Real-time payments may be “eating the world” but North America, where cards dominate, has still to receive the memo. Real-time Account-to-Account (A2A) payments, whether initiated through a digital wallet or otherwise, are a side-show compared to cards.

I have written about this before1 when I quantified the 2023 payments landscape in the USA – 271bn payments in total, split 163bn cards, 51bn cash, 39bn ACH and checks and 17bn through real-time systems.

Here, I focus on real-time payments across North America to complete the real-time payments per capita series I have written over the past two months. This series quantifies and compares the adoption of real-time payments in most of the world’s regions in 2024, creating a baseline to measure the pace of future adoption.

Real-Time Payments Landscape in North America

North America covers the USA and Canada. The USA has three real-time interbank systems – FedNow, RTP and Zelle. Canada has none in operation, although Payments Canada is building the Real-Time Rail (RTR) which is 60% complete and due for completion by the end of September 20252.

Additionally, the USA has real-time A2A payments using stored value accounts through PayPal and Venmo (which is owned by PayPal), while Canada has PayPal (but without Venmo). There are also wallets and apps such as Wealthsimple Cash, KOHO, Interac e-transfer, Apple Cash (imessage) and Cash App but these are either card-based or lack true 24/7 real-time payment capability and are outside my definition of real-time A2A payments3.

FedNow was launched by the Federal Reserve on 20 July 2023 with baseline functionality to support A2A transfers and bill payments between banks and credit unions of all sizes, intended for use by individuals and businesses. Currently 1,389 financial institutions are participants. The average payment value4 in Q1 2025 was $37k and was as high as $52k in Q3 2024, suggesting that currently FedNow is used by institutions more as a cheaper alternative to FedWire, the RTGS system than for consumer or business-focused payment propositions.

The Clearing House’s RTP system was launched in 2017 using software provided by VocaLink (owned by Mastercard) based on the UK FPS system, that also powers real-time payment systems in Singapore and Thailand. Although RTP has around 891 participating banks, credit unions and payment companies, its adoption has been much slower than in these countries. Its average payment size in 20245 was around $718 indicating it is used by businesses and for higher value consumer bill payments. In February 2025, the transaction limit was raised to $10m from $1m and the average transaction value doubled to $1,630 in Q1 2025. Perhaps TCH RTP is also positioning as an alternative to Fedwire?

Zelle was launched in 2017 by 30 US banks for real-time P2P payments, designed to compete against PayPal, Venmo, Square (Cash App) and Apple which were dominating and growing P2P payments. Zelle is very successful, processing 3.6 billion real-time payments in 2024, an annual increase of 24%, valued at just over $1 trillion. Zelle is available through bank apps and until recently was available through a standalone app. The standalone app was discontinued on 1 April 2025, ostensibly because Zelle is used mainly through bank apps. However, more likely the US banks are resisting the rise of A2A digital wallet real-time payments to protect their cards revenue. Eliminating the standalone Zelle wallet removes the risk of it becoming a universal digital wallet for ecommerce and in-person payments at the expense of cards. Instead, using the same supplier, US banks are promoting Paze, a cards-based digital wallet.

PayPal, launched in 1999, is the veteran of digital real-time A2A payments. It also owns the popular Venmo P2P app, which it acquired with Braintree in 2013. PayPal publishes only global volume data, but I estimate that combined, PayPal and Venmo US volumes were 13.5bn payments in 2024, by far the largest real-time payment volume in the USA.

PayPal is the only true real-time A2A payments system in Canada at the moment, where I estimate its volume was 1.3 billion payments in 2024.

Figure 1 shows my estimates for the average real-time payment value for the different payment systems in 2024 (excluding FedNow given its disproportionate size, $37k, for the graph).

Figure 1 – Average Real-Time Payment Transaction Values

Figure 1 shows that whereas the TCH RTP system supports business and consumer bill payments, Zelle is more for P2P and bill payments (e.g. rent) while PayPal is used for lower value everyday payments, in particular for ecommerce.

Real-Time Payments per Capita

Figure 2 shows the real-time payments per capita in 2024 for Canada and the USA. They average 48 real-time payments per capita, barely more than one tenth the average cards payment per capita in the region which averages 469 (footnote 1).

Figure 2 – Real-Time Payments per Capita in North America - 2024

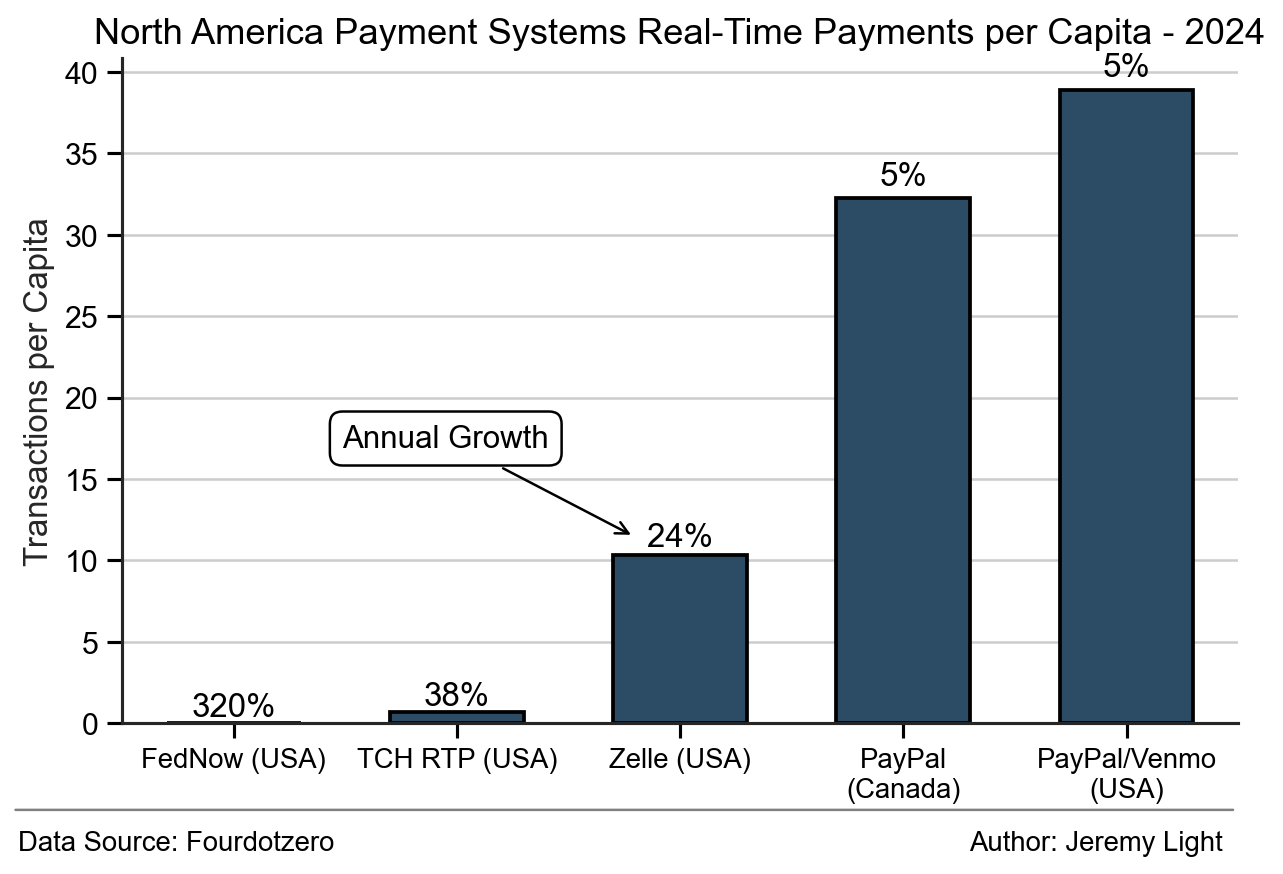

Figure 3 shows the real-time payments per capita by payments system and their annual growth rates.

Figure 3 – Real-Time Payments per Capita by Payment System in North America – 2024 (PayPal figures are my estimates based on published global volumes. The FedNow growth rate is the annualised quarterly growth from Q4 2024 to Q1 2025)

PayPal has the highest usage followed by Zelle. The TCH RTP and FedNow interbank payment systems are a long way behind but are growing faster rates.

International Comparison

Table 1 compares the real-time payments per capita for North America with the regions covered in previous articles. It shows that North America is a slow adopter, as to be expected due to the dominance of cards.

Table 1 – Real-time payments per capita regional comparison (averages weighted by population for countries with a real-time payment system and/or mobile money services)

However, Table 1 also shows the huge potential for growth in real-time payments in the region.

Cash Withdrawals per Capita

ATM cash withdrawal data for all the USA is provided only by the Federal Reserve, every three years through the triennial Federal Reserve Payments Study (FRPS)6. The latest figures available are for 2021 when 3.7 billion ATM withdrawals were made, equating to 11 withdrawals per capita, comparable but below that for Europe (15 in 2024).

No ATM withdrawal figures are published publicly for Canada.

Conclusion

Despite pioneering real-time A2A payments with PayPal in 1999, North America is a slow adopter, particularly for payments made from bank accounts.

This is due to cards being entrenched throughout the US and Canadian economies. The contrast with other countries, particular in Asia and Latin America is stark, suggesting that US banks are preventing real-time payments from competing with cards – the lack of use of TCH RTP and FedNow in everyday payments, the sunsetting of the standalone Zelle app and the lack of spillover from the successful P2P apps such as Venmo and Zelle into consumer-to-business payments suggest a concerted effort to keep real-time payments at bay.

Consequently, as I have written before, it could take a decade or more before real-time payments displace cards in the region. However, it is inevitable that real-time A2A payments made through digital wallets will prevail - it’s a matter of time. The evidence is everywhere around the world and a glance at the complex cards value chain compared to the download-and-go digital wallet A2A value chain7 shows how cards are becoming unsustainable economically and functionally.

The key question is how quickly, or slowly real-time payments will gain further adoption in the region – stay subscribed to track how they develop in North America and globally over the coming years.

USA Payments Landscape 2023: https://jeremylight.substack.com/p/paying-in-america?r=axqgy

I define real-time A2A payments as any payment that clears instantly between two accounts through a system that is operational 24/7, regardless of the type of account or where it is hosted e.g. a bank account at a bank, stored value account on a digital wallet.

TCH RTP volume and value graph: https://www.theclearinghouse.org/payment-systems/rtp

Federal Reserve payments Study 2022 https://www.federalreserve.gov/paymentsystems/2023-April-The-Federal-Reserve-Payments-Study.htm?

Payment value chains: https://jeremylight.substack.com/p/value-chain-gang?r=axqgy

What I find interesting with Zelle is that it doesn’t have its own rails, rather it’s using a mix of ACH, Visa Direct/Mastercard Send, and RTP