account payments, bank and mobile money, is looking very bright.

CEMAC - The Central African Economic and Monetary Community: Cameroon, the Central African Republic, Chad, Equatorial Guinea, Gabon, and the Republic of Congo, who share a common currency, the CFA franc.

GSMA State of the Industry Report on Mobile Money 2025, p.12: https://www.gsma.com/sotir/

Very recent real-time interbank clearing systems implementations include: Eswatini – Fast Payments Module (Domestic Switch) 11 Dec 24, South Sudan – National Instant Payment System (NIPS) 7 Feb 25. In May 2024 UPI International announced in May 2024 it is helping Namibia build a UPI-like service. The Economic Community of West African States (ECOWAS) is proposing to build a real-time Payments and Settlement System (EPSS) based on a possible new currency for the region.

Bank of Tanzania data: https://www.bot.go.tz/PaymentSystem Mobile Transactions and Low Value Transactions (TIPS)

Other non-real-time regional payment systems are RTGS systems covering East Africa (EAPS), Eastern and Southern Africa (COMESA REPSS) and Southern Africa (SADC/SIRESS).

PAPSS - https://papss.com/network/ (note: I am a member of the PAPSS Management Board)

AfCTA – African Continental Free Trade Area: https://au.int/en/african-continental-free-trade-area

La Poste Tunisia: https://www.poste.tn/

Why and How QR Codes are Dominating Payment Initiation: https://jeremylight.substack.com/p/que-qr-qr-whatever-will-be-will-be?r=axqgy

Angola KWiK statistics: https://emis.ao/estatisticas/

Ethswitch Annual Report 2023-2024 p.24/25: https://ethswitch.com/wp-content/uploads/2024/11/ETS-Annual-Report-2023_2024.pdf

Safaricom FY25 investor presentation 9 May 2025, slide 34: https://www.safaricom.co.ke/images/Downloads/FY25-Investor-Presentation-9-May-2025_R.pdf

Bankserv PayShap Rapid Payments Programme: https://www.bankservafrica.com/website/services/rapid-payments-programme

Calculated for calendar year 2024 by pro-rating across Safaricom’s (year-end 31 March) FY24 and FY25 reports.

Central Bank of Kenya mobile cash in/cash out statistics: https://www.centralbank.go.ke/national-payments-system/mobile-payments/