Let Your Payment Flow

Contactless account-to-account mobile payments without opening an app

Last week I showed that the volume of payment initiation API calls in Brazil were up over five times since the launch of the JSR non-redirect APIs at the end of February this year. In this article I investigate the impact of JSR non-redirect APIs.

Their importance is considerable as, among other uses, they enable one-tap contactless (NFC) account-to-account mobile payments without opening an app. This has big implications for contactless card payments (plastic and mobile), for in-person QR code payments ubiquitous in Brazil and other countries, for competition from non-bank new entrants and for new methods such as agentic AI payments.

Non-redirect APIs

Non-redirect APIs allow a user to initiate a payment from a third-party app without redirecting to a bank app to authorise the payment. This means that once the user links their bank account to a third-party app, the third party controls the full user experience and customer journey.

In Brazil, with the mass adoption of Pix payments, until this year, there has been little need for open banking payment initiation. Although open APIs in Brazil are widely used for various financial purposes (97bn API calls in 2024), payment initiation APIs are only a tiny fraction, less than 0.2% of all open API call volumes. The proportion of Pix payments (which total about 7bn per month) initiated through these APIs is even smaller.

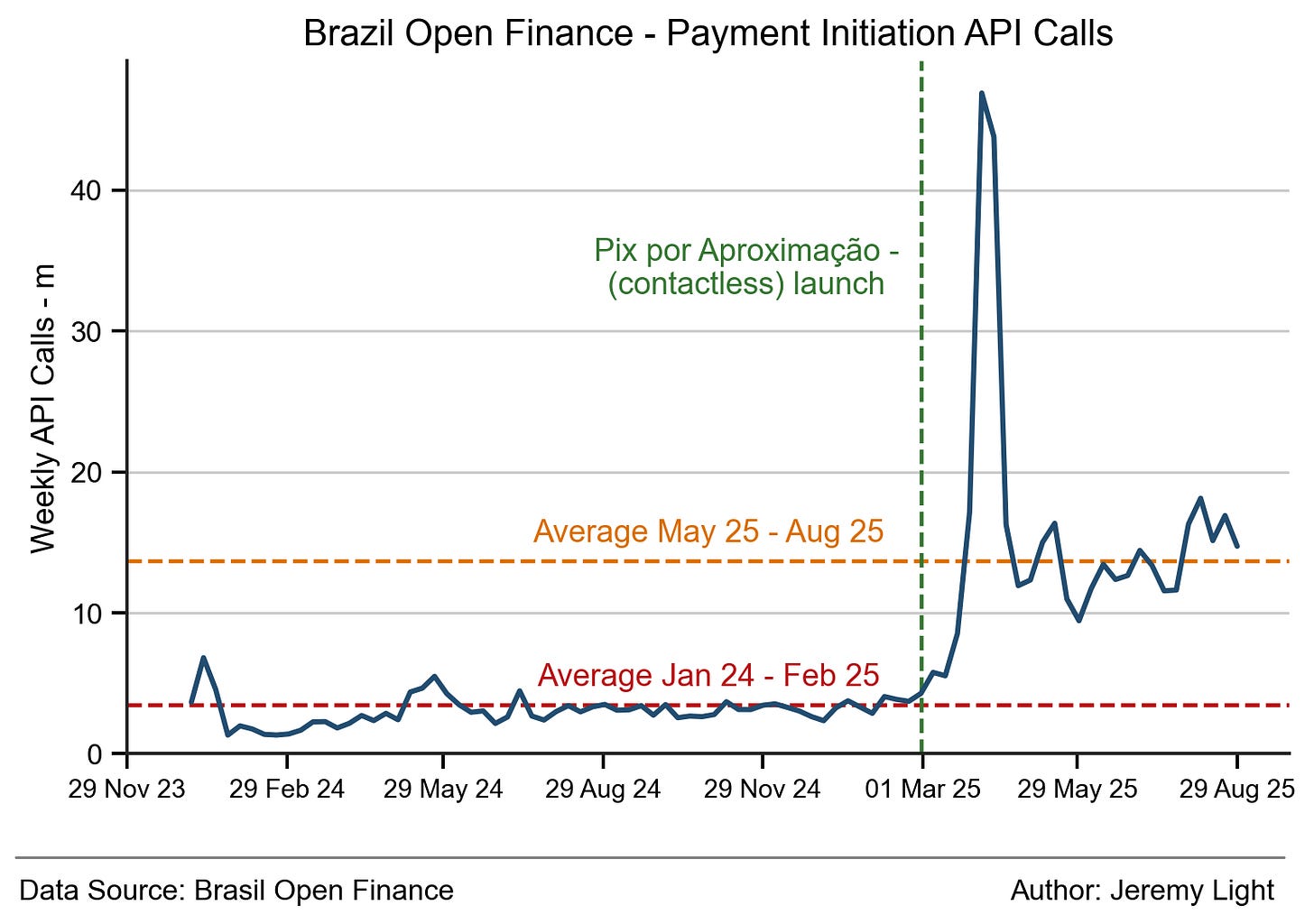

The JSR was published in August 2024 and since then Pix has launched two new services using non-redirect APIs, Pix por Aproximação (contactless) in late February 2025 and Pix Automático (recurring payments) in June 2025. As I observed last week, there was an immediate and significant rise in payment initiation API call volumes when these were launched, shown in Figure 1.

Figure 1 – Weekly Volumes of Brazil Payment Initiation API calls

In the 14 months prior to the first launch, payment initiation APIs averaged 3.5m weekly calls. Since the spike in March and April, they have averaged 13.7m weekly calls.

Payment Initiation API Categories

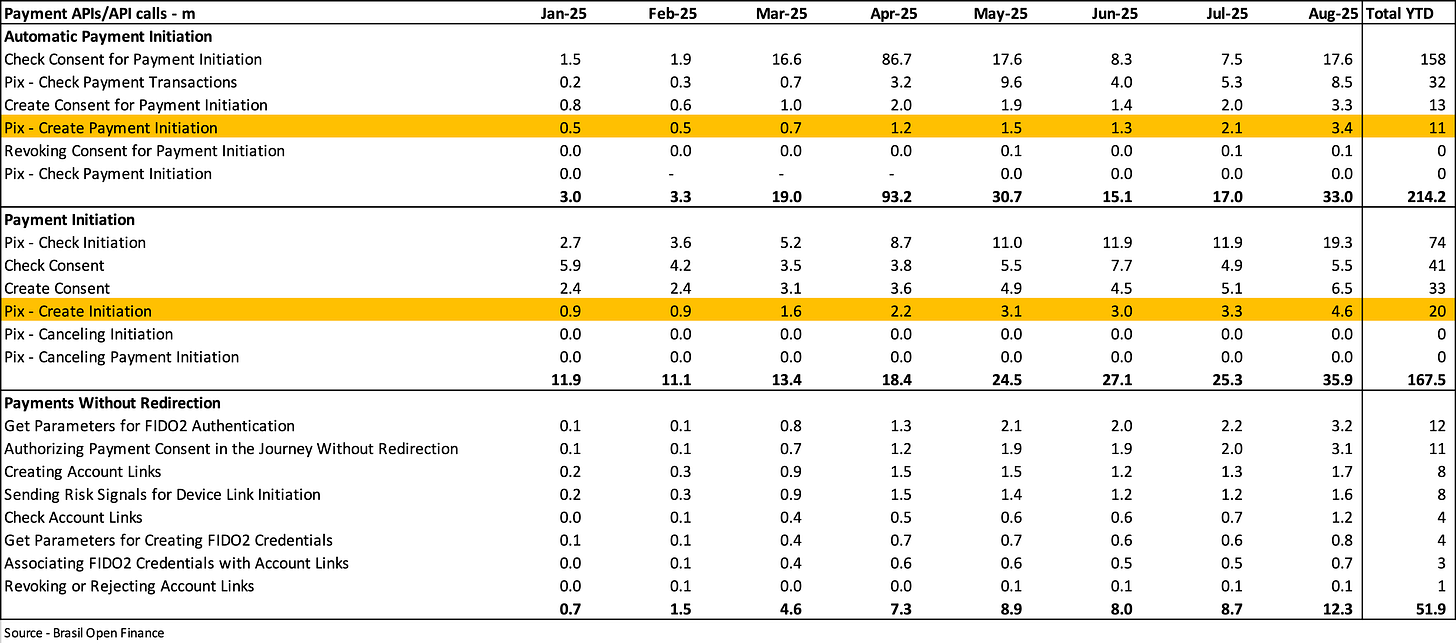

Going deeper into the data1, there are 20 payment initiation APIs in total, grouped into three API categories, shown in Table 1 together with monthly volumes so far this year:

1. Automatic Payment Initiation (new - recurring payments)

2. Payment Initiation

3. Payments Without Redirection (new - wallet enablement and bank account linking)

Payment Initiation APIs have been around since the end of 20212 but have been little-used for payments made through redirection to banks. Now, with non-redirection possible, they are used additionally for contactless payments.

The biggest contributor by far to the spike in March and April is the “Check Consent for Payment Initiation API in the Automatic Payment Initiation Category”. This looks unusual as the spike was in advance of the launch in June of Pix Automático (recurring payments) which uses it. It may have been part of a campaign to onboard customers to Pix Automático before launch but I have no evidence.

Table 1 – APIs and categories within the set of payment initiation APIs

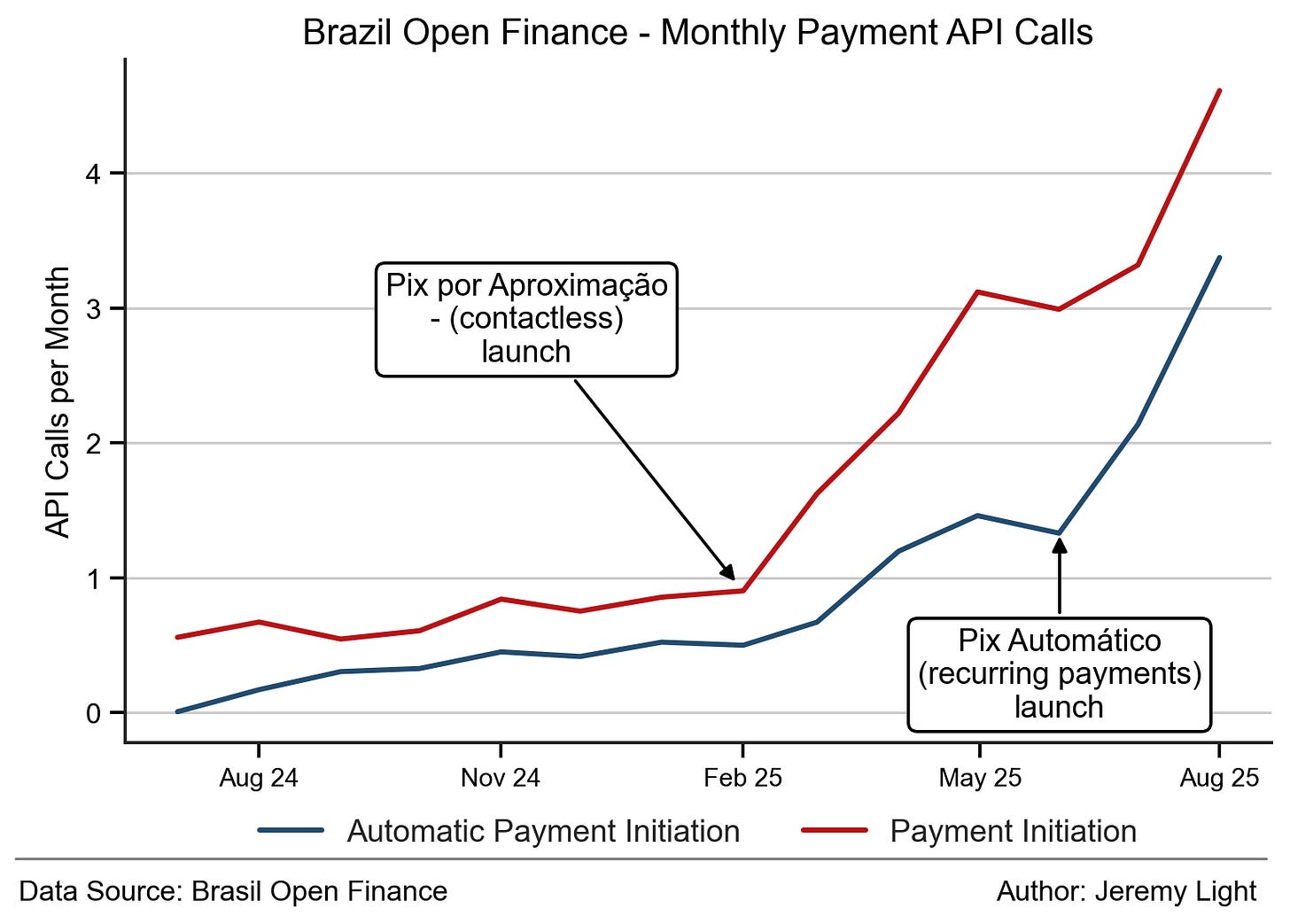

However, the volumes of the actual payment initiation APIs within the Payment Initiation and Automatic Payment Initiation categories show strong growth. These are highlighted in yellow in Table 1 going back to the start of 2025 and plotted in Figure 2, going back further to July 2024.

Figure 2 – Brazil automatic payment initiation and payment initiation API call volumes

Figure 2 shows that Payment Initiation API call volume had been flat for many months, before taking off with the Pix contactless launch in February 2025. Similarly, the Automatic Payment Initiation volume started rising rapidly after the Pix Automático launch in June 2025 (I assume the volume prior to that was due to testing, early use by control groups and onboarding before the national roll out in June).

Payment Initiating Institutions

Any third party can use these APIs (with a licence), including the non-redirect APIs, for their own propositions. These can be for contactless and recurring payments but other use cases are likely, which may also be driving volumes. For example, agentic AI commerce (too soon for mass adoption but testing and piloting could be in the numbers) or non-bank third parties issuing their own digital wallet for Pix payments for all payment types (contactless, P2P, ecommerce etc).

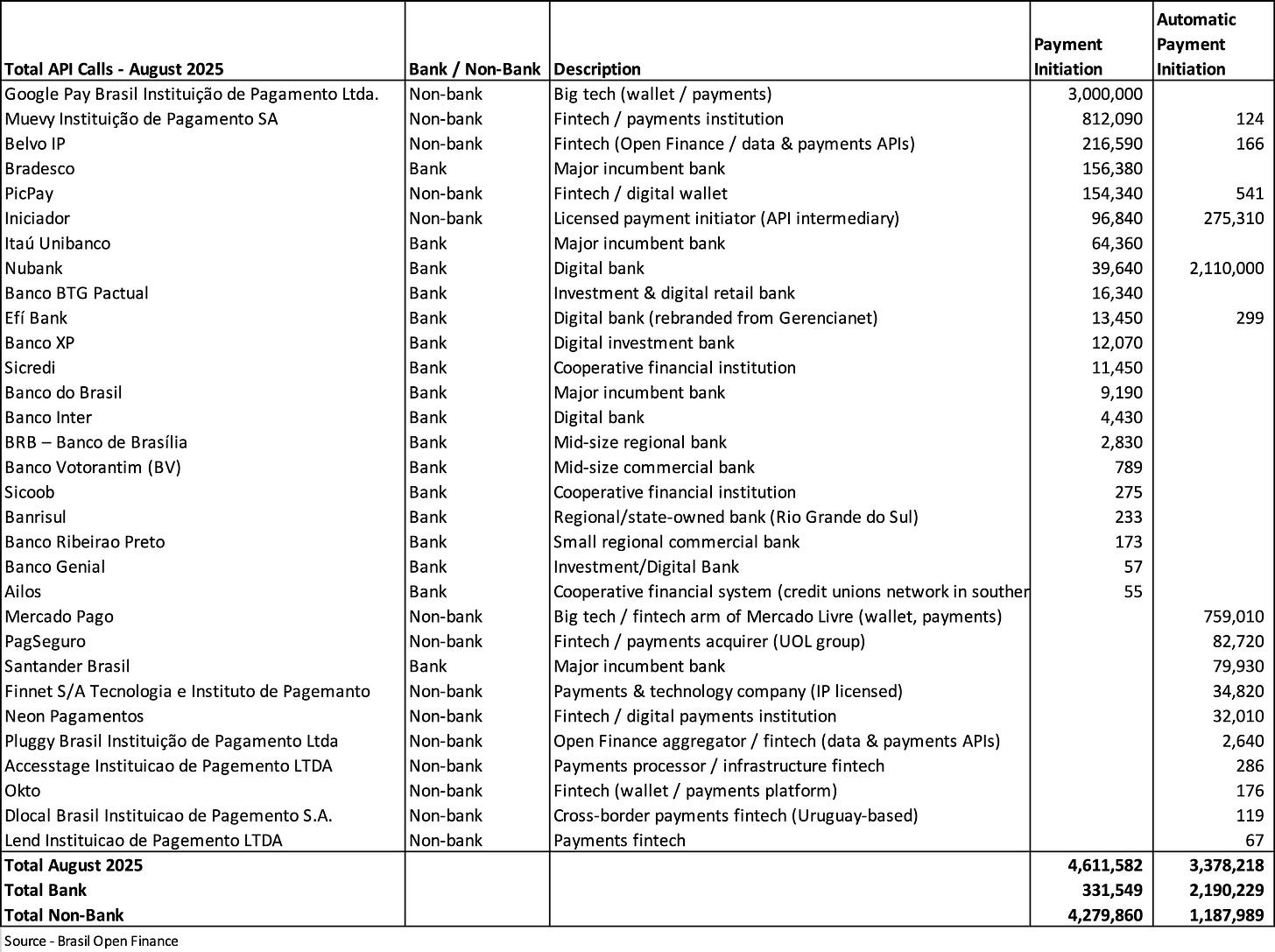

Table 2 shows there are at least 14 non-banks using these APIs, headed by Google Pay with Payment Initiation APIs. This is as to be expected, as Payment Initiation APIs have been around for a number of years and have been more useful to non-banks than banks for Pix payments. It is only now with the JSR non-redirect APIs that banks as well as non-banks can build compelling contactless and recurring payment propositions.

Google Pay accounted for 3m Payment Initiation API calls in August 2025 compared to just 131k calls in February 2025. This increase must have come from contactless payments suggesting that Google Pay looks set for significant adoption in Brazil.

Table 2 – Brazil automatic payment initiation and payment initiation API August call volumes by initiating institution (ordered by Payment Initiation API volume)

The institutions with the very low API volumes shown in Table 2 for August are probably still testing their Pix por Aproximação (contactless) and Pix Automático (recurring payment) services before enabling their customers to use them. The statistics suggest that new entrants are moving into Pix payments and they reveal who they are. Statistics for the Payments Without Redirection APIs also indicate further new entrants who look to be planning to offer these services – for example Adyen.

Pix Mix

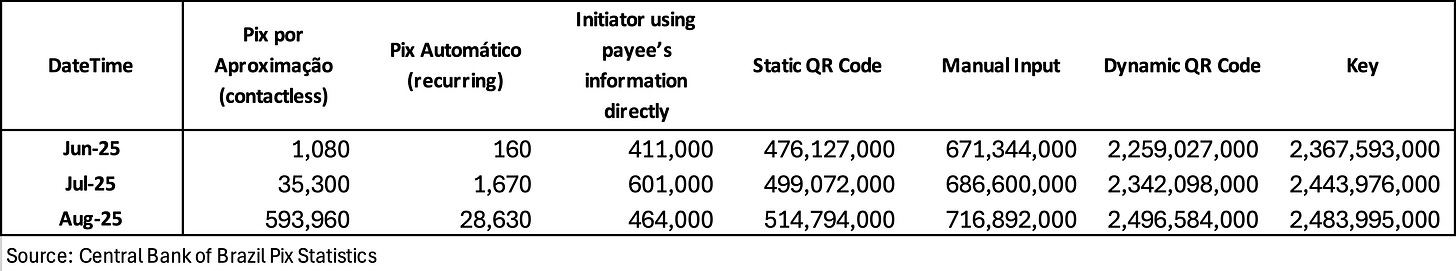

There are multiple API calls in a payment, making API volume statistics difficult to interpret without knowledge of the API flows. However, since June 2025 Pix has included Pix por Aproximação (contactless) and Pix Automático (recurring payments) payments in its monthly statistics, shown in Table 3, alongside the established initiation methods.

Table 3 – initiation methods and volumes for Pix payments

These show that Pix por Aproximação and Pix Automático payments are very low compared to the established methods, discussed in a previous article3. They are just getting started and have a long way to go to catch up with the other methods - but they are growing fast.

Conclusion

As these non-redirect payment methods gain widespread adoption, their impact is likely to result in:

- an increase in overall Pix volumes

- an increase in the non-bank market share of Pix payment initiation and the emergence of new non-bank entrants

- a change in consumer behaviours at point-of-sale with new preferences for contactless (NFC) Pix payments over QR Pix payments in some situations and the use of recurring Pix payments for subscriptions and bills – the mix of payment initiation methods is likely to change

- a reduction in the use of debit cards, already impacted by Pix, substituted further by Pix contactless

- the introduction of new uses such as AI agentic commerce.

These factors are of immense importance over the next few years with implications for innovation and the direction of payments in Brazil.

In fact, the implications are wider - the scene is set for a new dynamic and force for change in payments the world over.

Brazil Open Finance statistics: https://dashboard.openfinancebrasil.org.br/payment-initiation/api-requests/evolution